Technical Tracker - PGF: Turning the Corner

HLInvest

Publish date: Thu, 29 Sep 2022, 09:50 AM

Glass mineral wool manufacturer. Listed in 1990, PGF Capital Berhad (PGF) is mainly involved in design, manufacturing, and distribution of glass mineral wool insulation for energy efficiency (widely considered an effective yet one of the cheapest insulation materials in the market) and acoustic comfort. The group also ventured into real estate and agro-tourism businesses by leveraging its 1,311 acres of leasehold land in Tanjong Malim (strategically located adjacent to Proton City) but the contribution from these segments are still negligible (>2% of revenue). Geographically, Oceania markets (58% FY21 revenue) are the top revenue generators, followed by Malaysia (25%), SEA (6%), and others (2%).

Riding on higher energy rating. Insulation plays an important role in saving energy, and it is part of the building code in some countries. Unlike Malaysia where only roof insulation is compulsory (industrial and commercial), New Zealand and Australia’s (where PGF has a strong presence in) building codes require roofs, walls, and floors to be insulated to get the CCC certificate. This is also denoted by a higher R-value – a measurement that tells how well it can keep heat from leaving or entering your home – requirement in New Zealand and Australia than in Malaysia (Figure#1).

Despite rosy demand outlook in New Zealand and Australia markets, PGF’s 2020 -2021 export sales were weighed by the buoyant freight rate, given its low sales value per container as glass mineral wool is bulky. Nevertheless, in wake of easing freight rates, we reckon the group’s export sales will turnaround in the coming quarters, underpinned by New Zealand and Australia’s move to revise their building codes (potentially to be implemented in mid-2023) with a higher energy rating requirement, fuelling the demand for glass mineral wool. With this, the group will build three new warehouses in the Oceania region and hopes to grow its market share to 20% (from 5% now) by FY25 through the funds raised from the ICPS in 1Q22.

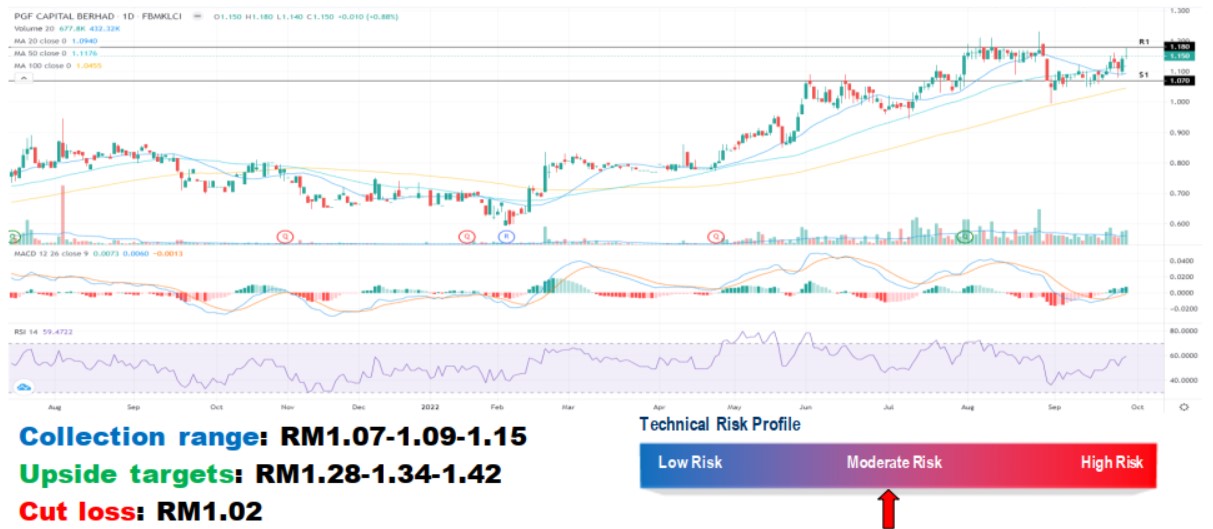

Pending resistance breakout. Technically, PGF is pending a resistance breakout of RM1.80. A successful breakout above the said hurdle will spur the price toward RM1.28-1.34-1.42 levels, creating a higher high pattern. Cut lost at RM1.02.

Source: Hong Leong Investment Bank Research - 29 Sept 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jan 14, 2025

Created by HLInvest | Jan 08, 2025