Traders Brief - A Pocket of Fear

HLInvest

Publish date: Fri, 28 Feb 2020, 11:27 AM

MARKET REVIEW

Tracking the 5th day of selling spree on Dow, sliding commodity prices and record low of US 10Y/30Y bond yields, most Asian markets were mixed as investors remained cautious over the fast-spreading new coronavirus that has infected over 81000 people and killed nearly 2800, with the spread of the coronavirus beyond China was escalating. Top losers were JCI (2.7%), NIKKEI 225 (2.1%), NZX20 (2.1%) and KOSPI (1.1%).

Ahead of the positive economic stimulus package announcement, KLCI staged a 10.4-pt technical rebound to 1505.6 following recent slump amid domestic political noise. Trading volume decreased to 3.52bn shares worth RM2.66bn as compared to Wednesday’s 3.87bn shares worth RM3.07bn. Market breadth was negative with 264 gainers as compared to 621 losers. The Dow plunged for the 6th straight sessions as Trump’s news conference failed to reassure investors. Sentiment took a hit, triggered by knee-jerk selloff by the COVID-19 and news that the California’s governor said 8400 people were being monitored after travelling to China.

The Dow tanked 4.4% or 1191 pts at 25767 (-12.9% from all-time high 29569) while the S&P 500 plummeted 4.4% or 138 pts at 2978 (-12.2% from all-time high 3393). Meanwhile, the Nasdaq lost 4.6% or 414 pts to 8566 (-12.9% from all-time high 9838).

TECHNICAL OUTLOOK: KLCI

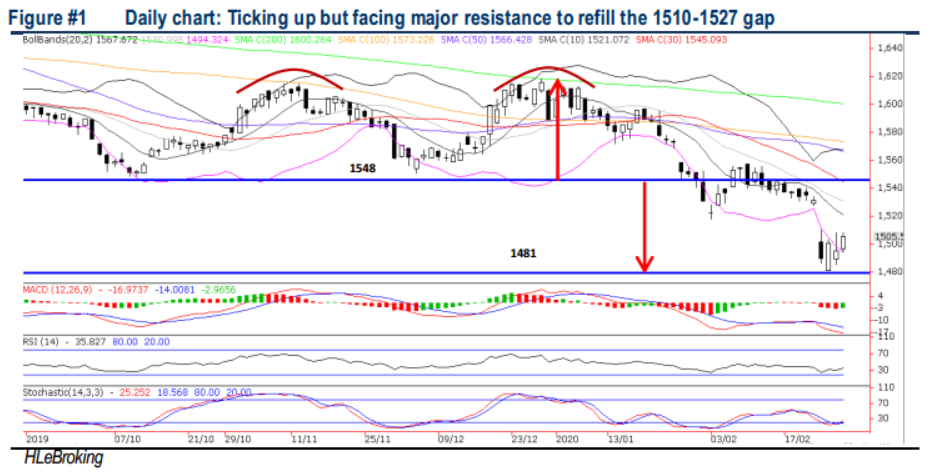

Following the double top formation and a violation of 1548 neckline supp ort , KLCI had already tumbled 8.4% or 136 pts from 1617 (30 Dec) to a low of 1481 (25 Feb low and the double top reversal base support) before staging a technical rebound to end at 1505 yesterday. MACD remains negative whilst RSI and stochastic readings are slowly ticking up. We expect consolidation to prevail and only a successful rebound towards refilling the 1510 -1527 gap (24 Feb) would spur greater upside to revisit the support-turned-resistance 1548 levels. Conversely, a violation below 1481 could reignite further selling spree towards 1440 territory.

In wake of the bearish Wall Street trend and ahead of the special sitting of Dewan Rakyat on 2 March (to decide the next PM and/or the possibility of a snap election), we believe wild swings may continue, with key supports at 1440-1480, whilst resistances are set at 1510-1527 levels. Given the elevated risks and uncertainty in the near term, priority for equity investors should be the preservation of capital, with core holdings in defensive and resilient high-yield stocks.

TECHNICAL OUTLOOK: DOW JONES

The Dow extended its fall for the 6th consecutive day to 25767, plunging 12.9% or 3802 pts from all-time high 29569 (12 Feb). The MACD indicator continues to extend its bearish decline but both the RSI and Stochastic oscillators are extremely oversold, signalling potential technical rebound in the near term. A successful closing above 26400-26800 in the near term will spur further technical rebound towards 27200/28000 zones. Further downside supports are 25000/24700 levels.

We are likely to witness investors to continue fleeing equities and rushing for bonds at the moment as the 10Y/30Y yields are hovering at all-time lows, on the back of the COVID-19 outbreak which has potential becoming pandemic, in turn affecting global trade and travel as well as potentially taking a bite out of confidence on US corporate earnings and economic growth in the mid to long term. However, based on the technical readings, the Dow could stage a technical rebound in the near term with the upside capped near 28000 levels, while key supports are located around 24700-25000 zones.

Source: Hong Leong Investment Bank Research - 28 Feb 2020