Technical Tracker - ASTRO: Grossly Oversold

HLInvest

Publish date: Fri, 26 Aug 2022, 04:02 PM

The infection point. Weighed by the illegal TV box piracy and intense competition from Unifi TV and streaming service (i.e Netflix and Disney+), ASTRO's subscription revenue (>70% of revenue contribution) experienced tremendous pressure and has been on a declining trend since 2018. As a result, ASTRO's share price slid 61% from 2018's peak of RM2.10 to RM0.84 yesterday, tracking the falling household penetration rate from a peak of c.77% to c.71% in 1Q23.

While the outlook for ASTRO's TV operation remains challenging, seve ral key developments were implemented by the authorities may bode well for the group. For instance, the enforcement of the Copyright (Amendment) Act 2022 will help to reduce the number of illegal TV boxes being used and sold as it allows ASTRO to take legal action against illegal TV Box sellers and distributors of its content. Also, the launch of its broadband services and becoming a streaming service aggregator at the same time enables ASTRO to provide a similar value proposition as TM in the way of one-bill convenience and additional cost savings from the bundles.

Advertising segment. Astro's advertising revenue was also cannibalized by the advent of Facebook and Google, which collectively took up an estimated 80% of digital adex share in Malaysia. That said, we note that advertisers are increasingly adopting an omnichannel advertising approach (a method where advertisers do not just advertise through online platforms but also through traditional media platforms to widen their audience reach) which will benefit the local media players. We also note that the ROI gap on ad spend on Facebook and Google vs ASTRO has substantially narrowed over the years following Malaysia introducing a 6% digital tax on foreign digital services providers in 2020. Furthermore, with ASTRO launching addressable advertising in 2022, allowing it to serve targeted ads to different customer segments based on their profiles, this ROI gap is anticipated to narrow further.

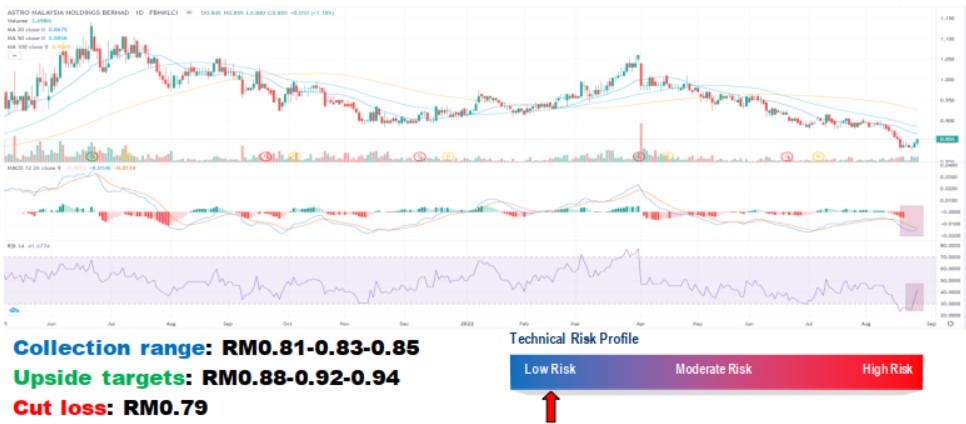

Limited downside amid grossly oversold level. Technically, ASTRO is grossly oversold with indicators on the mend. A successful breakout above RM0.86 will spur the price toward RM0.88-0.92-0.94 level. Cut loss at RM0.79.

Source: Hong Leong Investment Bank Research - 26 Aug 2022