Traders Brief - Ripe for a Pullback

HLInvest

Publish date: Mon, 06 Apr 2020, 09:44 AM

MARKET REVIEW

Global: Despite anticipating final approval by Congress on the USD2 trillion stimulus package late evening last Friday, the MSCI Asia APEX50 index ended 0.3% lower to 1156 (+11% from the 19 March bottom near 1041) as rapid acceleration of Covid-19 infections worldwide fuelling panic selling amid fears more travel and movement restrictions will adversely impact the global economy. Last Friday, the Dow soared as much as 225 pts to 22327 following the approval by Congress of a USD2 trillion Covid-19 stimulus package. However, the entire gains were wiped out and the index ended 915 pts lower to 21637 (+14.3% WoW and -18.7% from all-time high of 26598), as investors refocused back on the coronavirus outbreak, given that the US had become the country with the most confirmed cases.

Malaysia: Taking cues of the no-limit QE program and USD2 trillion stimulus cheer coupled with positive expectations prior to the PRIHATIN stimulus package last Friday, KLCI rallied as much 25 pts to 1353 (+146 pts or 11.2% from 1207 bottom) before profit taking capped gains at 15 pts to 1343. Trading volume increased to 4.23bn shares worth RM2.74bn as compared to Thursday’s 3.53bn shares worth RM2.27bn. Market breadth was positive with 711 gainers as compared to 232 losers.

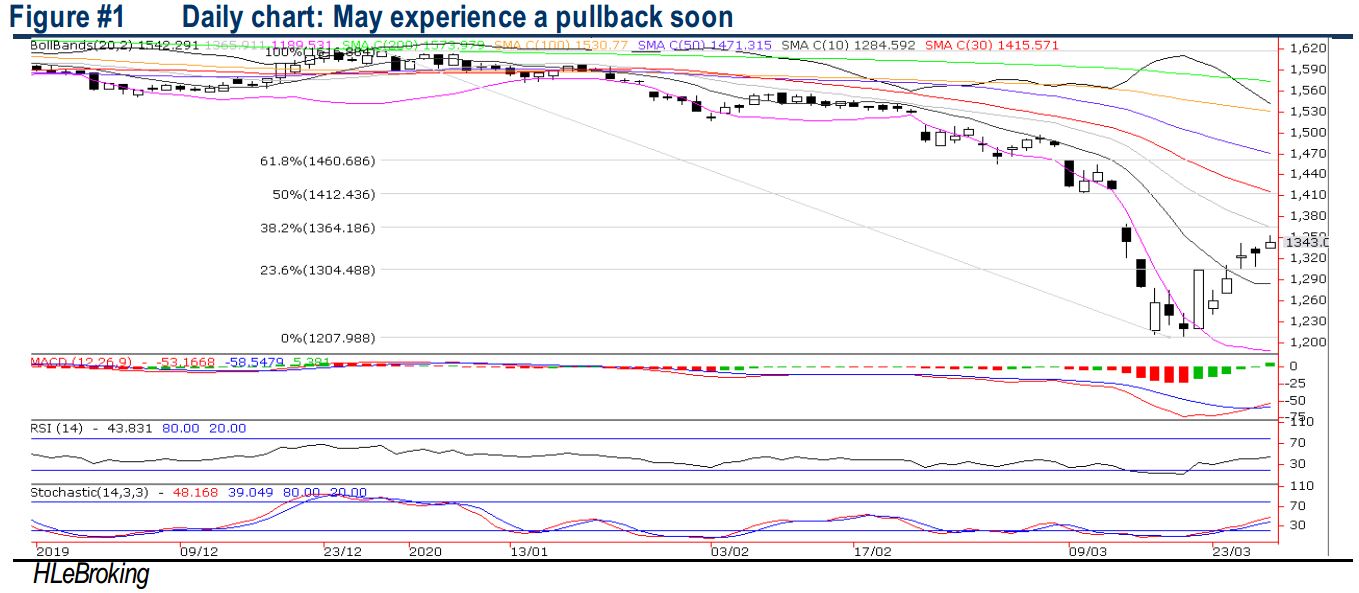

TECHNICAL OUTLOOK: KLCI

After a 25% or 404-pt rout from YTD high of 1612 (7 Jan) to a low of 1207 (19 Mar), KLCI rebounded as much as 146 pts to 1353 last Friday before narrowing the gains to 146 pts at 1343 (-352 pts or 20.8% from 52W high of 1695). The MACD has staged a golden cross while the RSI and Stochastic oscillators are firming up, signalling further upside ahead. Nevertheless, following the formation of a small inverted hammer and a sluggish performance on Dow, we think the index is about to embark on a counter-trend move in the near term. Resistances are located at 1353 and 1369-1419. Key supports are at 1304/1285.

MARKET OUTLOOK

This week, KLCI could advance further towards our envisaged target at 1350-1360 levels amid expectations of 1Q2020 portfolios rebalancing by money managers and the RM250bn PRIHATIN package coupled with recent stock market friendly measures by SC/Bursa. Nonetheless, further upside could be capped by uncertainties lingering from the MCO extension, more countries going into lockdown and spiking Covid-19 cases worldwide. We reiterate a SELL INTO RALLY strategy and rebalance portfolio to sectors that are deemed to be more defensive as the Covid-19 is not only a public health crisis but also a global economic crisis as activities worldwide shutdown.

Source: Hong Leong Investment Bank Research - 6 Apr 2020