Traders Brief - Technical Rebound Should Sustain on KLCI

HLInvest

Publish date: Thu, 05 Mar 2020, 09:02 AM

MARKET REVIEW

Asia’s stock markets ended mostly higher following the unexpected rate cut by the Federal Reserve. Despite China’s Caixin/ Markit services Purchasing Managers’ Index plunged to 26.5 in February from 51.8 in January, Shanghai Composite Index gained 0.63%. In South Korea, Kospi Index jumped 2.24% after the country proposed an extra budget of 11.7 trillion Korean won (USD9.86bn) to combat Covid-19 and its economic impact. Meanwhile, Hang Seng Index fell 0.24% and Nikkei 225 traded flat.

On the local front, the FBM KLCI extended its rebound after BNM cut its OPR rate for the second time in 2020 on Tuesday as well as calmer political scene; the key index rose 0.76% to 1,489.95 pts. Market breadth was however slightly negative with 464 decliners vs 431 gainers. Overall traded volume stood at 2.99bn, worth RM2.37bn. Given the rising concerns over rapid spread of the Covid-19 outside of China, healthcare-related stocks such as TOPGLOV, HARTA, CAREPLS, COMFORT, OCNCASH traded actively higher for the session.

Wall Street garnered significant buying support which sparked a massive rally within healthcare sector following major victories from former Vice President Joe Biden during Super Tuesday. Also, US lawmakers have struck a deal on more than USD8bn emergency funding to fight coronavirus. On a side note, the US services sector expanded at a faster-than-expected pace in Feb. The Dow and S&P500 advanced 4.53% and 4.22%, respectively, while Nasdaq added 3.85%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded for the second consecutive day as bargain hunting activities were noted. The MACD Histogram continues to recover, but the MACD Line is still hovering below zero. Meanwhile, both the RSI and Stochastic oscillators are hooking upwards from the oversold region. Based on the technical readings, we may anticipate further recovery towards 1,500-1,515, while support is anchored around 1,444-1,450.

With the calmer political scene, coupled with positive performance on Wall Street, we expect buying interest could spillover towards stocks on the local front, lifting the key index towards 1,500-1,515 eventually, while support is set around 1,444-1,450. Also, traders will be focusing on gloves, masks, sanitisers related stocks amid the ongoing Covid-19 outbreak.

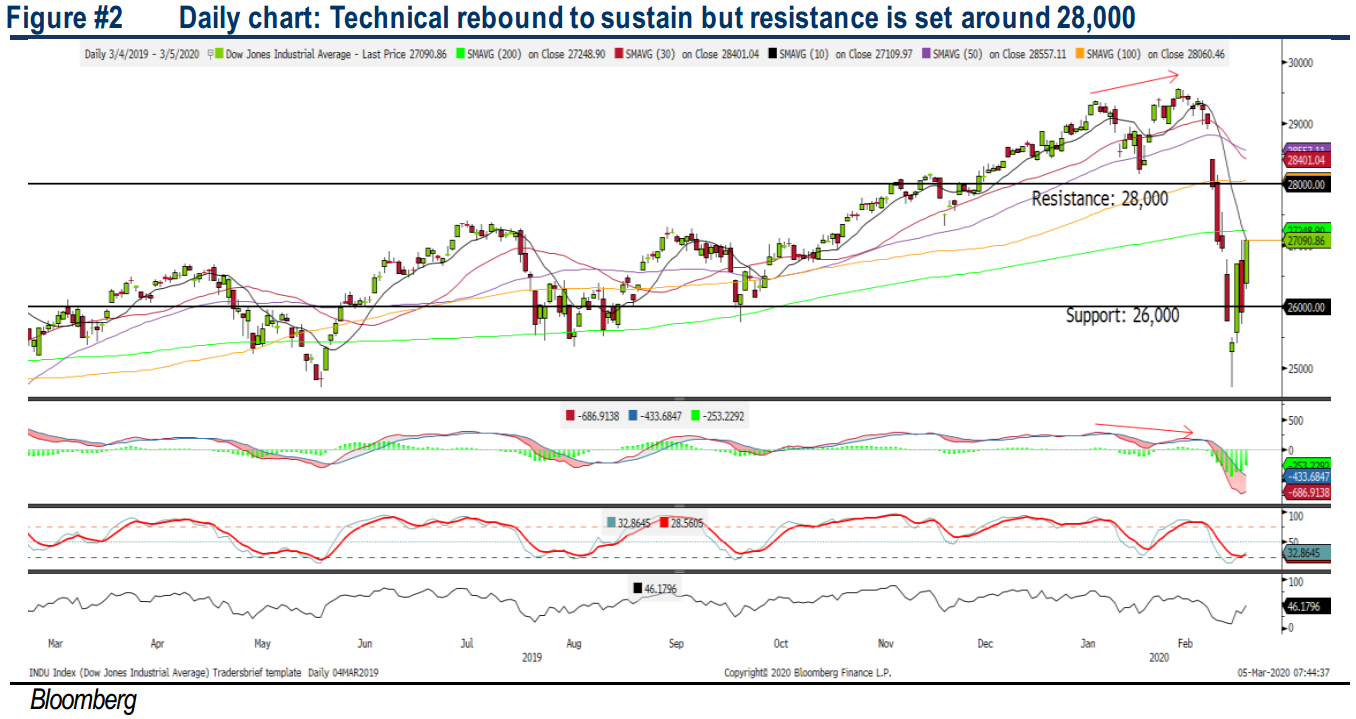

TECHNICAL OUTLOOK: DOW JONES

The Dow has regained traction above the 27,000 level and the MACD Histogram has recovered mildly. Also, both of the RSI and Stochastic oscillators have recovered out of the oversold region. Next resistance will be envisaged around 28,000, while support is located around 26,000.

With the Federal Reserve introducing the 50 basis points cut yesterday, coupled with USD8bn emergency fund being passed by the lawmakers to combat Covid -19 outbreak in the US, we believe the sentiment has stabilised and the Dow could remain positive over the near term. Next major event that traders will be monitoring will be the FOMC meeting that will be held on 17-18 March. Meanwhile, should the headlines on Covid-19 continue to worsen, we expect profit taking to emerge.

Source: Hong Leong Investment Bank Research - 5 Mar 2020