OCK Group - Due for a Technical Rebound

HLInvest

Publish date: Wed, 18 Mar 2020, 09:35 AM

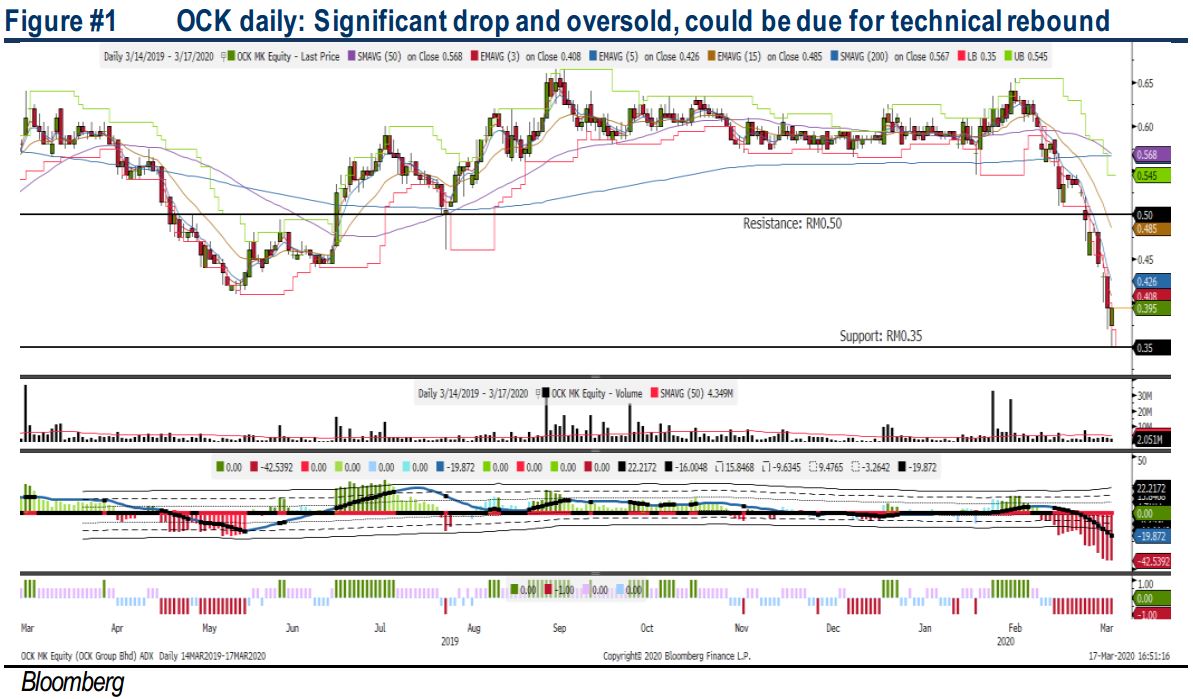

Under this negative trading sentiment amid the ongoing Covid-19 episode, most of the stocks have taken significant beating and we may see some potential recovery in certain stocks. In the telco sector, we noticed Perikatan Nasional (PN) commented that the NFCP, budgeted at RM21.6bn will proceed and the plans of rolling out 5G in 3Q are on schedule. Hence, it may be decent for traders to pick up some short term opportunities within telco stocks after a significant fall recently. OCK could be fitting the bill at this juncture as it has formed a hammer candle after declining 47% from the recent peak of RM0.65. Resistance is at RM0.425-0.45, followed by RM0.50. The support is set along RM0.365-0.37, while cut loss is located around RM0.35.

PN administration to maintain the RM21.6bn NFCP. According to Minister of Communications and Multimedia, Datuk Saifuddin Abdullah on 13 -Mar, the National Fiberisation and Connectivity Plan (NFCP) will proceed and the 5G is likely to roll out in 3Q. We view this as one of the positive catalysts under this cautious environment amid the ongoing Covid-19 situation. Hence, any pullback in this sector could be decent for traders to take a short term opportunity.

Significant pullback but severely oversold. Following the sharp decline of 47% from the peak of RM0.65, it is seen as oversold and could be due for a short term technical rebound. With the hammer formed along the support of RM0.35, we may anticipate slight rebound towards the near term resistance of RM0.425-0.45, followed by a LT target of RM0.50. Support is set around RM0.365-0.37, followed by a cut loss level pegged around RM0.35.

Source: Hong Leong Investment Bank Research - 18 Mar 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|