[KAYAPLUS]: Why You "Shouldn't" Invest With StashAway

mykayaplus

Publish date: Fri, 29 Nov 2019, 11:03 PM

For those who are not very up to date on financial news and services, you might not have heard of the latest trend in town - Robo-advisor investing.

What is Robo-advisor? A Robo-advisor is a financial adviser, that provides financial advice with moderate to minimal human intervention. In simpler words, you will be tapping on robots and Artificial Intelligence to invest.

Robo-advisor is relatively new in Asian countries but is already very popular in the United States of America. Of course one of the key players in Malaysia and Singapore is none other than StashAway.

StashAway's Economic Regime-based Asset Allocation™ (ERAA™) utilizes economic data and trends to execute informed and intelligent decisions. As the market's daily movement can be very volatile (ever more so since the past few years), by focusing on economic conditions, ERAA™ filters out the market noises by allocating your funds into the most ideal combinations of investments.

But is StashAway the way forward in investing?

Let us spell out why you "shouldn't" invest with Stashaway

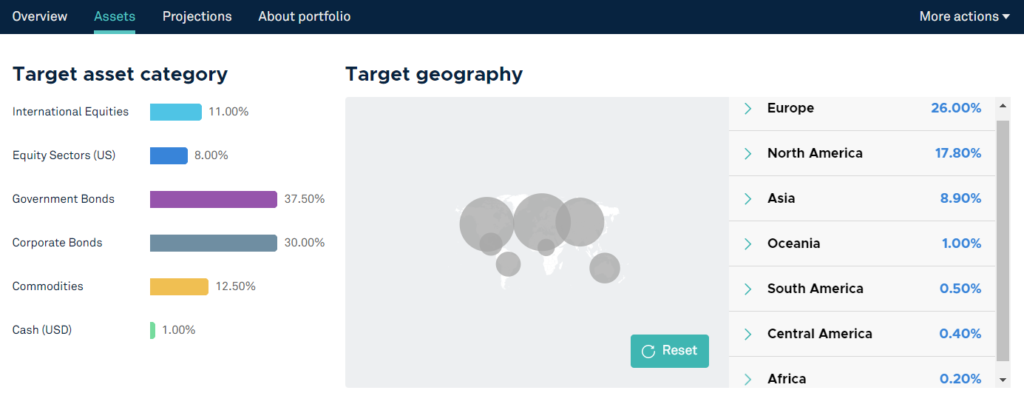

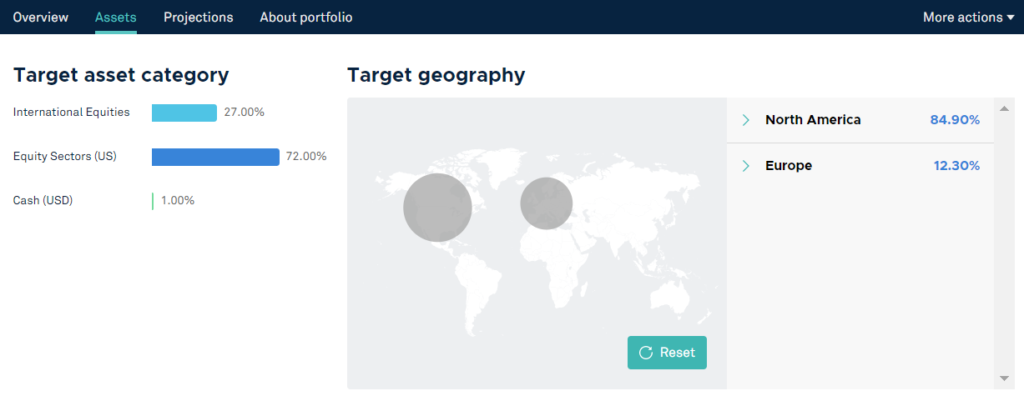

1. StashAway invests globally

StashAway helps to diversify investments by going global. Depending on your preferred risk index, a conservative one will have a geographical portfolio comprising of equities and bonds in the US, Europe, Asia, Oceania, and even Africa! (Who invests in Africa??)

An aggressive portfolio hits it hard on US equities and European stocks. Which clearly defies the traditional Malaysian way of investing. Traditional investors like our parents or even grandparents have always been investing in Malaysia since their times. Why should we change and invest in the US or Europe right? Not like the returns are "very fantastic" if we invested overseas...

Blue Line: Euro Stoxx 50 Historical Returns

Black Line: US Dow Jones Index Historical Returns

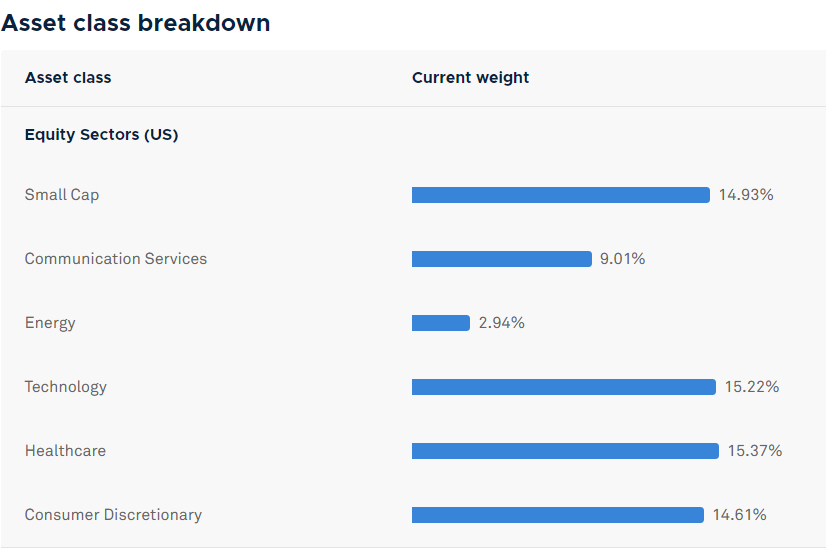

2. StashAway invests in ETFs that holds stocks we are "unfamiliar" with

A quick scroll down we are able to see what are the asset classes of Exchange Traded Funds (ETFs) according to our risk portfolio

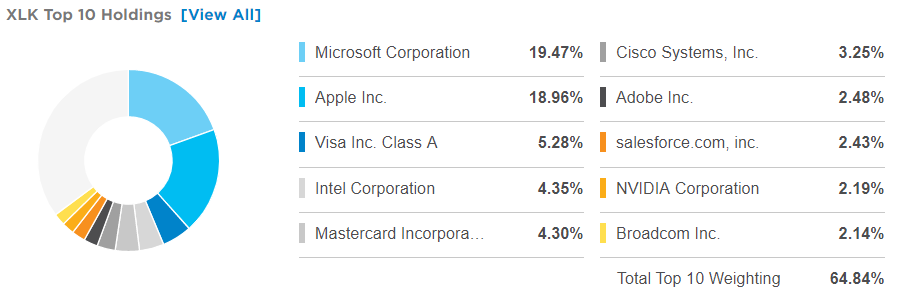

And by clicking into the Technology sector, we are redirected to an ETF Wikipedia that houses all big well known ETFs. So what is under the XLK Technology Select Sector SPDR Fund?

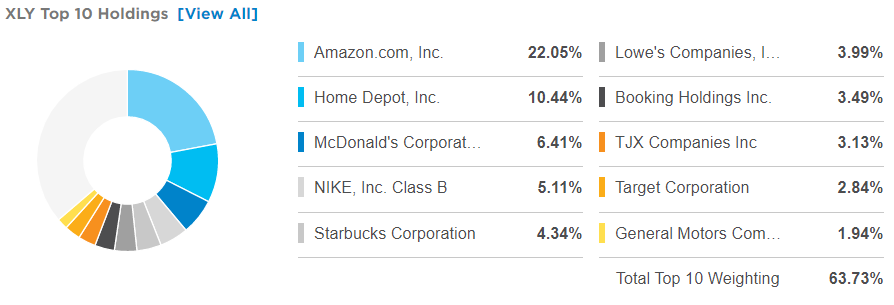

What about the XLY Consumer Discretionary Select Sector SPDR Fund?

And with just a minimum deposit of RM100, you can buy a fraction of ALL of these "unknown" companies.

RM100??! RM100 can't even buy me one lot of Malayan Banking Berhad shares!

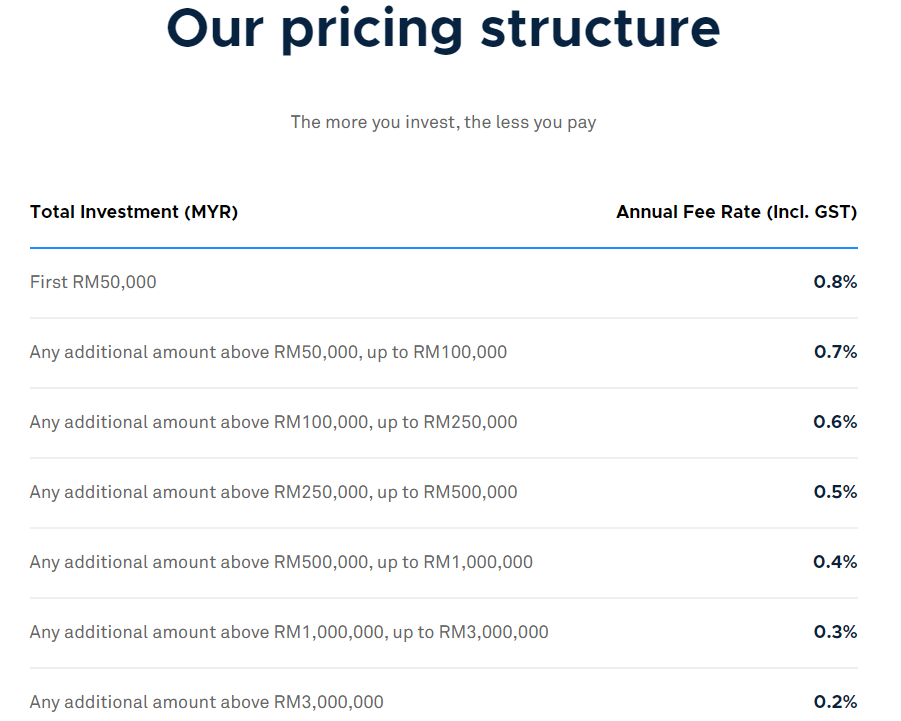

3. "Exorbitant" management fees

Just when it couldn't have gone worse, StashAway charges you an annual management fee! How much? 0.2-0.8%! PRICEY!!!

If you put in just RM100, your annual management fee will be 0.8% x RM 100 = RM 0.80 A YEAR!!

Which works out to be roughly RM 0.07 per month! Think of all the Boba Tea I can get with that amount of money!

If you are rich enough to deposit RM3,000,000 with them to qualify for the 0.2% per annum fee, you will be charged 0.2% X RM 3,000,000 = RM6,000 a year! Which is equivalent to RM 500 a month!

4. "Unsatisfactory Returns"

Of course, the main "put off" would be to show an actual performance return by StashAway. Above is an ACTUAL portfolio of a 36% risk index held for 1 whole year.

21.67%. Unimpressive.

Oh, did we also forgot that this is an actual return during the infamous "Trade War" period?

5. "Promotion" to Mykayaplus readers

We were approached by StashAway themselves (How dare them!). Clearly what they can offer is "too underwhelming".

If you are into investing globally, buying up "unfamiliar" big US and Europe companies, Stashaway is ready to deduct 50% of their management fees on your first RM100,000 invested for 6 months

That means if you invested a minimum of RM100, and instead of getting charged RM 0.80 a year, you'll be charged around RM 0.60 instead.

Act noble give discount for RM 0.20 only... Cheh...

If you manage to read until the end of the article and still want to sign up, please use our sponsored link to sign up.

For anyone from Singapore interested, here's your link

100% of your deposits with StashAway goes straight to your portfolio. Not even RM 0.01 from your deposit is apportioned out to pay Mykayaplus (Seriously!). We just wanted to make a post on why you "shouldn't" invest with Stashaway.

Good things must share... Bad things also must give a warning...

OK. On a serious note: We champion and adore individual stock picking because we are passionate about investing. By no means encouraging ETF investing is against our investing principles. Heck even Warren Buffett himself personally used an Index Fund to win a head-on-head battle with a hedge fund.

So we are honoured to be partnering with StashAway to provide Malaysians (& Singaporeans) a chance to invest like the big boys in the United States via robo-advisors, which in the year 2019 is having Assets Under Management of USD 980 billion!

If stock picking is too tedious and difficult, or you do not have enough time, then StashAway is a fantastic option to grow your wealth.

We also make a pledge to feature only parties/investment opportunities that we deem legit and have a decent track record. We personally diversify a fraction of our capital into StashAway and the return screenshots are hard solid proof that we only introduce things that we ourselves are willing to invest or participate in.

Thank you for reading. See you at the top!

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from direct and indirect use & application of any contents of the article/report/written material

More articles on https://www.mykayaplus.com/

Created by mykayaplus | Apr 05, 2020

Created by mykayaplus | Feb 07, 2020

Created by mykayaplus | Jan 19, 2020

Created by mykayaplus | Jan 14, 2020

Created by mykayaplus | Dec 23, 2019

Created by mykayaplus | Dec 23, 2019

Discussions

paperplane=== 21% still unimpressive? Lol

30/11/2019 12:43 AM

=====

Gone oredy Public Mutual Fun.

Gone oredy ASN, ASB, ASW, ASM etc

All of these fun... Public Mutual, ASN etc will reduce in fun size after people getting unimpressive 21% return from StashAway lah,

OMG.

The real Robot investing for Msian is here with unimpressive 21% returns lah.

This Stashaway should have come to Msia earlier lah.

Ma ma mia... Only today I heard of this unimpressive robot investing.

2019-11-30 07:19

Most of our local funds invest heavily into KLCI stocks. And we all know KLCI has underperformed for the year 2019. Yes, we are still living in the trade war era but if we follow global news, the US market has been bullish as hell.

We would like to remind that StashAway's portfolio just tagged along with the bullish sentiments, particularly in the US markets. No one would have foreseen or can confidently say that the US market would have gone up that much last year this time.

Never time the market. StashAway has offered a cheap and viable solution to get exposure to the world's most profitable stock market. Learn and improve, maybe someday you all will be able to invest in the greatest market alongside with the great Warren Buffett and Ray Dalio

2019-11-30 09:22

u comparing 2 diff animals lah. LOCAL UNIT TRUSTS MOSTLY INVEST ONLY LOCAL, if you invest DowJones, S&P of course much higher return loh

2019-12-02 10:59

paperplane

21% still unimpressive? Lol

2019-11-30 00:43