Dayang Enterprise Holdings - Time to Trade for a Rebound After the Recent Fall

HLInvest

Publish date: Wed, 11 Mar 2020, 09:39 AM

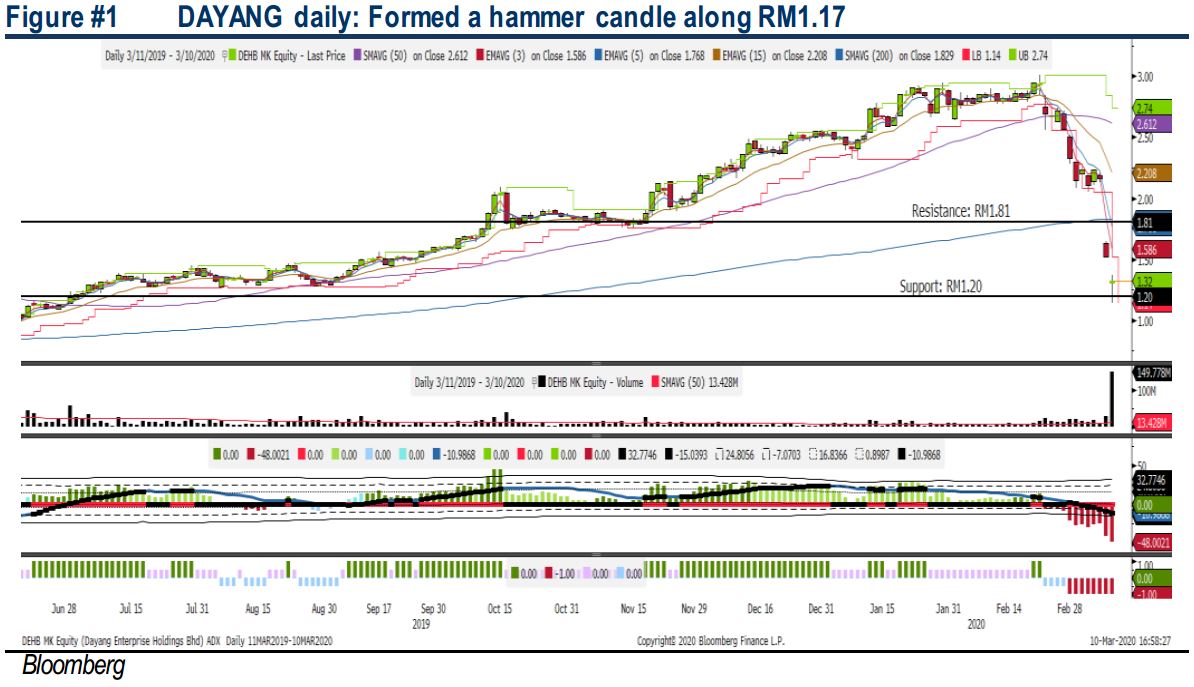

The Covid-19 episode and the oil crisis over the weekend contributed to a sharp correction on most of the energy stocks on Bursa Malaysia; the Energy index pulled back 25% on Monday while Brent oil price was traded within the region of USD31-38/bbl. In tandem with the broad market decline, Dayang was traded lower for the past two trading days, but we believe the selling pressure could be overdone and warrant for a technical rebound. Resistance is located around RM1.40-1.50, followed by LT target of RM1.81. Support is set around RM1.24- 1.26, with a cut loss set around RM1.20.

Decent results in FY19. Dayang’s FY19 core profit of RM227.3m was above our/consensus expectations due to robust contribution from both offshore TMS and marine charter segments. Our analyst believes the earnings momentum will be able to sustain into FY20 in tandem with the uptick in upstream activities. Dayang’s prospects are underpinned by its solid existing orderbook of c.RM4.5bn post award of the I-HUC and MCM contracts won recently.

Significant pullback but severely oversold. Following the declining Brent oil on Monday, Dayang has retreated sharply from RM2.16 (last Friday) to hit a bottom near RM1.17 yesterday, forming a hammer candle. Our indicator is suggesting that the trend is down at this moment. However, we believe the selling pressure is overdone and indicator could be signalling a potential technical rebound in the near term. Should the price surge above RM1.35, next target will be at RM1.40-1.50, with a LT target at RM1.81. Meanwhile, support is set around RM1.24-1.26, with the cut loss anchored around RM1.20.

Source: Hong Leong Investment Bank Research - 11 Mar 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024

KAQ4468

Waaaaa

Limit down lagi la

Hahaha

2020-03-12 09:07