Technical Tracker - SCOMNET: Growing Strong

HLInvest

Publish date: Thu, 08 Sep 2022, 09:11 AM

Medical Segment. Being SCOMNET’s key growth engine (as well as commanding the highest profit margin division), Supercomal Medical Products Sdn. Bhd (SMP) accounted for 61% of SCOMNET’s revenue in 2Q22, serving reputable customers such as Ambu Medical and Edwards Lifesciences (accounting for c.94% of SMP’s revenue). With the resumption of the MerMaid D*Clot project (put on hold during Covid-19) in early 2022 and started its delivery in 2Q at about 600 units (vs capacity of 4k units), the group believes the output will ramp up in the coming months (c.1k units). To recap, D*Clot is a rotational thrombectomy system that Mermaid Medical Group launched. Likewise, the IHS syringe infusion system –the first-ever non-electric infusion pump for both intravenous and subcutaneous routes of administration- is expected to begin mass production by 4Q22. We believe the contribution from new products, on top of growing orders from existing clients, will provide a new stream of income to SMP. In fact, the group is hopeful that the sales from the IHS syringe infusion system and Mermaid Medical will surpass Ambu Medical and Edward Lifesciences by 2023.

Automotive Segment. Under its wholly-owned subsidiary Supercomal Advanced Cables Sdn. Bhd (SAC), SCOMNET is currently the only wire harness and fuel tank supplier for a European car company in the Asia Pacific region. We gather that the group is currently in the process of submitting quotations to supply wire harness and fuel tank for another car model of the same brand, with sample units submitted in 2Q-3Q22. The mass production for both products is expected to kick start by 4Q22.

Transfer to Main Board. Meanwhile, the group is seeking for a transfer to the Main Board and is expected to be completed in 4Q22. We opine that a Main Board listing will be a re-rating catalyst given the limited medical technology stocks in Bursa Malaysia.

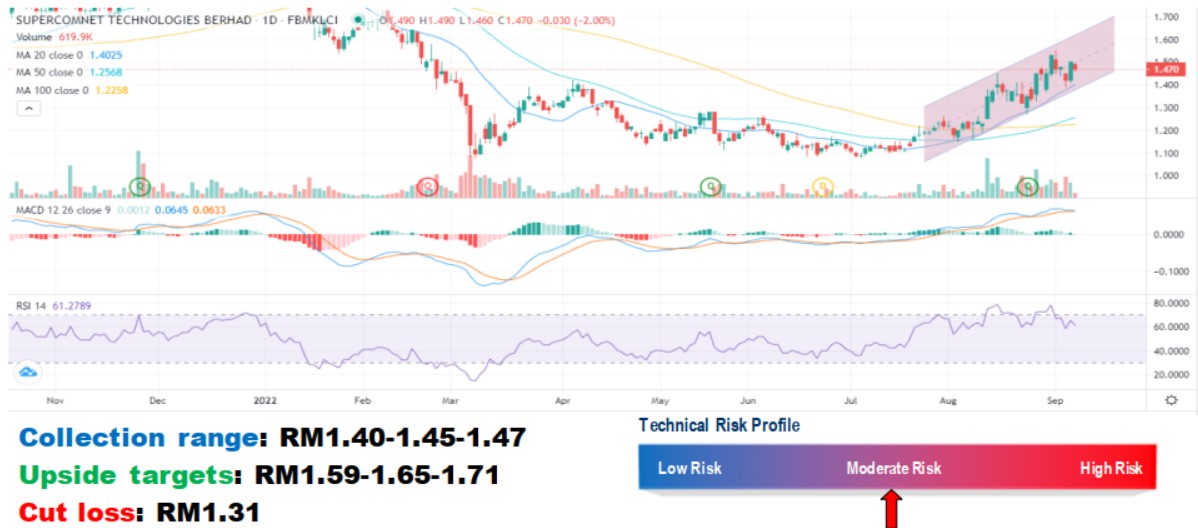

Higher high formation. After staging a downtrend line breakout in July, a new uptrend channel was formed in SCOMNET. In light of a higher high formation, SCOMNET could advance further toward RM1.59-1.65-1.71 area. Cut loss at RM1.31.

Source: Hong Leong Investment Bank Research - 8 Sept 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|