Traders Brief - Consolidation Phase to Persist

HLInvest

Publish date: Wed, 29 Jan 2020, 09:36 AM

MARKET REVIEW

Asian markets ended mildly higher from early losses. Sentiment improved as Beijing vowed to contain a virus outbreak that has killed 17 on Wednesday, with more than 540 cases confirmed, leading the Wuhan city at the center of the outbreak to close transportation networks and urge citizens not to leave as fears rose of the contagion spreading.

Contrary to the regional markets rebound, KLCI slid 9.3 pts to 1578 (its 3rd straight fall), mainly led by banking stocks (amid concern of profitability erosions on lower net interest margins) following an unexpected 0.25% pre-emtive measure OPR cut by BNM to secure improving grwoth trajectory as downside risks to growth remained. Trading volume increased to 3.07bn shares worth RM2.57bn as compared to Tuesday’s 2.66bn shares worth RM1.93bn. Market breadth was negative with 397 gainers as compared to 509 losers.

The Dow rose as much as 124 pts to 29320 in early session, boosted by upbeat earnings report from IBM and news that Chinese authorities were taking steps to contain a possible coronavirus pandemic from Wuhan, relieving investor fears about a threat to global economic growth. However, the index reversed 134 pts to ease 10 pts at 29186 as investors continued to monitor the Chinese flu outbreak and worried that Boeing will post a sluggish 4Q19 earnings after the company pushed back its 737 Max return to service timeline to possibly mid-year.

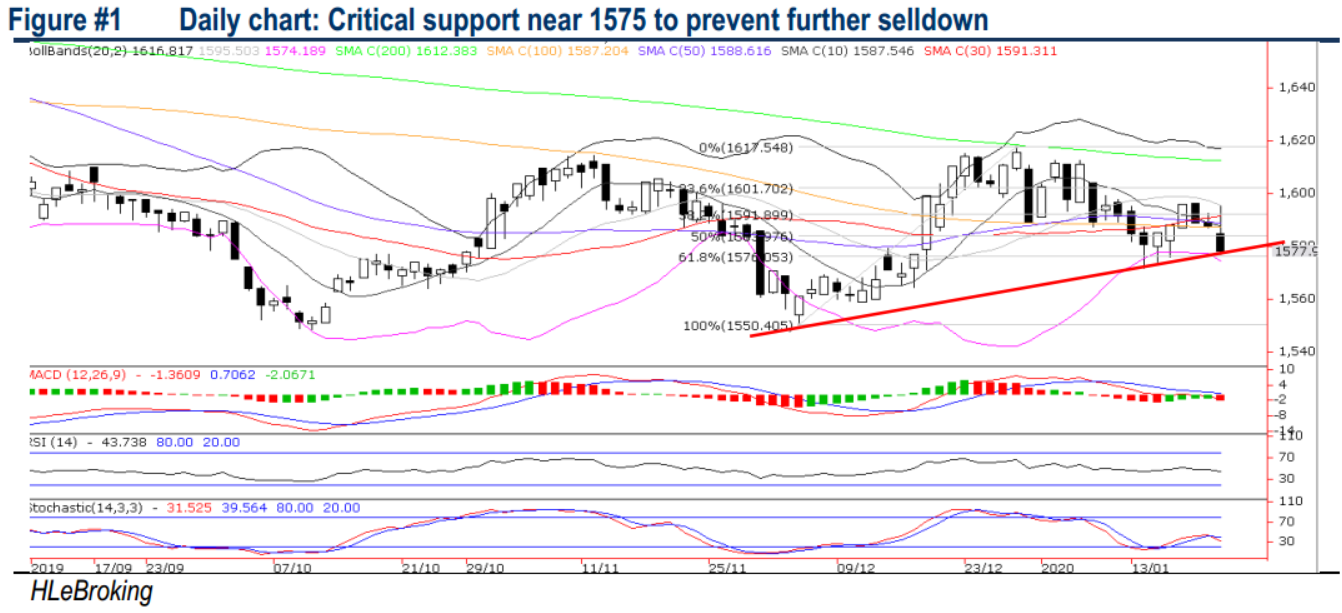

TECHNICAL OUTLOOK: KLCI

Following a mild rebound from a low of 1551 (24 Dec) to a high of 1617 (30 Dec), KLCI had retreated 39 pts to close at 1578 yesterday, below the 20D/30D/50D SMAs. Unless a decisive fall below 1575 (uptrend line support from 1551), KLCI’s near term upward momentum remains intact. Key resistances are 1588 (50D SMA), 1600 and 1612 (200D SMA) levels. Conversely, failure to hold at 1575 may induce more selling spree towards 1566 (76.4% FR)/1550 levels.

Following another sluggish performance on Bursa Malaysia and persistent profit taking pullback on Dow after rallying 22% in 2019, KLCI is envisaged to extend its consolidation mode ahead of the long CNY holidays (half day trading on 24 Jan and reopens on 28 Jan). As consensus view that BNM will stand pat with no more OPR cuts for 2020 (assuming subdued external downside risks), KLCI is expected to build a base near 1566-1575 territory. Key resistances are situated 1588/1600/1612 zones. Nevertheless, traders may continue to focus on plantation counters as FCPO staged a 3% relief rally yesterday whilst gloves companies could see mild profit taking after recent rallies as Beijing’s strong response helped to allay concerns.

TECHNICAL OUTLOOK: DOW JONES

From an all-time high of 29374 on 17 Jan, the Dow had retraced 188 pts to 29186. Given the weakness in the MACD/RSI/stochastic readings, the Dow is likely to experience choppy sessions ahead. Nevertheless, uptrend remains intact for now unless key supports situated at 28827 (20D SMA) and 28603 (30D SMA) zones are broken decisively. Formidable hurdles are 29500-30000 levels.

Despite the fear of coronavirus pandemic from Wuhan would cast a threat to global economic growth. the Dow’s uptrend is fairly intact, taking cues from the prompt Chinese authorities measures to contain the spread and the de-escalation of US-China trade disputes coupled with the expectation of low Fed’s interest outlook ahead of the 28-29 Jan meeting (US time). Moreover, ongoing positive 4Q19 reporting season (as 75% of the S&P 500 companies reported beat EPS estimates) could be a rerating catalyst for the Dow to advance further towards our envisaged 29500-30000 territory in the next few weeks albeit interim profit taking pullback, with support set around 28600-28800 levels.

Source: Hong Leong Investment Bank Research - 29 Jan 2020