Traders Brief - Profit taking activities may emerge

HLInvest

Publish date: Wed, 05 Feb 2020, 09:12 AM

MARKET REVIEW

Despite Hong Kong’s hospital confirming the first coronavirus-related death in the city, sentiment was fairly positive led by a rebound in Shanghai stock exchange, recovering from a more than 7% slide on Monday. The Shanghai Composite Index and Hang Seng Index added 1.34% and 1.21%, respectively, while Nikkei 225 rose 0.49%. Meanwhile, the Reserve Bank of Australia (RBA) announced its decision to leave the cash rate unchanged at 0.75% on Tuesday.

In tandem with the regional stock markets, the FBM KLCI managed to recover sharply to an intra-day high of 1,542.59 pts before ending at 1,535.80 pts (+0.91%). Market breadth was positive as bargain hunting activities emerged; there were 552 advancers vs. 351 decliners, accompanied by 3.05bn (RM2.56bn) shares traded for the session. Also, we noticed several telecommunication-related stocks such as BINACOM, OPCOM and OCK were traded actively higher for the session.

Wall Street turned more bullish led by Tesla and selected tech giants like Apple and recovered from the previous steep sell-off attributed to the worries over the coronavirus. Despite the Wuhan coronavirus death toll reaching 426 with more than 20k confirmed cases, White House economic advisor Larry Kudlow states in an interview that he does not see US economic ‘disaster’ from the outbreak has provided some further buying support towards the stock markets. The Dow and S&P500 gained 1.44% and 1.50%, respecti vely, while Nasdaq advanced 2.10%.

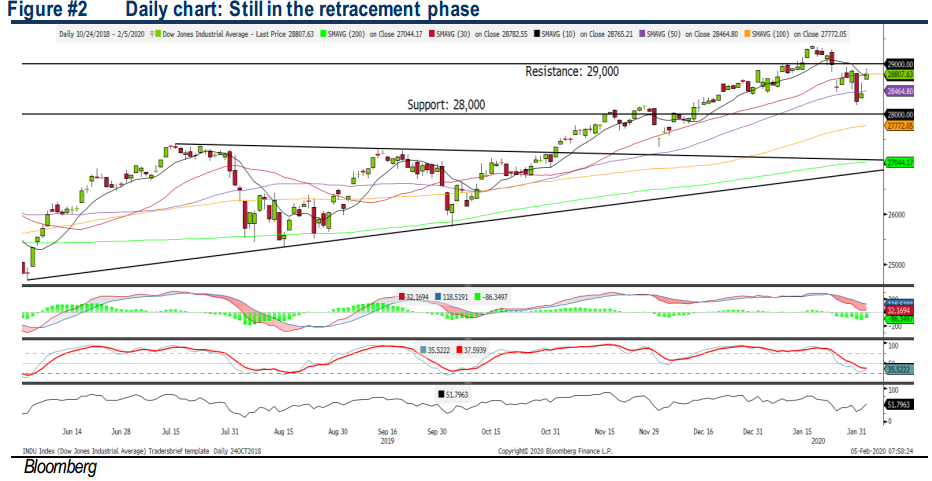

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has rebounded after forming a doji candle on Monday. The MACD Histogram has recovered mildly, but the MACD Line is hovering below zero. Meanwhile, both the RSI and Stochastic are hooking upwards in the oversold region. We may anticipate the key index to trade slightly higher for the upcoming sessions, but upside could be set along resistance around 1,550-1,560. Support will be set around 1,515, followed by 1,500.

With the stock exchanges across the globe heading for a technical rebound after a sharp decline over the past week, we believe market participants have priced partially the concerns over the Wuhan coronavirus impacting global economy into the stock markets. Nevertheless, should the Wuhan coronavirus persist without any solid improvements (i.e. delay in vaccine developments, worsening of death tolls), profit taking activities could re-emerge. KLCI’s trading range will be set around 1,515-1,550.

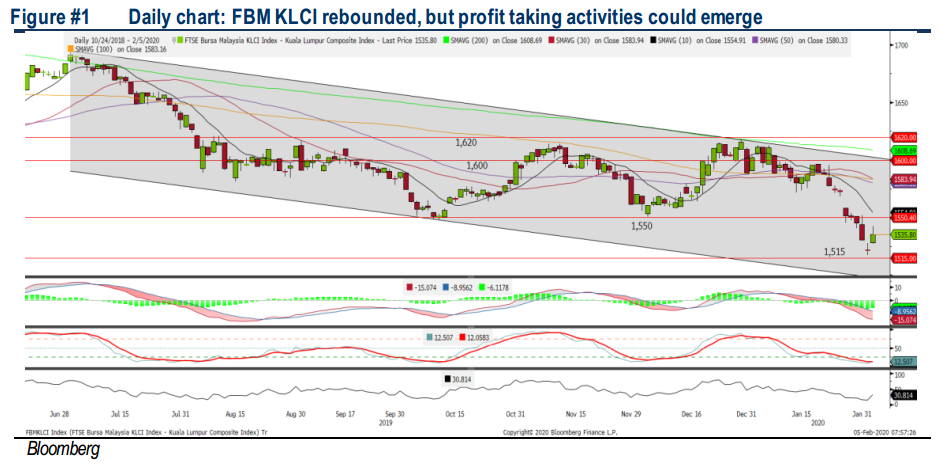

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded for the second consecutive day, recouping most of the losses in Friday’s sell-off and the MACD Indicator remains positive (MACD Histogram recovering, while MACD Line is hovering above zero). Meanwhile, both the RSI and Stochastic oscillators have hooked upwards; indicating that the positive momentum is returning. The resistance is located around 29,000, while the support is pegged around 28,000.

In the US, as the technical rebound has been quite significant over the past two trading days, we anticipate profit taking activities to emerge. Also, the confirmed cases and death toll has risen to above 24k and 492, respectively. We believe the markets could remain choppy within the range of 28,000-29,000 and traders may put their focus on the ongoing US reporting season for the moment

Source: Hong Leong Investment Bank Research - 5 Feb 2020