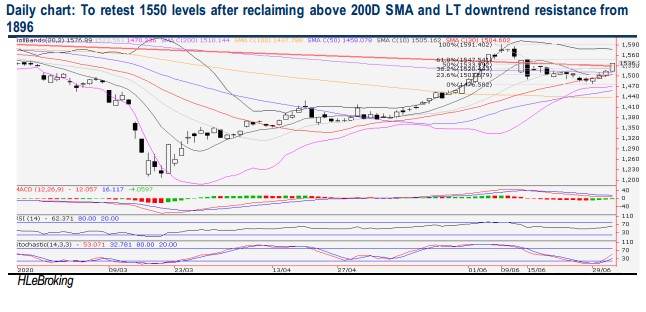

Traders Brief 3 Jul 2020- To retest 1547 levels after reclaiming above 200D SMA and LT downtrend resistance

HLInvest

Publish date: Fri, 03 Jul 2020, 09:41 AM

MARKET REVIEW

Global: In tandem with higher S&P500 and record close on Nasdaq, Asian markets rose as hopes for development of Covid-19 vaccines and positive economic data from the US and China as both countries ramped up stimulus measures, offset concerns on resurgence in virus infections worldwide. Meanwhile, Hang Seng index rallied 2.85% despite the implementation of security law by China effective 1 July as investors sees US moves to revoke HK’s special treatment will have limited impact while closer economic ties with China will benefit the city.

Dow surged as much as 469 pts to 26204 amid optimism surrounding a robust June employment report. However, the gains were reduced to a meagre 92 pts at 25827 (+812 pts or 3.2% WoW) ahead of the Independence Day holiday on Friday, after a report indicated that final-stage trial of a Moderna coronavirus vaccine candidate was delayed and persistent spike in infections and hospitalisations could prompt states to re-schedule re opening plans. Meanwhile, the Nasdaq rallied as much as 156 pts to all-time high at 10310 before paring earlier gains to 53 pts at 10208 (+451 pts or 4.6% WoW).

Malaysia. Tracking bullish regional markets, KLCI surged 21.9 pts or 1.44% at 1536.3 (recorded a 4-day cumulative gains of 48 pts), lifted by active buying interests in oil & gas, glove and banking stocks such as PCHEM, PBBANK, MAYBANK, TOPGLOV, HARTA and CIMB. Trading volume declined to 5.90bn shares worth RM4.02bn as compared to Wednesday’s 7.33bn shares worth RM3.60bn. Market breadth was positive with 701 gainers as compared to 334 losers.

TECHNICAL OUTLOOK: KLCI

After peaking at 1591 (9 June) from bottom of 1208 (19 Mar), KLCI surrendered as much as 115 pts to 1476 (29 June low) before gradually narrowing the losses to 55 pts or 3.5% at 1536 yesterday. In wake of a decisive rebound above the 200D SMA (or 1510) and LT downtrend line (near 1530), the index is likely to retest between 1547 (61.8% FR) and 1563 (76.4% FR) region soon, supported by bottoming up indicators. On the flipside, violating 1510 support would imply further profit taking pullback towards 1500 and 1483 (30W SMA) levels.

MARKET OUTLOOK

The index may continue on its positive run in the near term towards 1547-1563 zones, riding on a highly welcomed measure by Bursa/SC last Friday to extend the short-selling ban to 31 Dec 20, ongoing rebound in oil prices coupled with a positive reclaim above the key 1510 and 1530 barriers. However, a profit taking pullback could be triggered by further surge in Covid-19 count globally, souring US-China relations, domestic political uncertainty with the focus on Parliament re-sitting on 13 July and deteriorating August results season. On stock selection, we believe MISC (RM7.85-Buy-TP RM8.98) could attract further buying interests amid a bullish flag breakout yesterday, towards near term RM8.00-8.30 upside targets. Fundamentally, the stock is a rare diamond amidst current global economic climate and is an MCO proof stock, benefitting from the strong petroleum tanker charter rates amidst global shortage of oil storage space. Besides, it offers stable DY of 3.8% to give a degree of defensiveness within the big-cap space. Support is near RM7.55-7.75. Cut loss at RM7.45

Source: Hong Leong Investment Bank Research - 3 Jul 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024