WTI - Bearish Undertone Prevails Amid Sluggish Demand

HLInvest

Publish date: Mon, 23 Mar 2020, 09:57 AM

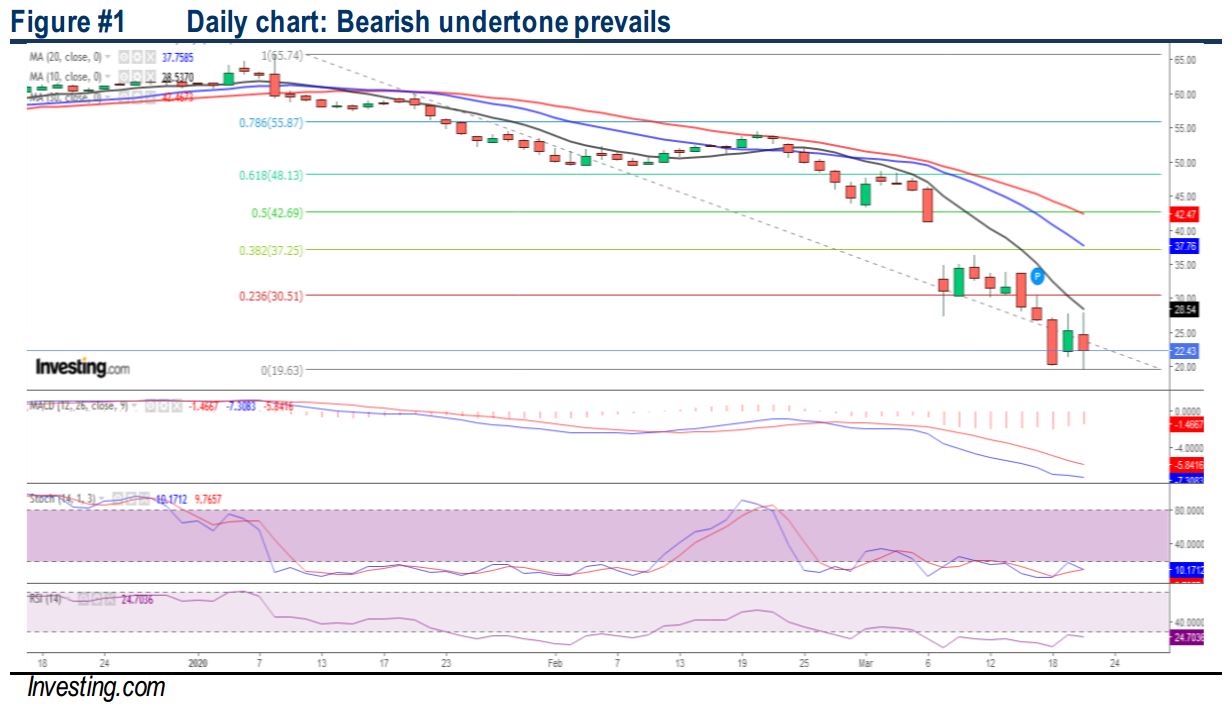

Oil prices slumped 70.4% from YTD high of USD65.6 (8 Jan) to a low of US$19.5 (20 Mar) before ending at USD23.7 last Friday. The slide was mainly driven by the twin shocks of the demand destruction caused by the COVID-19 pandemic and the unexpected oil price war that erupted between major producers from the US, Russia and Saudi Arabia earlier this month. Technically, with the current production cut deal expires 31 March, oil prices are likely to trap in a bearish mode within USD18-30 levels in the near term (following the crucial neckline support breakdown at USD30) amid disaster demand destruction and building global stocks.

Bearish undertone prevails. Despite steeply oversold readings after recent carnage as oil prices slid 64% from YTD high of US D65.6, the rapid breakdowns below the multiple daily SMA supports and the monthly long term crucial neckline support near USD30 are likely witness oil prices to engage in bearish mode in the short term, with key supports situated at USD18-20. Conversely, a strong breakout above USD30 will lift oil prices higher towards USD37-40 territory.

Source: Hong Leong Investment Bank Research - 23 Mar 2020