Economics & Strategy - …and It Goes on

HLInvest

Publish date: Fri, 24 Apr 2020, 09:13 AM

The MCO has been extended into Phase 4 by another 2 weeks (29 Apr to 12 May). Collectively, the 4 MCO phases would total slightly below 2 months. With the extension, we cut our 2020 GDP forecast from -4.0% to -6.0%, making this “Covid-19 recession” worse than the GFC and almost as bad as the AFC. As our earnings forecast (2020: -3.9%) only imputes 6 weeks of MCO, this extension presents further downside. We continue to expect a W-shaped trajectory for the KLCI with a bottom estimate range of 1,236 to 1,029 before hitting our year-end target of 1,350.

NEWSBREAK

Last night, PM Tan Sri Muhyiddin Yassin announced that the MCO will be extended another round (Phase 4: 29 Apr to 12 May). The PM also mentioned that the government will deliberate to allow more sectors to recommence operations, subject to stringent conditions. To recap under MCO Phase 3 (15-28 Apr), several sectors were allowed “restricted operations”.

HLIB’s VIEW

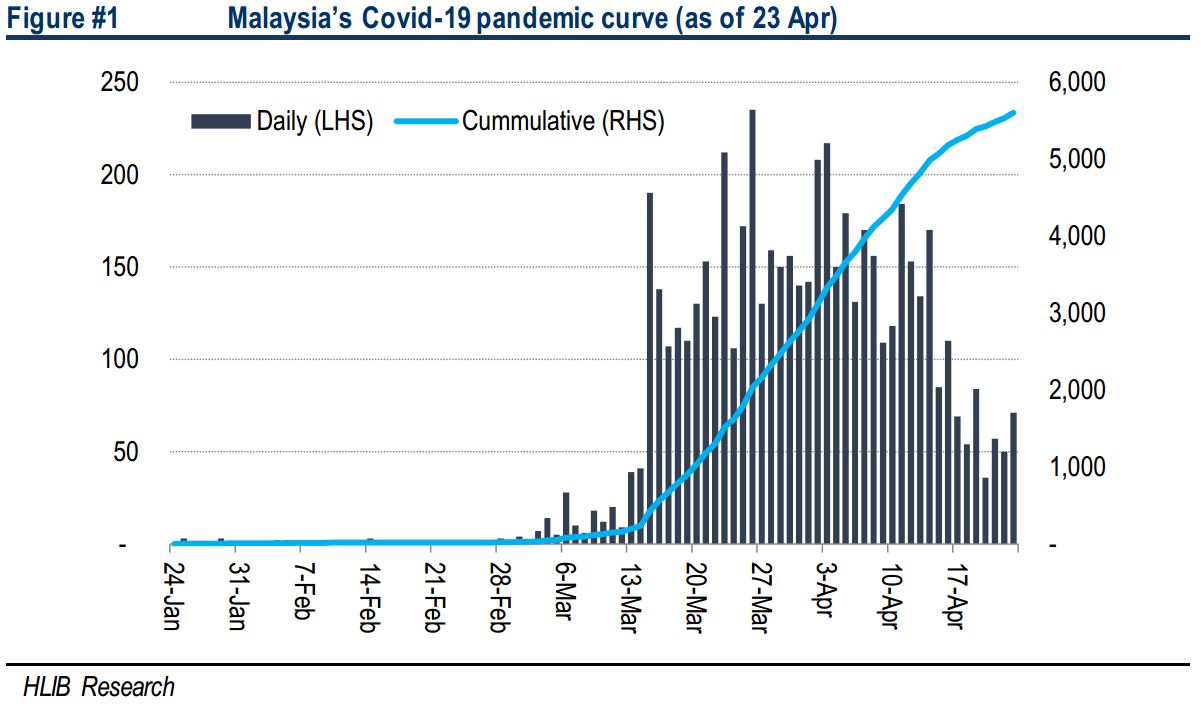

Nip it in the bud. This decision marks the 4th phase to the MCO which began on 18 Mar. Malaysia’s Covid-19 pandemic curve has shown encouraging signs of decline with new daily cases consistently coming in below 100 since 1 7 Apr (1 week). Nonetheless, we view this extension as a necessary pain to ensure resurgence does not happen. Collectively, the 4 MCO phases would total 55 days or slightly below 2 months. We maintain our view that Malaysia’s Covid-19 situation will possibly subside to containable levels sometime in May (1st-2nd week), which coincides with the end of MCO Phase 4.

Lowering 2020 GDP to -6.0%. Following the MCO extension by another 2 weeks, we downgrade our 2020 GDP forecast to -6.0% (previous: -4.0%). This is premised on the assumption that economy is operating on the capacity of 50% of GDP (MCO Phase 2: 45% of GDP). As the economy is now under MCO for a total of 8 weeks (slightly below 2 months), concerns are rife on the impact to the economy and employment. While the latest MOF report on the utilisation of wage subsidy bill (RM13.8bn) showed that RM1.2bn of funds have already been approved for almost 1m workers, this is subjected to conditions and is only for 3 months. We continue to see further downside risks to our GDP forecast from (i) possibility of MCO being extended further, (ii) likelihood of a sluggish recovery post-MCO due to social distancing measures, and (iii) weak global economic environment. We maintain our expectation for BNM to reduce the OPR by 50bps in 2020, with a move to come as early as the upcoming 5 May MPC meeting.

Profound impact to income. The Department of Statistics Malaysia (DOSM) has released the results of an online survey that was conducted from 23-31 Mar 2020 to analyse the effects of Covid-19 on individuals’ employment and income. In terms of income loss, more than half of own account workers (66%) and employers (65.9%) said they experienced an income drop by 50-100%. Own account workers are also the most vulnerable group to job losses, as 46.6% of respondents said they lost their jobs, followed by employers (23.8%). Own account workers and employers account for 18.1% and 3.7% respectively of total employed persons in 2019. A separate survey conducted by the Federation of Malaysian Manufacturers (FMM) from 6-10 Apr, found that more than 50% of 419 companies revealed that revenue had declined by >50%. As a result, businesses said they are unable to sustain their operations beyond 3 months, if the MCO is extended or conditions do not improve. Hence, they plan to undertake cost cutting measures.

W-shaped trajectory to play out. Since its low of 1,220 (19 Mar), the KLCI has rebounded by 13.3% (peak of rebound at 15.9% on 20 Apr). With this “Covid-19 recession” likely to be worse than the GFC and almost as bad as the AFC, we reckon that the recent reprieve over the past 1-month will be short lived; past bear markets have all seen a “dead cat bounce” ranging 10-13%. We continue to envisage a W shaped trajectory for the market and our bottom estimates for the KLCI ranges 1,236 to 1,029; we would only turn buyers closer to those levels. Possible triggers to those levels include (i) another MCO extension beyond Phase 4, (ii) May reporting season with weaker-than-expected corporate results and 1Q20 GDP (vs BNM’s 2020 range of -2.0% to +0.5%), (iii) continued decline in oil prices and (iv) a perhaps overlooked risk of US-China trade war reescalation, noting the barrage of less than cordial statements by President Trump on China.

Downside risk to earnings. We currently project 2020 earnings for KLCI to contract - 3.9% but rebound by +7.7 in 2021. Our forecasts mostly impute a 6 week MCO impact; as such this extension will present further downside to our estimates. Needless to say, there will negatives for most sectors: aviation (travel ban), autos (closure of sales outlets), banks (weaker loan growth and higher credit cost), consumer (panic buying for staples but weak demand for discretionary), construction (work halt except for critical ones), gaming (closure of Genting Highlands and NFO shops), REITs (closure of retail outlets) and property (closure of sales/showrooms).

Year-end target of 1,350. Continuing from our W-shaped trajectory expectations, we maintain our 2020 KLCI year-end target at 1,350, but not before hitting our bottom estimate range first. Our target is based on 14.6x PE (GFC mean) pegged to mid- 2021 EPS. No changes to top picks.

Source: Hong Leong Investment Bank Research - 24 Apr 2020