Traders Brief - Stiff Resistance at 1350-1360 Levels

HLInvest

Publish date: Thu, 26 Mar 2020, 09:25 AM

MARKET REVIEW

Global: On the back of robust gains of regional benchmark indices in Japan (8%), India (7%) and Singapore (6%), Asian markets ended broadly higher after Washington moved closer to delivering a massive US$2 trillion economic rescue bill for voting to reduce the negative repercussions due to the contagious and deadly Covid-19 pandemic. Overnight, the Dow rallied as much as 1314 pts to 22020 but the gains were trimmed to only 496 pts at 21200 after Sen. Bernie Sanders (who is running for the Democratic presidential nomination) said he was prepared to “put a hold” on the USD2 trillion stimulus aid until stronger conditions are imposed on the USD500bn corporate welfare fund.

Malaysia: Taking cues of an overnight Dow’s 11.4% rally amid US stimulus cheer and the bold measures by Bursa/SC suspension of short selling as well as relief measures by BNM to assist borrowers affected by Covid-19, KLCI rallied as much as 50.7 pts to 1341.9. However, profit taking reduced the gains to 33.4 pts at 1324.5 after PM announced an extension to the MCO by another two weeks to 14 April. as compared to Monday’s 2.8bn shares worth RM2.32bn. Trading volume increased to 4.33bn shares worth RM2.83bn as compared to Tuesday’s 3.17bn shares valued at RM2.18bn. Market breadth was positive with 641 gainers as compared to 267 losers.

TECHNICAL OUTLOOK: KLCI

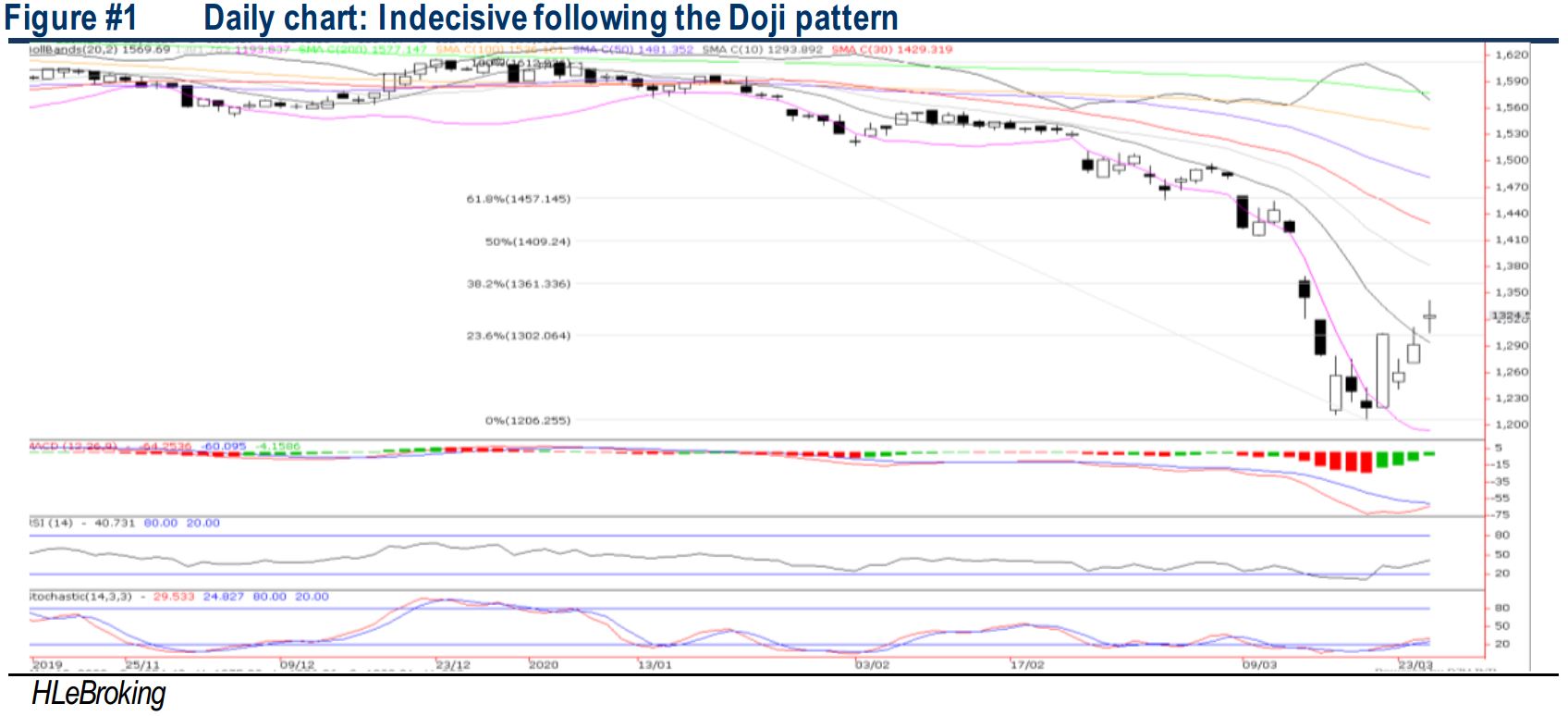

After a 25% or 404-pt rout from YTD high of 1612 (7 Jan) to a low of 1208 (19 Mar), KLCI rebounded as much as 134 pts to 1341.9 before paring the gains to 116 pts at 1324.5 yesterday. The MACD is in the midst of forming a golden cross while the RSI and Stochastic oscillators are firmly hooking up, signalling further upside ahead. Nevertheless, after a strong rally and the formation of Doji, we think the index is about to embark on a counter-trend move in the coming days. Stiff resistances are located at 1342 and 1369 -1419 gap down (13 Mar). Key supports are at 1300/1260/1240.

MARKET OUTLOOK

Following Dow’s back-to-back gains overnight amid US$2 trillion stimulus hopes approval (despite jostling at Capitol Hill), KLCI could record a 3rd straight advance today, in anticipation of a more comprehensive Covid-19 stimulus package on 30 Mar. However, FTSE Russell’s decision about keeping Malaysia in its World Government Bond Index (by end March) and the MCO extension to 14 April, further rebound could be capped at 1342/1369 zones, reflected by the Doji formation and investors’ continued assessment on the financial and economic fallout from the MCO and COVID-19.

Source: Hong Leong Investment Bank Research - 26 Mar 2020