Technical Tracker - MYNEWS: Slowly But Surely

HLInvest

Publish date: Fri, 02 Sep 2022, 09:46 AM

Convenient store (CVS) operator. Being the largest home-grown retail convenience store operator in Malaysia, MYNEWS' portfolio includes MYNEWS include Mynews, Mynews Supervalue, CU, and WH Smith Travel Limited. By entering into two separate agreements with Japanese wholly-owned companies in 2017, MYNEWS diversified into fresh food production to supply and sell Halal ready-to-eat food and baked goods to enhance the fresh food offerings at its stores. As of 2Q22, MYNEWS owns 558 outlets (vs 4QFY21: 542 outlets).

CU-the largest CVS from Korea. In April 2021, MYNEWS launched its first CU store – the largest convenience store in South Korea – to complement its existing CVS line-up, offering Ready-to-Eat fresh food with South Korean street food flavors, snacks, beverages, and beauty products imported from South Korea. Since then, the number of CU outlets grew encouragingly to 95 in 2Q22 from 61 in 1Q22. With c.65% of the selection focusing on the fresh food segment, which typically gamers a higher margin than other products, the rollout of CU is deemed as one of the major long term earnings drivers. The ramping up of CU stores opening will also complement MYNEWS’ food processing centre (FPC) by improving its utilisation rate.

Despite persistent losses for nine consecutive quarters – as CU is still undergoing painstaking gestation period (c.2.5 years) despite being a beneficiary of the economic recovery – market consensus is expecting MYNEWS to return to black by FY23, premised by (i) growth in number of stores; (ii) improvement in efficiency in running the FPC (iii) bigger contribution from CU stores with a higher proportion from fresh food segments that command higher margin; and (iv) potential of new RTE product launches.

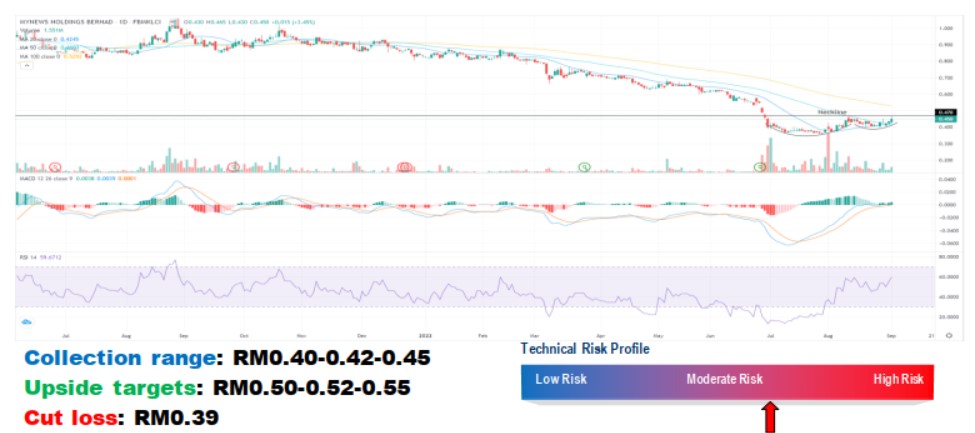

Pending Double bottom breakout. Technically, MYNEWS is pending for a double bottom breakout. A successful breakout above the RM0.47 neckline will indicate a downtrend reversal and spur the price toward RM0.50-0.52-0.55 level. Cut loss at RM0.39.

Source: Hong Leong Investment Bank Research - 2 Sept 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|