Globetronics Technology - Light Before the Dawn

HLInvest

Publish date: Mon, 24 Feb 2020, 10:21 AM

From a low of RM2.02 (1 Nov) after reporting a weak 3Q19 results, GTRONIC rebounded 19% to RM2.40 last Friday, as investors are likely to price in a flattish 4Q19 results and look forward to stronger FY20/21 prospects, led by the ramp up of new and better margins laser headlamp products and gesture sensors coupled with new sensors for various applications. GTRONIC is trading at 24.7x FY20E (8% above its peers and 18% below its 5Y mean), supported by decent 3.3% DY (44% above its peers) and a strong 24% FY19-21 EPS CAGR coupled with RM0.18 net cash. Technically, GTRONIC’s uptrend is intact to advance towards RM2.48/2.68/2.90 levels following recent ascending triangle breakout.

Anticipate a flattish 4Q19, but likely to gain traction in FY20/21. To recap, GTRONIC reported a 20% YoY decline in 3Q19 earnings to RM18.9m (-37% YoY to RM30.1m on 9M19) due to lower loadings from South East Asia and North America customers, as well as rationalisation of its product portfolios by reallocating resources to high margin sensors and laser headlamp products while streamlining the exposure in the matured quartz crystal business.

For 4Q19, consensus are expecting another flattish quarter amid soft volume loadings for both light and gesture sensors from certain key customers and continuous product portfolio rationalisation. All in, FY19 earnings is expected to slide 31% YoY to RM48m before recovering 35%/14% for FY20/21 in anticipation of the commercialisation of new and better margins laser headlamp products and gesture sensors coupled with new sensors for various applications in 1H2020.

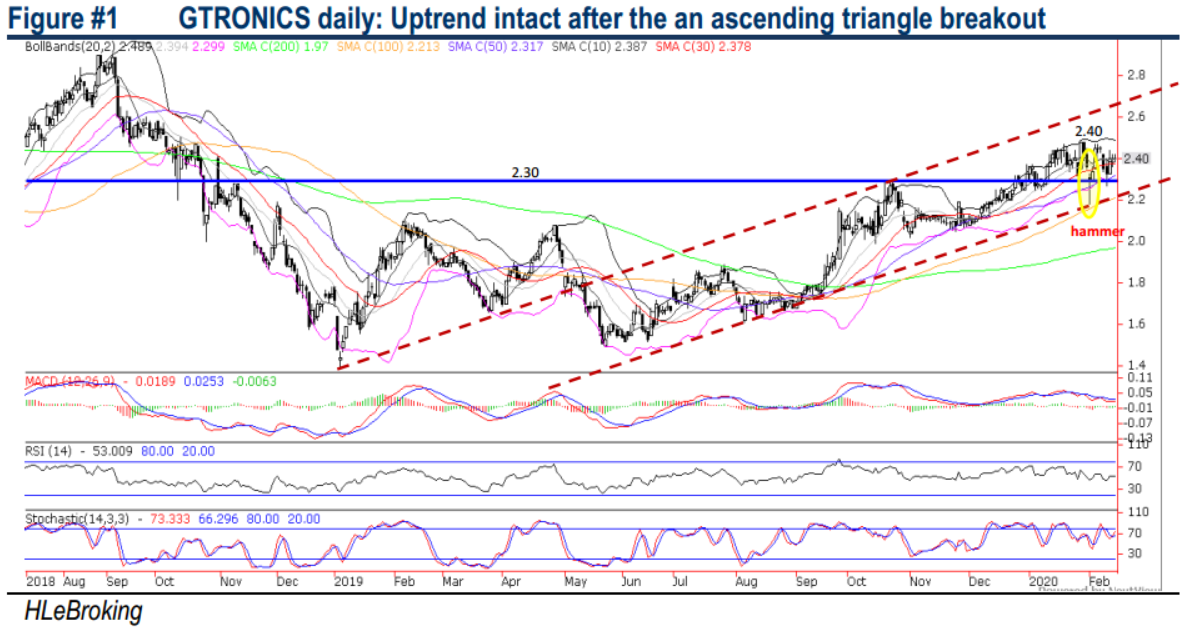

Uptrend intact after the bullish ascending triangle breakout and hammer pattern. The uptrend for the stock has been steady since Aug last year with prices above its 100d/200d SMAs. The recent ascending triangle breakout and hammer pattern are also likely to spur prices higher after a brief sideways consolidation. The MACD/RSI/Stochastic readings are still in consolidation mode, which is in line with the recent sideways trend.

We expect prices to break above immediate resistance at RM2.48 (29 Jan high). A successful breakout will spur prices higher towards RM2.68 (upper channel line) and our LT objective at RM2.90 (28 Aug 2018 high). Key supports are RM2.30 (neckline support) and RM2.20 (support trendline). Cut loss at RM2.18.

Source: Hong Leong Investment Bank Research - 24 Feb 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|