Traders Brief - Extended Consolidation Amid Domestic Headwinds

HLInvest

Publish date: Thu, 07 Jan 2021, 08:49 AM

MARKET REVIEW

Global. Asian markets ended mixed, pending the outcome of a pivotal US Senate election and fears of new COVID-19 restrictions would dampen global economic recovery coupled with slower growth in China’s Dec PMI services data. The Dow ended 438 pts or 1.4% higher at record high, as violent protests at Capitol Hill to stop the confirmation of President-elect Joe Biden’s victory was offset by a wave of optimism that more stimulus is on the way as Democrats won the Georgia runoff elections to take control of the Senate.

Malaysia. KLCI fell 16.4 pts to 1592, as sentiment was dampened by the Fitch Ratings ‘negative outlook’ for Malaysian banks and rumours of a MCO reintroduction amid elevated Covid-19 cases and clusters in Malaysia. Overall, market breadth was bearish as losers thumped gainers by 965-287 whilst a total of 7.7bn securities were traded for RM4.4bn.

TECHNICAL OUTLOOK: KLCI

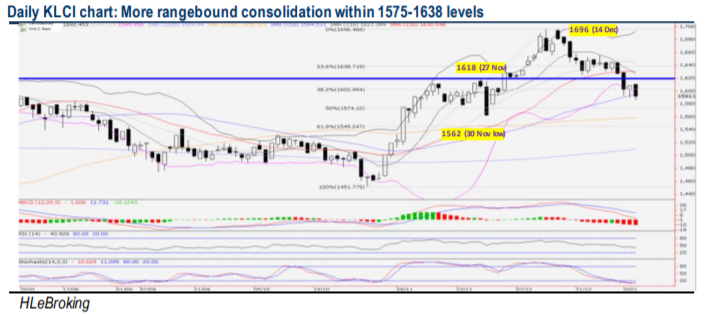

KLCI’s poor closing yesterday is likely suggests that the bears have not given up just yet. The index remained below the crititcal 1600-1618 supports, which can be deemed as negative. For a resumption of an upward momentum, the index may still need to find its footing above these hurdles in order to advance further to 1638 (23.6% FR) and 1667 (200W SMA) levels. Towards the downside, a breakdown below 1574 (50% FR) may trigger more selloff towards 1562 (30 Nov low) and 1545 (61.8% FR) levels.

MARKET OUTLOOK

In the absence of immediate-term drivers, KLCI may continue to remain highly volatile (weekly supports: 1562-1575; resistances 1618-1638), as investors digest more news flows about the surging local Covid-19 cases and clusters, vaccine distributions and challenges faced by nations in vaccinating their citizens coupled with the resumption of RSS. Nevertheless, optimism on economic recovery amid the multiple Covid-19 vaccine breakthroughs, a combination of continuing fiscal and monetary stimulus, the low-interest rates environment and China's firmer economic recovery will continue to underpin interests on the equity market.

On stocks selection, we believe the recent share prices’ slump in glove stocks offers tremendous buying opportunity. Gloves stocks under our BUYs coverage (TOPGLOV, KOSSAN and HARTA) are currently trading at 4.3x-11.9x FY21P/E offering dividend yield of 3.6%-15.4%, supported by lead times of >365 days indicating that demand will stay resilient and supply potentially exacerbated by temporary production disruption suffered by a few glove players due to COVID positive testing. Overall, global demand for will remain highly robust, with MARGMA projecting +25% YoY for CY2021. Post Covid-19, we opine the normalised global glove demand growth would be at circa 13%-15%; higher than the usual 8%-10% pre-pandemic.

Source: Hong Leong Investment Bank Research - 7 Jan 2021