Traders Brief - Profit Taking Activities Likely to Emerge

HLInvest

Publish date: Tue, 14 Apr 2020, 09:07 AM

MARKET REVIEW

Global: Despite OPEC and its allies finalising an agreement to cut production by 9.7m barrels per day (single largest production cut in history), crude oil declined nearing end of the the Asian hours and key regional markets (Nikkei 225: -2.33%, Shanghai Composite: -0.49%) follow suit led by unresolved Covid-19 situation amid a spike in mainland China cases (which rose above the 100-mark in a single day, mostly imported cases). Meanwhile, Wall Street ended off intraday lows, lifted by tech companies, but broad sentiment remains cautious ahead of the 1Q earnings season that will kick start later today, bracing for earnings and guidance outlook from corporates affected by Covid-19 pandemic.

Malaysia: Similarly, profit taking acitivites were noted across the local exchange; the FBM KLCI slipped 1.47 pts or 0.11% to 1,356.03 pts. Market breadth was negative with 497 decliners vs 307 advancers. Market traded volume stood at 3.11bn shares traded for the session, worth RM1.5bn. We observed that healthcare related and gold-related stocks traded higher for the session; the latter rose due to gold prices surging near the USD1,700 level.

TECHNICAL OUTLOOK: KLCI

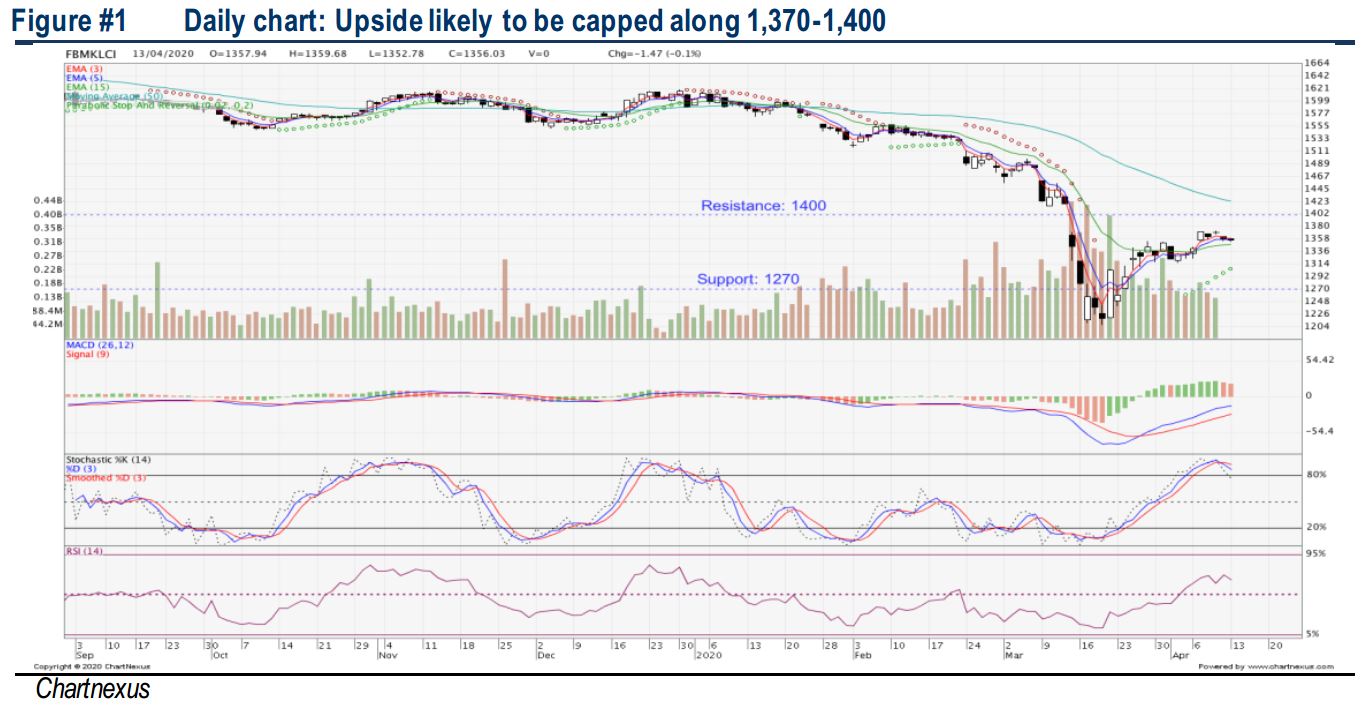

After staging a technical rebound of more than 13% over the past 3 weeks, the FBM KLCI is looking fairly overbought based on momentum oscillators such as RSI and Stochastic. Meanwhile, the MACD Histogram has weakened over the past two sessions. Hence, based on the technical readings, we believe the upside of the technical rebound could be limited around 1,370-1,400. Immediate support is located around 1,352, followed by 1,270.

MARKET OUTLOOK

In tandem with the negative sentiment on Wall Street as investors will be assessing 1Q20 results on the back of this Covid-19 episode and selling pressure is likely to spillover towards stocks on our local exchange. We advise to SELL INTO RALLY as we believe the key index is overbought and near term trading range for FBM KLCI will be located within 1,330 -1,370. Nevertheless, we believe trading interest will be seen within healthcare (gloves, medical equipment) related and gold-related (POHKONG, TOMEI, BAHVEST) stocks as investors continue to monitor the developments on the unsettled Covid -19 situation and rising gold prices, repsectively.

Source: Hong Leong Investment Bank Research - 14 Apr 2020