Traders Brief - Building Base Near 1,450-1,460

HLInvest

Publish date: Thu, 05 Jan 2023, 09:59 AM

MARKET REVIEW

Asia/US. Despite extended gains in China and Hong Kong bourses on hopes that China’s swift reopening boosted hopes for long term economic recovery, most Asian markets ended mixed as investors weighed on the upcoming US Job Openings and Labour Turnover Survey (JOLTS) and Dec FOMC minutes, as well as the repercussions of surging Covid cases and death tolls in China to its near term economy. Ahead of the key US Dec jobs report tomorrow, the Dow added 134 pts to 33,270 after swinging between 273 pts gain and 103 pts losses, as investors digested (1) the Dec FOMC meeting minutes signalling higher for longer rates, (2) JOLTS data showing a tight labour market that stoked fears of a wage driven pick-up in inflation and (3) a slower Dec ISM Manufacturing index PMI at 48.4, slipping further into contraction territory for a 2nd month.

Malaysia. Tracking the cautious regional markets and lack of market catalysts, KLCI eased 4.5 pts at 1,469.6 to record its 2nd straight decline. Market breadth (gainers/losers ratio) was negative for a 2nd day but improved to 0.93 from 0.78 a day ago while trading value rose 13% to RM1.66bn. Foreign investors extended their net outflows for a 4th session (-RM22m, Dec: -RM1.36bn) followed by the local institutions (-RM6m, Dec: +RM1.49bn) whilst retailers (+RM28m, Dec: -RM134m) emerged as the only net buyers in equities.

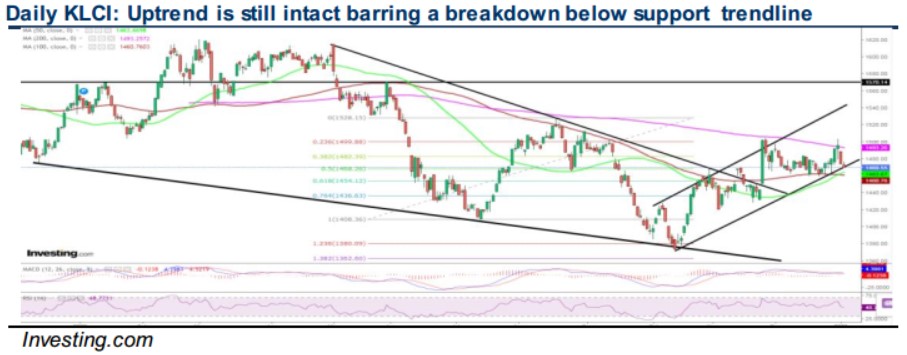

TECHNICAL OUTLOOK: KLCI

Barring any decisive breakdown below the support trend line from 1,373, KLCI’s near term uptrend may continue with major hurdles situated at 1,493-1,512-1,528 levels. Conversely, a breakdown below the support trend line near 1,469 would trigger a selldown towards 1,436-1,454 zones.

MARKET OUTLOOK

Barring a decisive breakdown below 100D MA near 1,460 and 1,454 (61.8% FR) support levels, we remain hopeful that KLCI could chalk up a back-to-back gain in Jan (resistance: 1,493-1,512-1,528) with more investors returning from the year-end holidays to cushion downside, as well as supported by undemanding CY2023’s valuation (13x P/E vs 10Y mean 16.9x) and low foreign shareholding (Nov 2022: 20.7% vs all-time low 20.1% in Aug). Major events to watch out for in Jan: (1) FOMC (31 Jan-1 Feb) and BNM (19-20 Jan) meetings to assess the 2022 cumulative impact of 4.25% Fed rate and 1% OPR hikes to weaker macroeconomic and corporate data, (2) the UMNO general assembly 11-14 Jan, (3) China’s borders’ reopening on 8 Jan. Technically, after surging to 18M high at RM1.41 (5 Dec), DAYANG (HLIB-BUY-TP RM1.71) should attract buyers on weakness during ongoing profit taking consolidation at RM1.20-1.25 levels. A decisive breakout above RM1.31-1.36 hurdles will spur greater upside to revisit RM1.41-1.51 territory.

Source: Hong Leong Investment Bank Research - 5 Jan 2023