Construction and Building Mat - Recovering Technicals and Increasing Trading Interest

HLInvest

Publish date: Tue, 18 Feb 2020, 09:34 AM

Last week, the Finance Ministry commented that a potential economic stimulus measure may be revealed (tentatively on 27th Feb) and the quantum will depend on the duration and impact of the Covid-19 outbreak. Although the stimulus measures could be targeting just the affected industries such as tourism, logistics and finance sector, we do not rule out that some of the mega projects (i.e. ECRL/ PTMP) may be expedited in 1H20. Also, soon after the comments by Finance Minister, construction (i.e. earthworks/pilling/consultant) and building material (steel and cement) segments have seen increasing trading interest. Should any announcement related to construction projects being revealed in the near term, it may trigger a broad base buying interest within the sector.

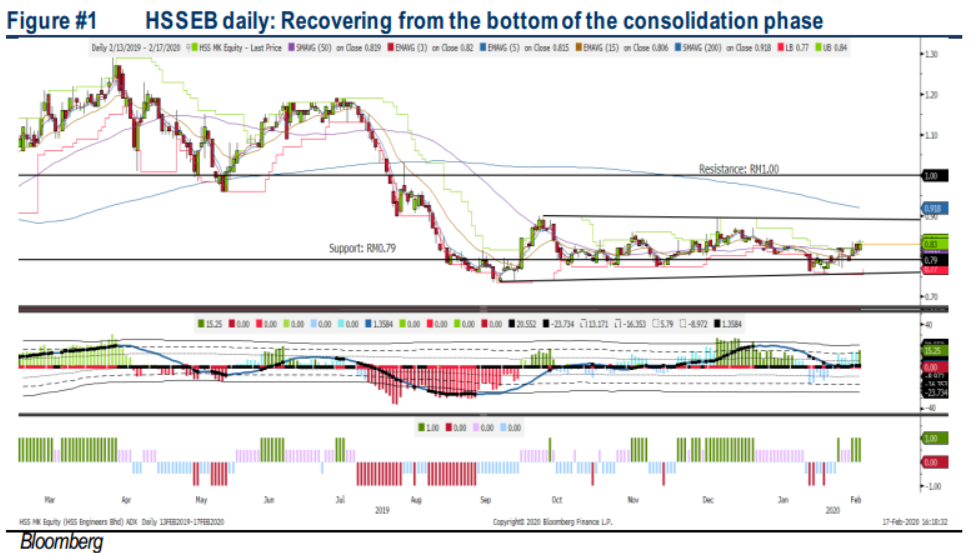

HSSEB: Price has been trending sideways over the past few months and our indicators are suggesting that the uptrend mode is intact again and may attract traders’ attention in the near term. Should the share price surge above RM0.84, next potential target is set around RM0.90-0.94, followed by a LT target at RM1.00. Support is set along RM0.81-0.82, stop loss is set around RM0.79.

MCEMENT: Share price has breached above the downward trendline in the middle of January. Indicator has turned positive since then and share price steadied above RM3.36. We believe follow-through buying interest could sustain towards RM4.06- 4.15, with a LT target set around RM4.46. Support is set around RM3.30-3.40, with a cut loss set around RM3.36.

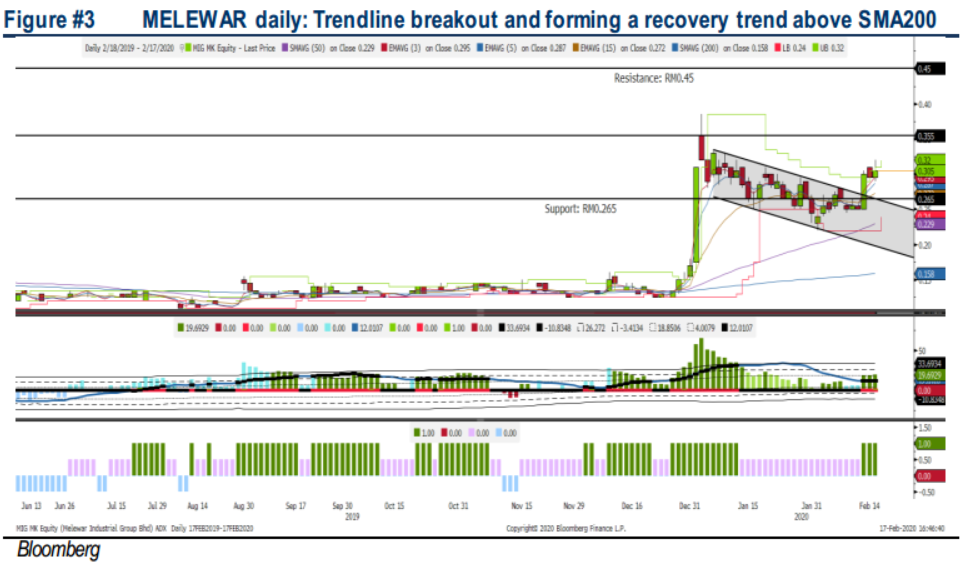

MELEWAR: Price has experienced a channel breakout last week and the uptrend is intact at this juncture. Should the share price sustain above the RM0.31, buying support may extend, targeting the initial resistance along RM0.355-0.38, followed by a LT target of RM0.45. Support will be located around RM0.27-0.28, with a cut loss set around RM0.265.

Source: Hong Leong Investment Bank Research - 18 Feb 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|