Traders Brief 9 Dec 2020

HLInvest

Publish date: Wed, 09 Dec 2020, 09:21 AM

MARKET REVIEW

Global. Asian markets ended mixed as investors continued to weigh on the surging Covid19 cases worldwide, the timing US stimulus negotiations as well as Brexit talks between the UK and the EU. The Dow ended 104 pts higher to 30173 overnight from 97 pts intraday losses, led by a rise in energy stocks and further signs of progress from lawmakers to reach a consensus on the USD908bn stimulus bill by end-Dec. Sentiment was also boosted by the FDA that the inoculation met its safety standards, with many expecting the health regulator to grant the vaccine emergency use authorization by end-Dec.

Malaysia. KLCI rose 8.8 pts to end at 18M high 1631.7 amid bargain hunting on index - linked glovemakers following recent rout, utilities and leisure stocks. However, market breadth was midly negative as losers 649 edged gainers 592 amid profit taking on penny stocks and lower liners. Yesterday, foreign investors (-RM32m) and local institutional (- RM81m) investors remained as the net sellers whilst local retail investors net bought RM113m in equities.

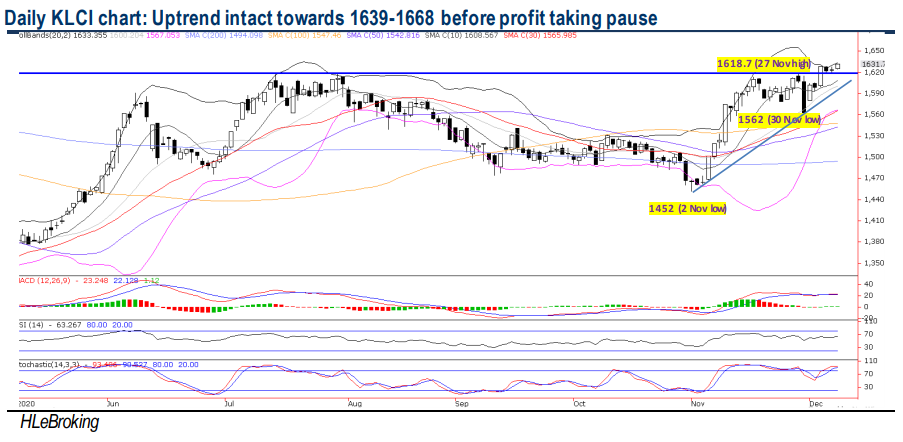

TECHNICAL OUTLOOK: KLCI

Although near term profit taking consolidation will prevail after rallying 180 pts or 12.4% from 1452 low to 18M high at 1631.7 yesterday, KLCI’s near term bullish charge towards 1638 (150W SMA) and 1668 (200W SMA) zones is still underway, barring any decisive breakdown below higher support base at 1600-1618 levels. A successful breakout above the said hurdles could signal a LT bullish view to re-challenge the 1700 psychological barrier. Conversely, a fall below 1600-1618 supports may trigger further pullback towards 1562-1580 territory.

MARKET OUTLOOK

Following recent 180-pt or 12.4% rally from 1452 low to 18M high at 1631.7 yesterday, KLCI is ripe for a mild pullback (with key supports upgraded to 1600-1618) due to the grossly overbought technical readings, concerns over the uneven global economic recovery despite vaccines’ optimism, the repercussions on our economy and corporate earnings after the CMCO 2.0, and Fitch’s downgrade on Malaysia’s sovereign credit rating. However, we opine that the traditional Dec window dressing (average +3.8% return from 1990-2019 with a 87% successful hit rate) and continued migration from pandemic-themed to economic recovery beneficiaries may provide the much-needed impetus to boost the benchmark higher towards 1638-1668 zones before profit taking pause.

Source: Hong Leong Investment Bank Research - 9 Dec 2020