Traders Brief - Retesting the 1,370-1,400 Zone

HLInvest

Publish date: Tue, 14 Apr 2020, 06:21 PM

MARKET REVIEW

Global: Asia stock markets ended on a positive note amid strong Wall Street performance on Monday, coupled with Japan which will provide stimulus package worth USD1 trillion to mitigate the economic fallout from the novel coronavirus as well as easing Covid-19 confirmed cases and death tolls rate in the US and Europe. However, profit taking activities have seen on Wall Street as the Dow gapped up more than 4% and drifted lower to end in the negative territory at -0.12% as investors reassessed the Covid-19 shutdown which may affect the economic significantly for the year 2020.

Malaysia: Taking cues from regional markets following another stimulus package from Japan to combat the coronavirus impact and overnight Wall Street performance, the FBM KLCI jumped 2.1% to close at 1,369.92 pts. Market breadth was positive as advancers led decliners by a ratio of 9-to-1. Market traded volume stood at 6.61bn, worth RM3.37bn. We noticed stocks within the technology sector traded higher for the session following solid global semiconductor sales, which grew 5% YoY in Feb.

TECHNICAL OUTLOOK: KLCI

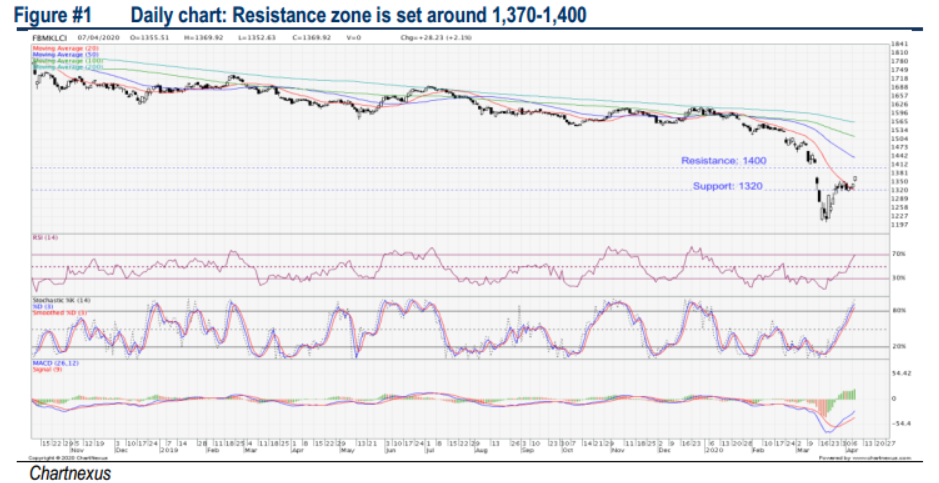

Following the sideways consolidation phase over the past 9 trading days, the key index has breached above 1,353 and ended near the 1,370. The MACD Indicator is suggesting a recovery trend at this juncture, while the RSI and Stochastic oscillators are heading into the overbought region; indicating upside could be limited. We believe the resistance will be located around 1,370-1,400, while support is located around 1,320-1,340.

MARKET OUTLOOK

With the Dow gapping upwards and traded softer throughout the session amid emergence of profit taking acitivities, especially after a 29.7% rebound from the recent bottom on the Dow, we expect similar trading tone on our local exchange. Despite several stimulus package to cushion the impact of Covid-19 from our government, traders are advised to deploy the sell into rally strategy for the near term as we believe the FBM KLCI is facing a stiff resistance along 1,370-1,400.

Source: Hong Leong Investment Bank Research - 14 Apr 2020