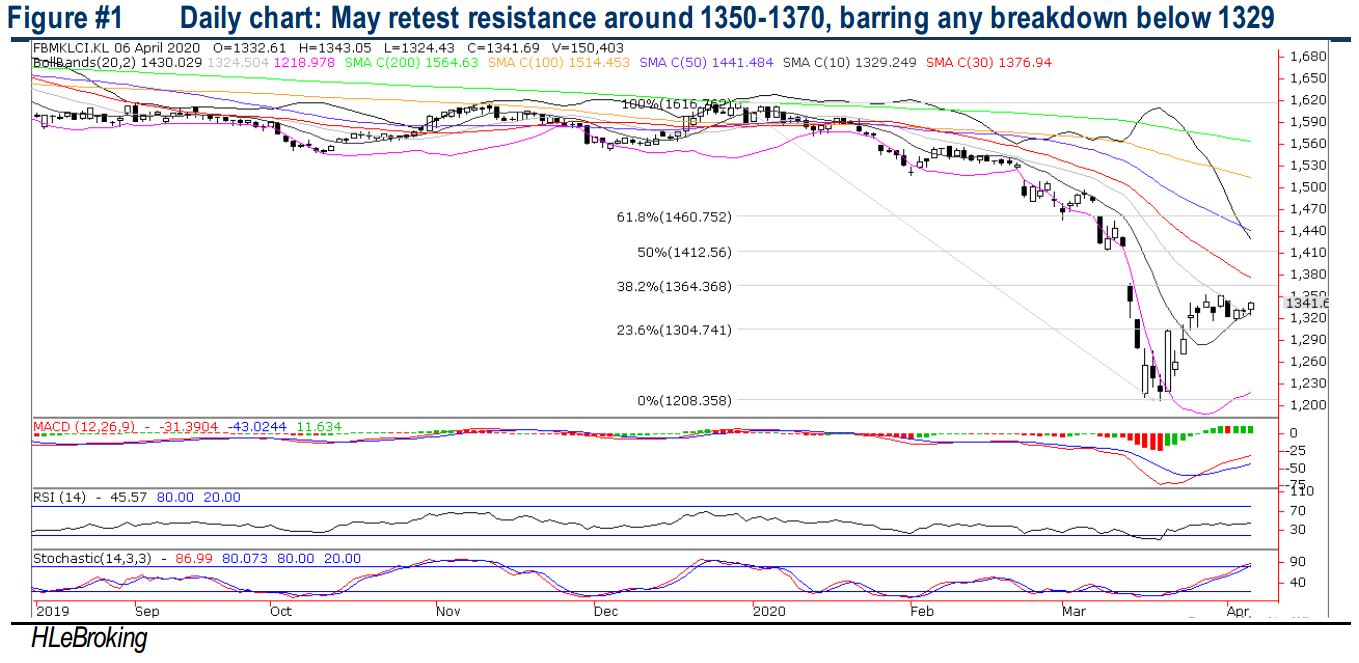

Traders Brief - Facing Stiff Resistances at 1350-1370

HLInvest

Publish date: Tue, 07 Apr 2020, 09:30 AM

MARKET REVIEW

Global: Asian markets managed to recoup early losses (due to an abysmal US March jobs report last week) to end mildly higher as coronavirus pandemic may be peaking in multiple world’s epicenters. Sentiment was also boosted by news that the CEO of Russian sovereign wealth fund told CNBC that Moscow and Riyadh are “very close” to an oil deal. Overnight, the Dow rallied 1627 pts or 7.7% to finish at 22680 on signs that the Covid-19 spread was slowing in New York, the urban metropolis reporting the highest number of cases in the US. Sentiment was also boosted by WHO’s comment that the research to develop vaccines and treatments to fight the coronavirus has “accelerated at incredible speed.”

Malaysia: Tracking higher regional markets, KLCI jumped 11 pts to 1341.9 amid optimism of a OPEC+ oil deal to cut as much as 10m/bpd and the annoucement of RM10bn aid package for SMEs ravaged by Covid-19. Market breadth was bullish with 738 gainers vs. 183 losers, accompenid by traded volume of 5.99bn shares valued at RM2.61bn against last Friday’s 5.35bn shares worth RM2.48bn.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continued to trend sideways between 1317-1352 over the past 8 trading days. The MACD Line and Histogram have continued to recover below the zero level over the past three trading days. Meanwhile, both the RSI and Stochastic oscillators are trending higher above 50. The key index could retest the 1350-1370 levels, while support is located around 1329/1313/1300.

MARKET OUTLOOK

In wake of overnight Dow’s 7.7% surge coupled with the 2nd government stimulus measures to spur domestic ailing SMEs, KLCI could still advance further to retest 1353 (26 March high) and 1364 (38.2% FR) territory. Nevertheless, we reiterate SELL INTO RALLY as we do not expect the formidable hurdles at 1369-1419 gap (16 March) to be filled in the near term, given the pandemic’s toll on the global economy although the latest fatality figures provided some relief to the onslaught of Covid-19. Conversely, a decisive breakdown below key support near 1329 (10D SMA) will acclerate further selling spree towards 1300 levels.

Source: Hong Leong Investment Bank Research - 7 Apr 2020