Traders Brief - Political Uncertainty to Persist, Limiting Upside Potential

HLInvest

Publish date: Wed, 26 Feb 2020, 09:52 AM

MARKET REVIEW

Tracking the negative performance on overnight Wall Street, Asia’s stock markets were mostly lower amid heightened worries on Covid-19 cases spiked in regions outside of China (Italy, South Korea and Iran). Also, traders worried that the outbreak in South Korea could impact the global technology and semiconductor supply chains. The Nikkei 225 dived 3.34%, while Shanghai fell 0.60%.

On the local front, the FBM KLCI and the broader market managed to make a swift rebound after a significant decline on Monday following a series of political developments over the weekend; the FBM KLCI added 0.73% to 1,500.88 pts. Market breadth was positive with 531 gainers vs. 380 decliners, accompanied 3.13bn (worth RM2.76bn). We noticed gloves sector remained resilient, trending higher for another session amid weak ringgit tone.

Wall Street extended another round of sell down amid a surge in Covid-19 cases outside of China, contributed to further concerns of a potential global economic slowdown. Also, some health officials in the US warned a possible outbreak in the US and the 10 -year Treasury yield was pushed to a record low have dampen the market sentiment for the session. The Dow and S&P500 declined 3.15% and 3.03%, respectively while Nasdaq lost 2.77%.

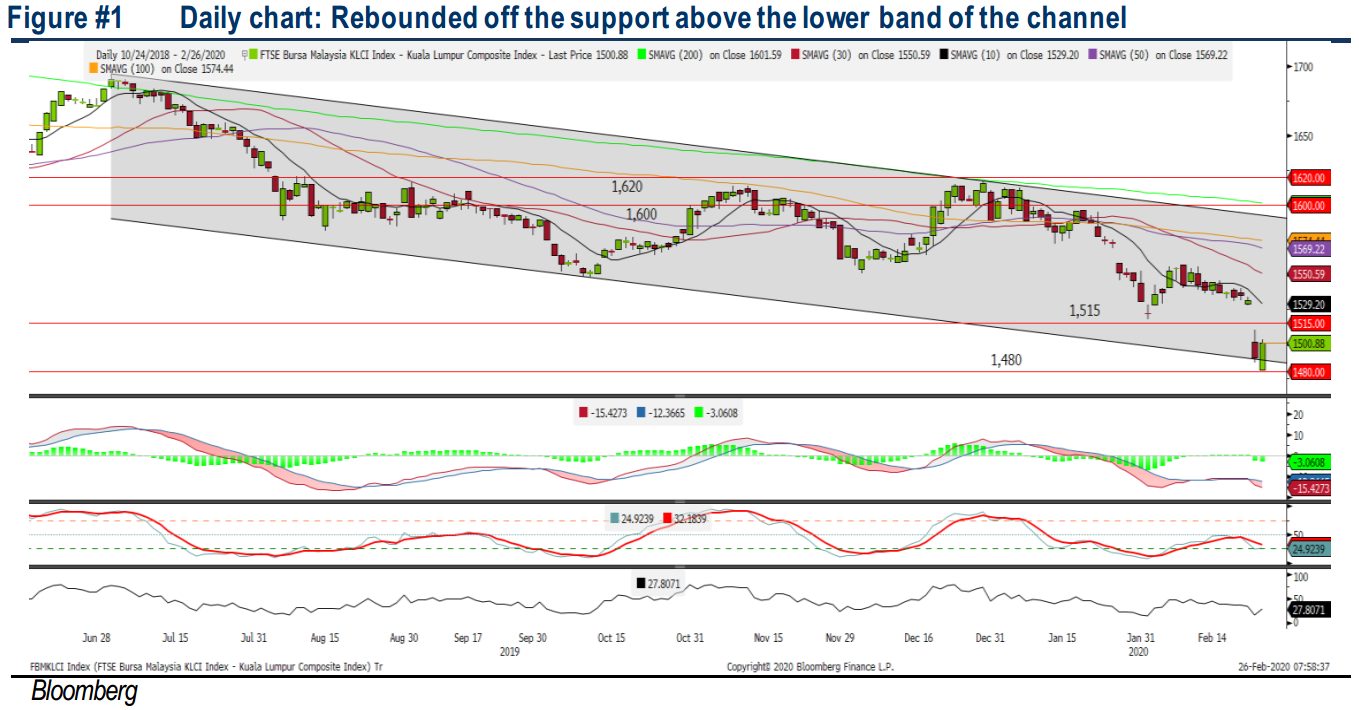

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded strongly on Tuesday, forming a white candle and securing mildly above 1,500 psychological level, but the MACD Indicator is still hovering in the negative region. The RSI has hooked upwards, but both the RSI and Stochastic oscillator are hovering in the oversold region. KLCI’s resistance is envisaged around 1,515-1,530, support is set along 1,480.

Taking cues from the sentiment on Wall Street overnight as well as the uncertain political developments in Malaysia, we believe selling pressure may emerge on the local stock exchange. Nevertheless, we expect another round of potential buying interest into gloves, masks and sanitizers related stocks on the back of rising Covid-19 cases outside of China. Trading range of KLCI will be set around 1,480-1,515.

TECHNICAL OUTLOOK: DOW JONES

The Dow extended its slide for the second consecutive day, the MACD indicator continues to decline and trending below zero. Both the RSI and Stochastic oscillators have fallen sharply (hovering in the oversold region at this juncture) over the past two days. Resistance is envisaged around 27,500, while support is located around 27,000.

We observed that investors are fleeing equities and rushing for bonds at the moment amid the uncertain global growth outlook following the ongoing Covid-19 outbreak, which the confirmed cases outside of China is on the rise. Nevertheless, the Dow could be due for technical rebound after a two-day selldown (amid oversold signals). The Dow’s upside will be located around 27,500, while support is located around 27,000.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off our positions on technical trackers i.e. HSSEB (6% loss) and PERDANA (3.4% loss).

Source: Hong Leong Investment Bank Research - 26 Feb 2020