Healthcare proxies - Covid-19 Theme Under Traders’ Radar

HLInvest

Publish date: Tue, 10 Mar 2020, 09:10 AM

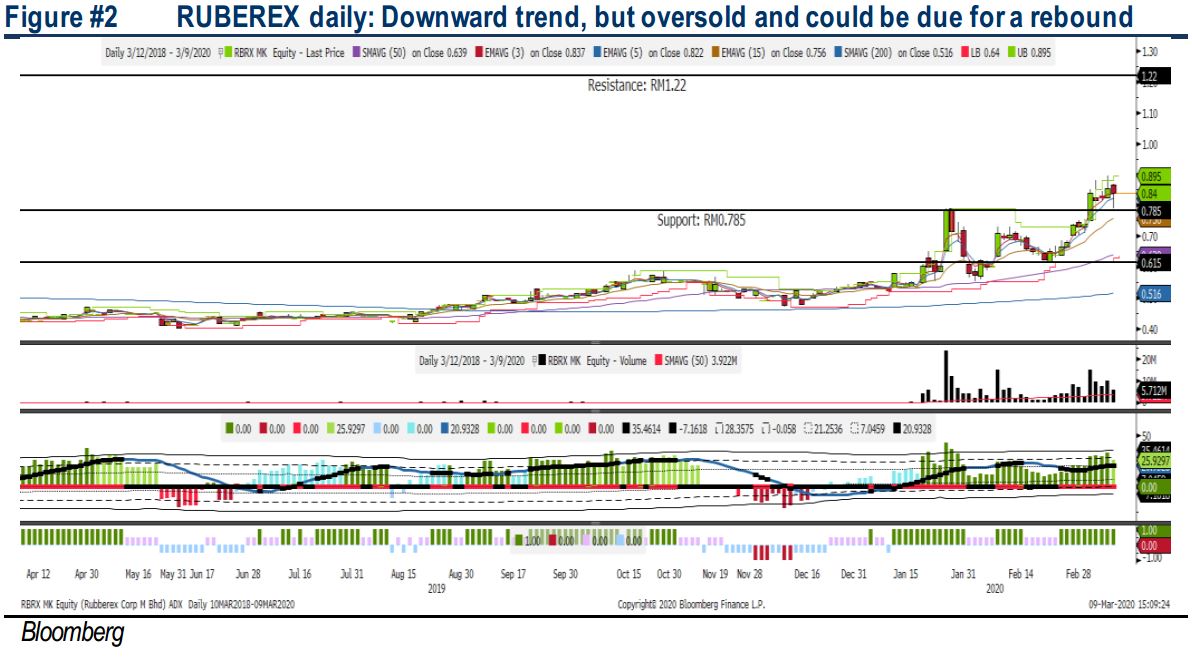

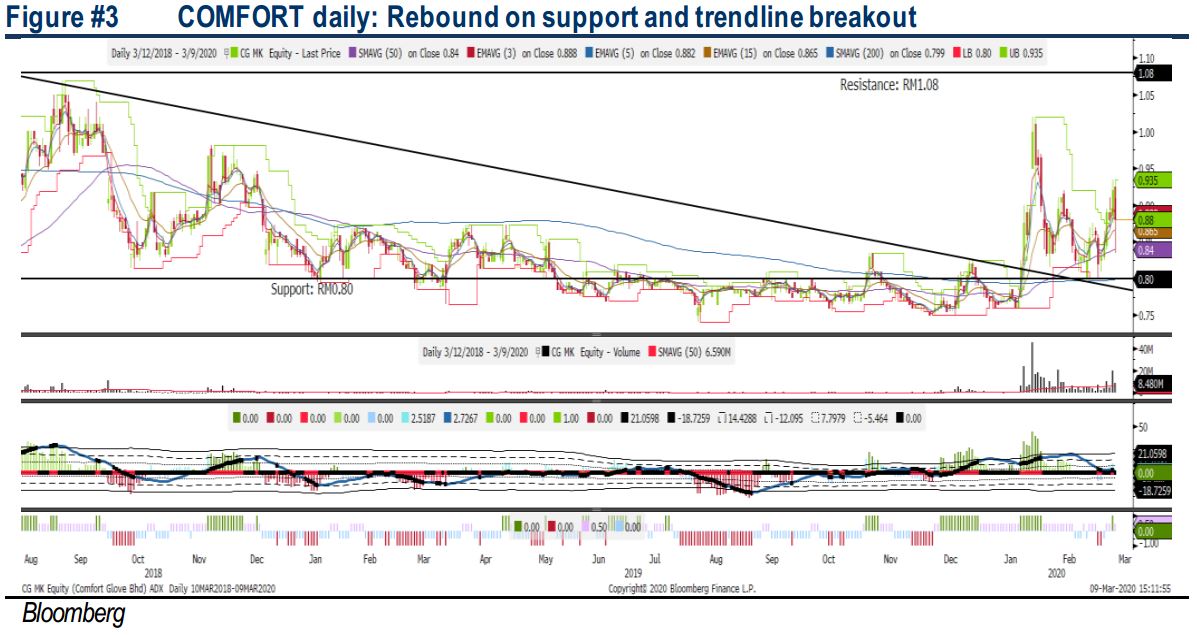

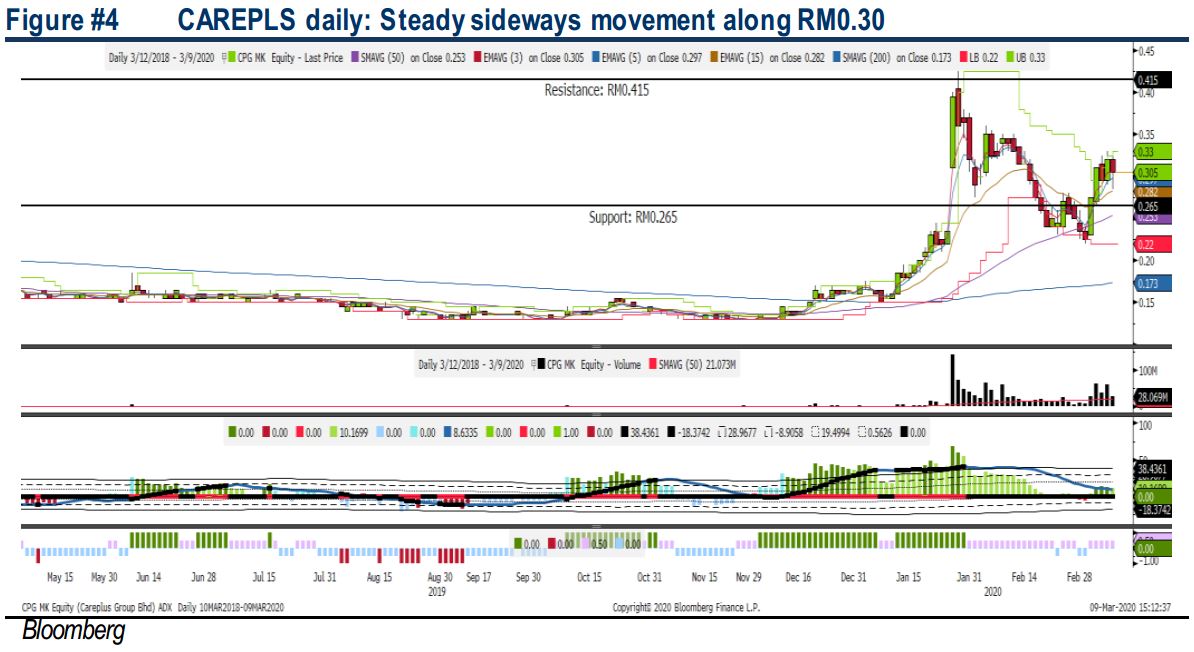

The ongoing Covid-19 outbreak and the oil crisis over the weekend have dampened the sentiment across the global markets yesterday; most of the regional markets were down more than 3%. However, with the ongoing Covid- 19, it is highly likely that it may bump up the demand for gloves, sanitisers and masks at least by 10-15% for 2020. Moreover, raw materials such as Butadiene and ethanol for gloves and sanitiser, respectively may trend lower in tandem with softer crude oil prices. We like RUBEREX, COMFORT and CAREPLS under gloves sector. For sanitiser-proxy, we would opt for HEXZA.

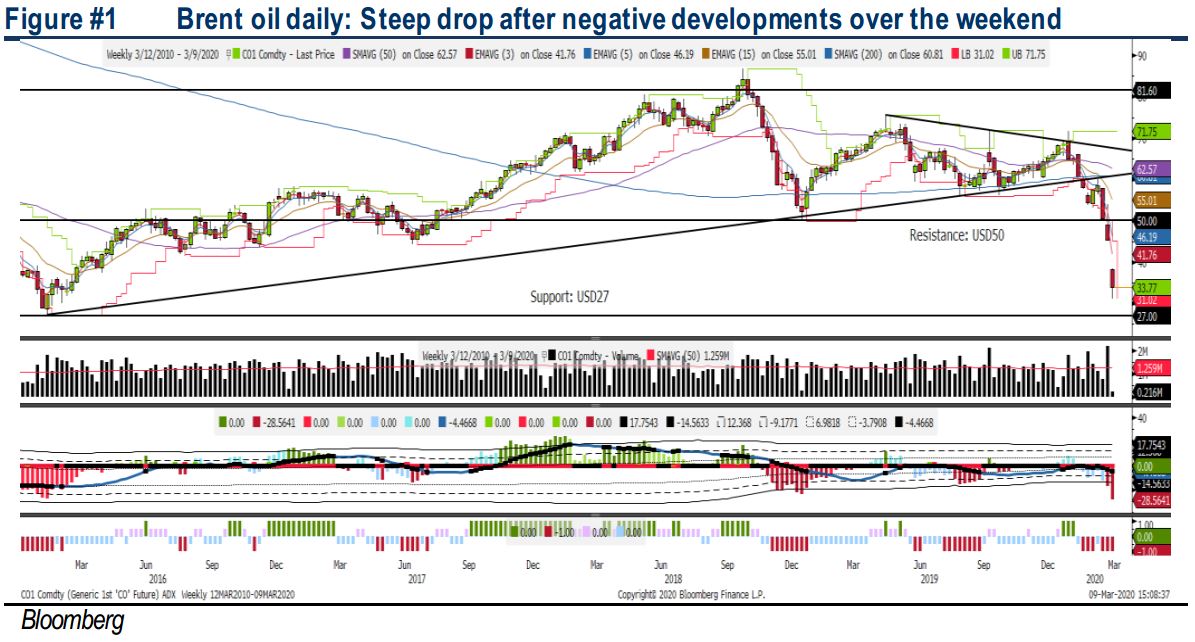

Brent: Brent oil has tanked more than 20% on Monday after violating below USD50 last Friday. The indicator is suggesting that the current trend is negative and next level of support is located at USD27, while upside resistance is pegged around USD50.

RUBEREX: The share price has been rallying above the RM0.785 level, despite the sluggish sentiment on the broader market. Also, our indicator is suggesting that the uptrend is still intact. Upside target will be envisaged around RM0.95-1.00, LT target is located around RM1.22. Support is pegged around RM0.78-0.79, cut loss point will be located around RM0.77.

COMFORT: Share price has rebounded above the trendline (~RM0.80) over the past few weeks. The indicator has turned sideways but hovering above zero for the past few days. Based on the technical reading, the uptrend may resume towards RM0.95- 1.00, followed by a LT target of RM1.08. Support is set around RM0.84-0.86, with a cut loss level located around RM0.80.

CAREPLS: Share price could be taking a breather along RM0.30 level after a sharp rally last week. Our indicator is suggesting that the uptrend is still intact and should the price breaches above RM0.33, next target is envisaged around RM0.35-0.38, with LT target at RM0.415. Support is located around RM0.28-0.29, cut loss is set around RM0.265.

HEXZA: Share price may have hit the resistance along RM0.84 and turned into a consolidation phase. However, based on the indicator, it is still suggesting that the trend is up. Should the price surge above RM0.84, next target will be at RM0.85-0.90, with the LT target located around RM0.95. Support is set around RM0.775 -0.78. Cut loss is located around RM0.76.

Source: Hong Leong Investment Bank Research - 10 Mar 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|