Traders Brief - Profit Taking Activities Likely to Emerge

HLInvest

Publish date: Mon, 23 Mar 2020, 09:56 AM

MARKET REVIEW

Global: Despite the unsettled Covid-19 situation across the globe, Asia’s stock markets managed to recover mildly amid bargain hunting activities after China kept both the 1 -year and 5-year loan prime rates unchanged at 4.05% and 4.75%. However, Wall Street gave u p earlier session gains and tumbled into the negative region as investors continued to monitor the developments of Covid-19 in the US region and crude oil extended its downward move.

Malaysia: Meanwhile, stocks on the local front rebounded sharply for the session and the FBM KLCI jumped 6.85% to 1,303.28 pts and market breadth was positive with 895 gainers vs. 145 losers. Market traded volume stood at 5.06bn (worth RM4.06bn). Most of the index -linked stocks gained traction after they were significantly bashed down earlier below their GFC valuations.

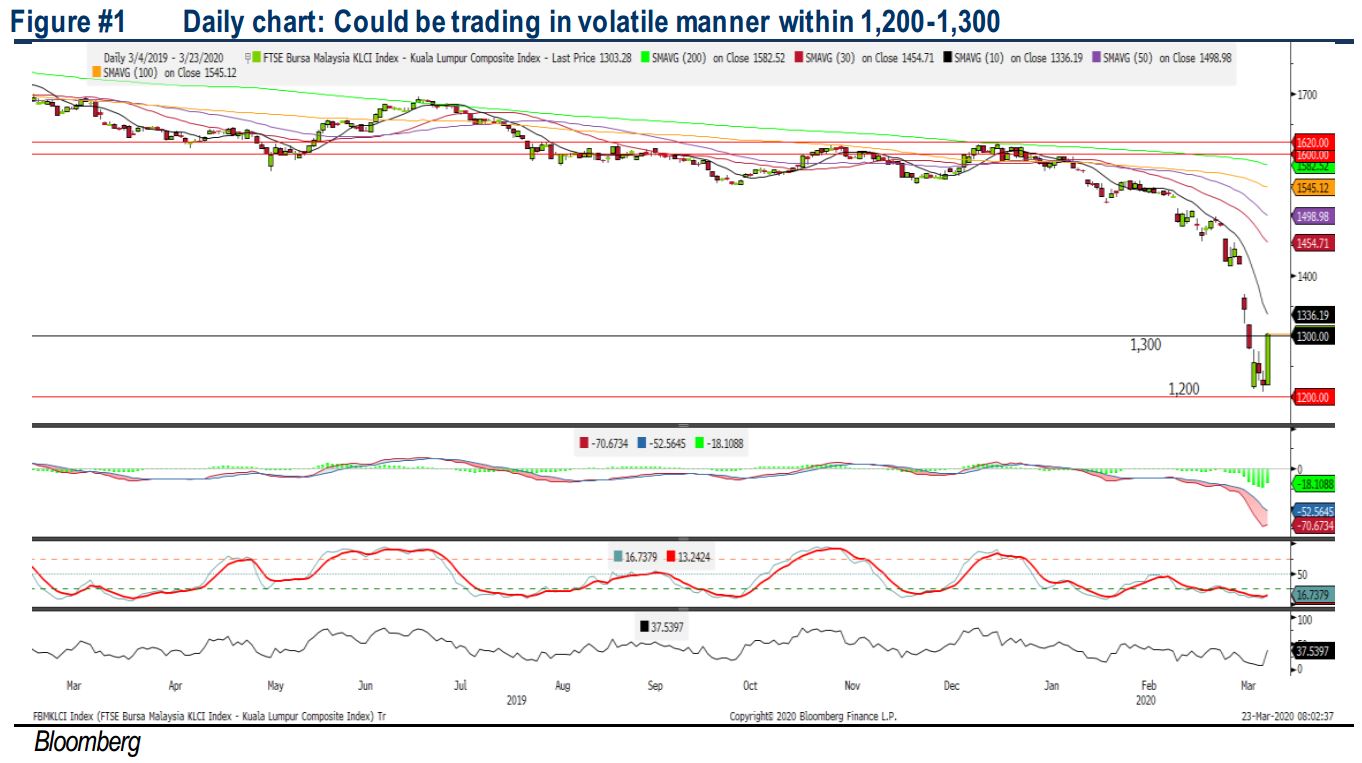

TECHNICAL OUTLOOK: KLCI

The FBM KLCI snapped a two-day losing streak, forming a bullish white candle covering most of the drop last week. The MACD histogram has turned green. Meanwhile, both the RSI and Stochastic oscillators have hooked higher for the session. Resistance will be set around 1,350, while support is located around 1,200.

MARKET OUTLOOK

As Wall Street has declined on Friday, we expect profit taking activities to emerge on local exchange after a sharp increase in the KLCI members and stocks on the broader market and we expect key index to trade in a choppy method along 1,200-1,300. In the US, selling pressure may continue as the stimulus package worth more than USD2trillion did not get enough votes in a key Senate procedural vote Sunday evening.

Source: Hong Leong Investment Bank Research - 23 Mar 2020