TIME DotCom - Missed But Dividend Surprised

HLInvest

Publish date: Tue, 30 Aug 2022, 09:53 AM

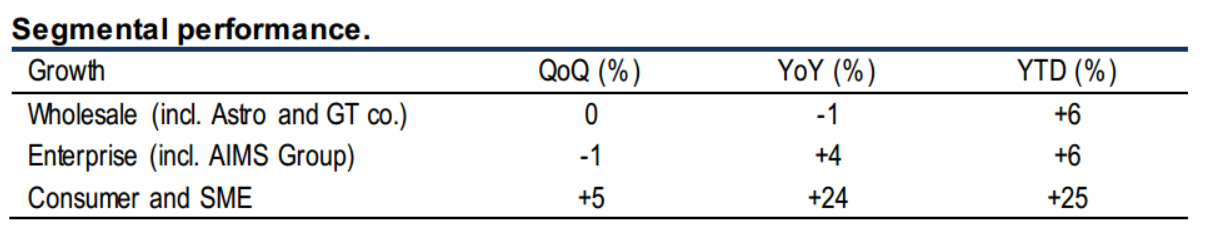

TdC’s 1H22 core net profit of RM192m (+7 YoY) missed ours but met consensus forecast. On a YTD basis, turnover grew 9% thanks to higher contributions from Data (+12%) and Data Centre (+13%), more than sufficient to offset Voice contraction (-6%). In terms of segment, all markets recorded positive trajectories led by Retail, followed by Wholesale and Enterprise. Regional associates contributed a total of RM11m (+8% YoY) in 1H22. TdC remains optimistic of growth prospects with the improvement of Malaysia’s economy. Reiterate BUY with lower SOP-derived TP of RM5.16.

Below HLIB but matched street. 2Q22 core PAT of RM93m (-5% QoQ, -1% YoY) brought 1H22’s to RM192m (+7% YoY) which came in below our forecast at 44% but was in line with consensus at 46%. The miss was due to lower-than-expected EBITDA margin. 1H22 one-off adjustments include net bad debt recovered (-RM344k), forex gain (-RM23m), net allowance for doubtful debts (+RM6m), PPE disposal gain (-RM1m) and PPE written off (+RM1m).

Dividend. Declared a special interim tax exempt (single-tier) DPS of 16.34 sen (2Q21: none), which will go ex on 14 Sep. 1H22 DPS amounted to 16.34 sen (1H21: none).

QoQ. Top line gained marginally (+1%) as all products experienced expansions: Data (+1%), Data Centre (+1%) and Voice (+2%). However, core net profit eased by 5% due to (i) higher D&A (+5%); and (ii) lower share of profit from associates (-3%).

YoY. Turnover grew 8% supported by higher contributions from Data (+11%) and Data Centre (+12%), more than sufficient to offset Voice contraction (-3%). However, core PATAMI was 1% lower attributable to (i) higher D&A (+11%); (ii) higher finance cost (+15%); and (iii) lower share of profit from associates (-3%).

YTD. Revenue grew 9% to RM743m driven by the improvements from both Data (+12%) and Data Centre (+13%), more than sufficient to neutralize Voice’s decline (-6%). With higher D&A (+9%), core earnings rose at slower pace of 7% to RM192m.

Regional associates. CMC (Vietnam) and Symphony (Thailand) were profitable and contributed RM11m (+8% YoY) to 1H22’s bottom line.

Outlook. It remains optimistic of its growth prospects for the year with the improvement of Malaysia’s economy. TdC’s top priorities remain network availability and stability. It is committed to continue network expansion and product innovation to seize opportunities in the local as well as the regional markets.

Forecast. Based on the deviation mentioned above, we tweak our cost assumptions and led to lower FY22-24 PATAMI by 4%. Reiterate BUY with lower SOP-derived TP of RM5.16 (previously RM5.37) (see Figure #2) with WACC of 8.2% and TG of 1.5% for domestic telco business. We like TdC as its retail is gaining momentum on the back of reach expansion and undisputable high value products. Also, data centre is expanding resiliently as IT outsourcing, cloud computing and virtualization are widely adopted. GBS is no longer a drag and expected to perform better as demand recovers.

Source: Hong Leong Investment Bank Research - 30 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|