[KAYAPLUS]: SUNWAY REAL ESTATE INVESTMENT TRUST

mykayaplus

Publish date: Thu, 20 Feb 2020, 12:32 PM

This post originally appeared on MyKayaPlus.com

Business Summary

Sunway Real Estate Investment Trust (SUNREIT) is an all-rounder REIT listed on the Malaysia Stock Exchange. Listed in the year 2011. it has grown into a portfolio of investment properties that caters the retail, hospitality, office and even healthcare segment. Its most attractive property is the Sunway Pyramid Shopping Mall, which is its crown jewel.

Sunway Pyramid Shopping Mall

SUNREIT’s sponsor is Sunway Bhd, a property development company also listed in the Kuala Lumpur Stock Exchange. Hence, SUNREIT will always have a number of investment properties with right of first refusal when Sunway Bhd decides to inject any properties into SUNREIT’s current portfolio.

Even though SUNREIT has a portfolio of investment properties in multiple sectors, retail investment properties contribute the most to its gross rental income at approximately 74%. Hotel segments contribute around 14%, and office buildings contribute around 7% as of the year 2019.

Last update: 12.02.2020

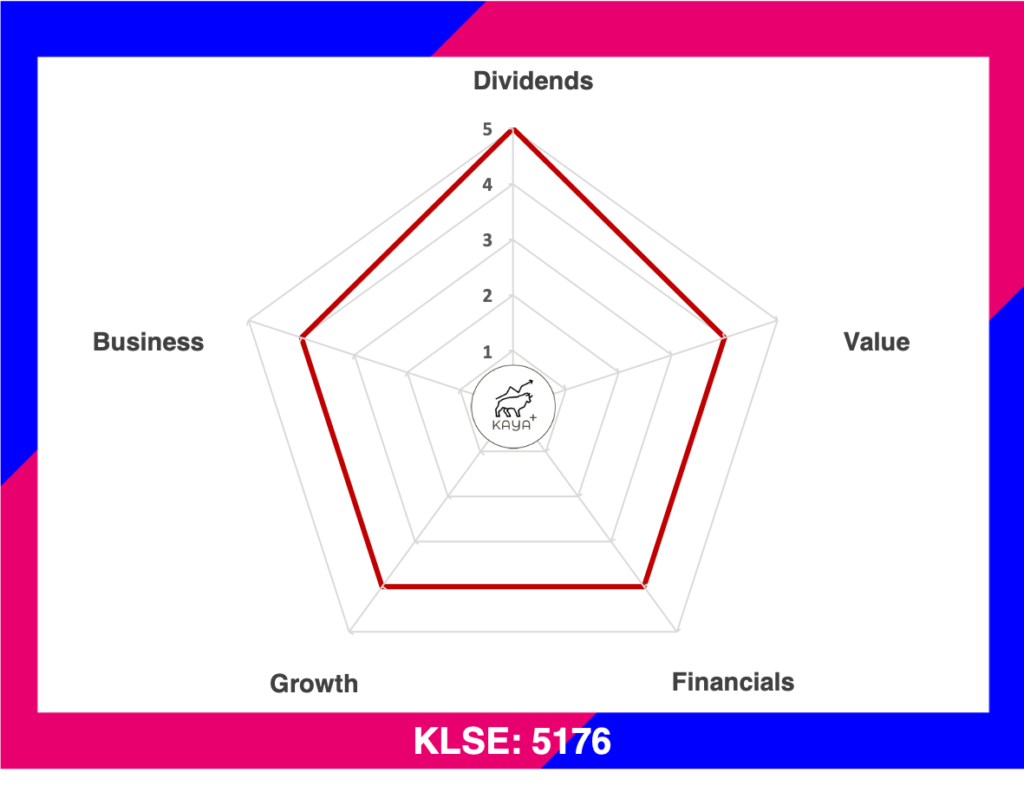

Dividends (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (4/5): ⭐ ⭐ ⭐ ⭐

Growth (4/5): ⭐ ⭐ ⭐ ⭐

Business (4/5): ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management

Although the Sunway Group Berhad is much well known for its founder and chairman, Tan Sri Jeffrey Cheah, SUNREIT is actually formed by his eldest daughter Ms Sarena Cheah. Sarena has always been with Sunway Group upon graduation. She is also a Director in Sunway Berhad and is touted to be the heiress of Sunway Berhad.

Quoted by her own father, Ms Sarena Cheah is a numbers and facts person. And with Tan Sri Jeffrey Cheah confidently handling over the major reins of Sunway Group and its related companies over to Ms.Sarena Cheah, shareholders should feel confident as the founding father of Sunway Group that the next management of Sunway is ready to bring the group to greater heights.

The Cheah family are the biggest shareholders of SUNREIT via a holding company Sunway REIT Holdings Sdn Bhd. at 40.88% as of the year 2019. The 2nd largest shareholder is the Employees Provident Fund Board (EPF) at 15.85%.

Financial Performance

SUNREIT has managed to grow its rental income year-on-year ever since it’s listed. As of 2019, it has a gross rental revenue of RM 580 million, with a net profit of RM 386 million. Not only that, but we have also seen SUNREIT growing by doing acquisition of new investment properties.

Return on Equity (ROE) and Return on Assets (ROA) are at 8.6% and 4.7% respectively. During the early years after SUNREIT was listed, it actually registers a higher fair value gain appreciation of its investment properties in its portfolio, hence showing a higher net profit over its gross revenue. That is also why the ROE and ROA values are higher in the earlier years.

The recent ROE and ROA trends are a bit flattish as undistributed income is trending higher. SUNREIT has a knack of not undergoing major corporate actions even though it has been active in property acquisitions. So the undistributed income will definitely come in handy for future upcoming potential acquisitions.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Gearing Ratio |

| 2019 | 8,158,038 | 3,361,482 | 4,796,556 | 37.89% |

| 2018 | 7,523,858 | 3,170,622 | 4,353,236 | 38.58% |

| 2017 | 6,839,893 | 2,628,173 | 4,211,720 | 34.27% |

| 2016 | 6,537,259 | 2,486,029 | 4,051,230 | 33.28% |

| 2015 | 6,430,018 | 2,447,758 | 3,982,260 | 33.31% |

In the year 2019, SUNREIT has Assets of around RM 8.2 billion, liabilities of RM 3.4 billion and equities of RM 4.8 billion. The gearing ratio is at 38% and has always been stable within the 30+% region.

Assets show a consistent year-on-year increase, which means SUNREIT’s properties have appreciated well in fair value and there have been aggressive portfolio acquisitions.

Net Operating Cash Flow & Distribution Paid Out

Source: SUNWAY REIT ANNUAL REPORT

Ever since its inception, SUNREIT has been performing well every year. It managed to collect high rental income, increase its investment property portfolios, and also increase its distribution paid out to unitholders.

Plus, since Sunway Group Berhad is the sponsor of SUNREIT, any upcoming properties can be injected to SUNREIT. This means that SUNREIT will tag onto the potential growth of Sunway Group Berhad.

Price

MyKayaPlus Verdict

The share price will always reflect the performances of the company or REIT. For SUNREIT, the price has been trending upwards ever since its IPO. This is justified that after looking through its financial and growth traction, it is no surprise that it has grown to the size it is today.

As mentioned before, SUNREIT is poised to benefit from the ongoing and upcoming projects of Sunway Group Berhad. There are several catalysts that could further boost SUNREIT’s portfolio of investment properties and also its future payout, most notably the Sunway Velocity Shopping Mall at Cheras and also the new Sunway VelocityMedical Center situated at Cheras.

Nonetheless, major reports are the retail segment facing a supply glut, it would not be easy for SUNREIT to maintain its rental rate or even increase it further if more and more new shopping malls are coming into the saturated market.

Would you consider adding SUNREIT to your portfolio? Or would you rather look at IGB REIT? Check out our analysis on IGB REIT here.

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from direct and indirect use & application of any contents of the article/report/written material

More articles on https://www.mykayaplus.com/

Created by mykayaplus | Apr 05, 2020

Created by mykayaplus | Feb 07, 2020

Created by mykayaplus | Jan 19, 2020

Created by mykayaplus | Jan 14, 2020

Created by mykayaplus | Dec 23, 2019

Created by mykayaplus | Dec 23, 2019