Traders Brief - Further Respite Amid Dow and Oil Price Relief Rally

HLInvest

Publish date: Wed, 11 Mar 2020, 09:37 AM

MARKET REVIEW

Asian markets and oil prices ended higher from Monday’s steep fall amid rising hopes that more fiscal and monetary stimulus measures from global policymakers would help to buffer economies from the rapid spread of the COVID-19 across the world. Sentiment was also boosted by Trump’s pledge to take "major" steps to blunt the economic impact of the coronavirus outbreak.

In wake of the recovery in regional markets and the announcement of a generally capital market-friendly cabinet line-up, KLCI ended 6.3 pts higher at 1430.5 on bargain hunting after fluctuated within an intra-day high of 1446.7 and a low of 1415. Trading volume decreased to 4.42bn shares worth RM3.21bn as compared to Monday’s 6.66bn shares worth RM3.27bn. Market breadth was positive with 491 gainers as compared to 477 losers.

The Dow (+4.9% or 1167 pts to 25105) staged a strong comeback from Monday’s 4.8% rout when stocks saw the biggest one day fall since the 2008 financial crisis. Sentiment was fuelled by a White House push to persuade Congress to agree to a fiscal stimulus package and other measures that may include a payroll tax cut to mitigate the economic impact of the COVID-19 epidemic. Meanwhile, oil prices surged 10% to USD37.9 following reports that ongoing talks from OPEC+ remain possible to stabilize oil markets after nose-diving 24% on Monday (the worst decline since 1991) following the breakdown in talks between OPEC and Russia last week and producers embark on price war in a battle for market shares.

TECHNICAL OUTLOOK: KLCI

Following a 60-pt correction on Monday at 1424.2, a tad below the long term downtrend channel near 1438, KLCI staged a 6.3-pt mild recovery to 1430.5 yesterday. Technical indicators remain oversold but are yet to indicate strong recovery signals, in line with the market consolidation. Near term supports are situated at 1415 (10 Mar low) and 1400. Conversely, a successful close above 1438 will spur further upside to refill the 1460-1480 (9 Mar gap down) territory.

On the back of overnight rebound on Wall Street and oil prices coupled with the announcement of a generally capital market-friendly and pragmatic cabinet line-up and PM8’s commitment to mending the economy, we expect KLCI to test 1438-1450 levels, followed by the stiffer resistance at 1460-1480 gap. Near term supports are situated at 1415 (10 Mar low) and 1400.

TECHNICAL OUTLOOK: DOW JONES

Following a 19.9% or 5878 pts correction from all-time high of 29568 to a low of 23690 (10 Mar low), the Dow finally staged a long-awaited rebound to end 4.9% or 1167 pts higher to 25105 on 10 Mar. On the back of a hammer pattern and bottoming up indicators, the Dow is envisaged to retest immediate upside near 25800 and 26200 zones before facing the formidable resistance at 27239 (200D SMA). Supports are near 24500/24000/23600.

Despite a commendable 4.9% rebound overnight, we are likely to witness an extended wild swings consolidation on the Dow in the near term amid lingering concerns about the economic impact as the COVID-19 outbreak has the potential to become a pandemic as investors remain attune for any decisive policy action from the White House either related to a financial stimulus effort or COVID-19 mitigation plan. Key supports are near 24000-23600 whilst resistances fall on 25800-26200 zones. The current downtrend will only end when the Dow can successfully reclaim above 200D SMA resistance near 27239.

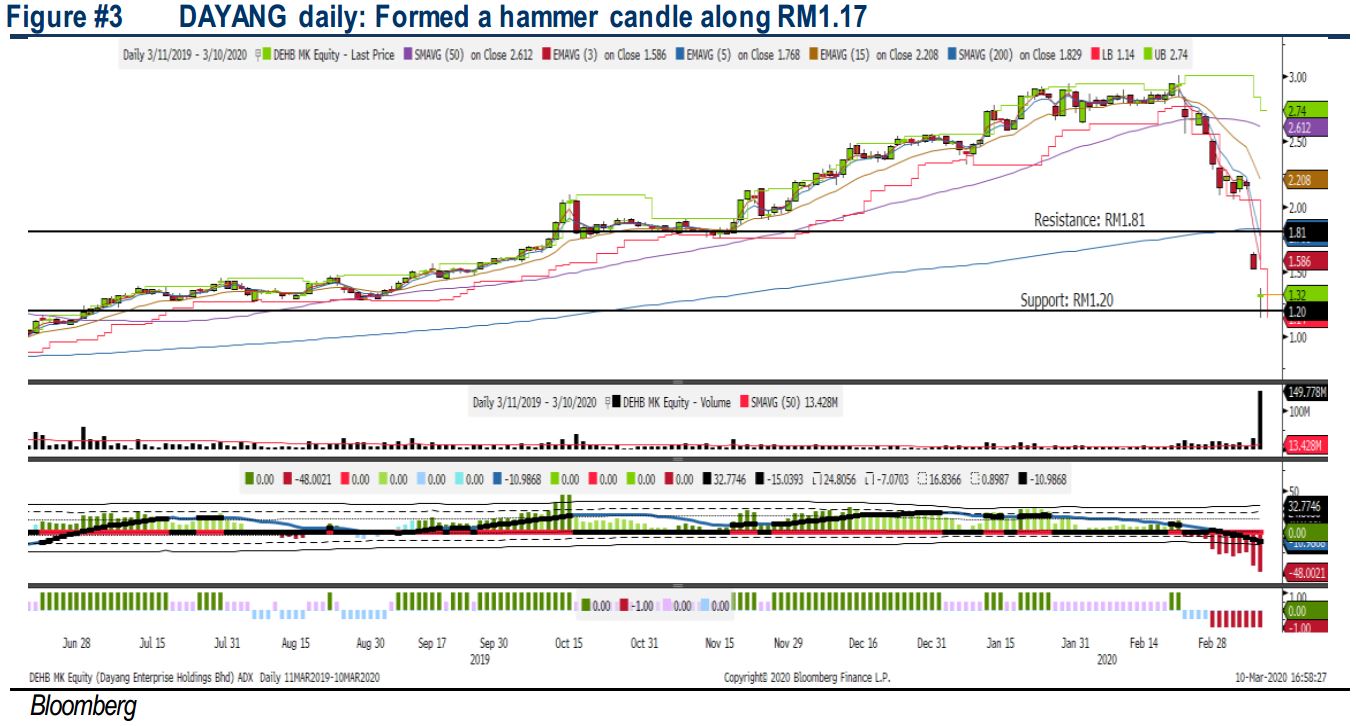

TECHNICAL TRACKER: DAYANG

Time to trade for a rebound after the recent fall. The Covid-19 episode and the oil crisis over the weekend contributed to a sharp correction on most of the energy stocks on Bursa Malaysia; the Energy index pulled back 25% on Monday while Brent oil price w as traded within the region of USD31-38/bbl. In tandem with the broad market decline, Dayang was traded lower for the past two trading days, but we believe the selling pressure could be overdone and warrant for a technical rebound. Resistance is located around RM1.40-1.50, followed by LT target of RM1.81. Support is set around RM1.24-1.26, with a cut loss set around RM1.20

Source: Hong Leong Investment Bank Research - 11 Mar 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024