Traders Brief- Further KLCI advance could be capped by the extended Raya holidays

HLInvest

Publish date: Thu, 28 May 2020, 05:29 PM

MARKET REVIEW

Global: Most Asian bourses ended mildy higher as hopes of a rebound in economic activity were boosted by countries easing coronavirus-induced restrictions and expectations of further monetary policy and fiscal stimulus measures from China on the National People's Congress today. Overnight, the Dow slipped 102 pts to 24474 amid a stream of poor economic data and mounting US-China animosities after US senators introduced a bipartisan bill that would sanction Chinese officials and entities who enforce the new national-security laws in Hong Kong, and the earlier Senate approval that would effectively bar some Chinese companies from listing on US stock exchanges.

Malaysia: Bucking cautious regional markets, KLCI rallied 17 pts to 1452, recording its 7th consecutive gains amid strong buying interests in healthcare-related, plantation, and oil & gas stocks. The sentiment was also boosted by expectations of another rate cut on 7 July MPC meeting after inflation declined 2.9% YoY in April. Trading volume increased to 7.15bn shares worth RM4.65bn as compared to Wednesday’s 6.73bn shares worth RM3.64bn. Market breadth was positive with 558 gainers as compared to 430 losers.

TECHNICAL OUTLOOK: KLCI

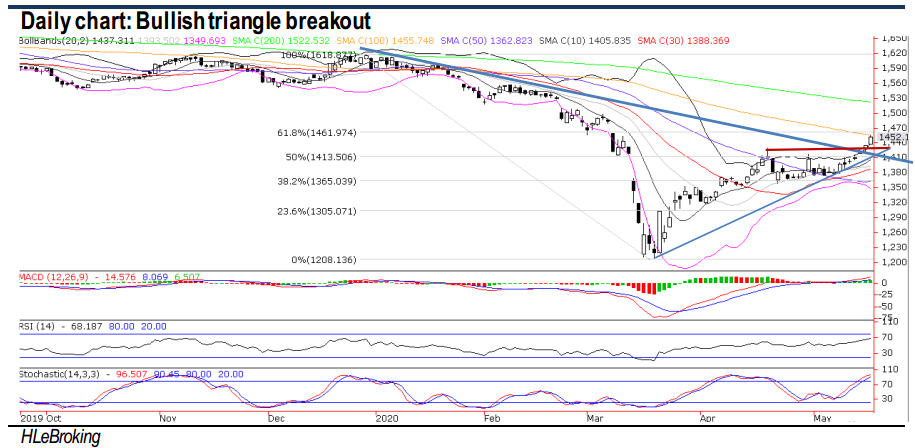

Following a bullish downtrend resistance breakout and surpassed 1429 (20 Apr high) neckline hurdles recently, KLCI is poised to advance further towards 1460-1470 zones, supported by positive daily and weekly indicators. However, after surging 20% from 1208 (COVID-19 bottom), further rally could be capped at 1500 and 1522 (200D SMA). Conversely, violating the key support at 1413 (50% FR and support trendline) could put the bears in the driving seat again, heading towards 1400 and 1388 (30D SMA) levels.

MARKET OUTLOOK

Led by active local institutional funds, we expect a two-tier market to prevail as KLCI is expected to exhibit strength to advance further to test 1460-1470 levels in the near term, supported by the bullish triangle breakout and positive daily/weekly technicals. Nevertheless, smallcap and lower liners are likely to witness further sideways consolidation and lower retail participation ahead of the long Hari Raya holidays (Bursa will be closed on 25-26 May) and ongoing results season.

Source: Hong Leong Investment Bank Research - 28 May 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024