[KAYAPLUS]: TOP GLOVE CORPORATION BERHAD

mykayaplus

Publish date: Fri, 29 Nov 2019, 11:04 PM

Business Summary

Top Glove Corporation Berhad (Top Glove Bhd) is a listed glove manufacturing company. It is the world’s largest glove-making company, with manufacturing facilities in Malaysian, Thailand, and China. Top Glove was founded in 1991by Tan Sri Dr. Lim Wee Chai with just 1 factory, 1 line, and just 100 workers. Top Glove Bhd now has an annual capacity of 64 billion pieces as of 2019.

Top Glove Bhd’s growth is mainly fueled by its strategic and shrewd merger and acquisition deals. How Top Glove Bhd grows its capacity is by buying out smaller glove manufacturers and consolidating their capacity to its capacity count and growth. It has proven to be a successful strategy as Top Glove is now the world’s largest glove factory with mind-boggling capacity.

Top Glove Bhd’s main business is in the manufacturing of gloves, namely nitrile gloves and rubber gloves. It started off as a major rubber glove manufacturer. But as nitrile gloves slowly gain popularity, Top Glove has been reducing rubber gloves production and increasing nitrile glove production over the years.

Last update: 21.11.2019

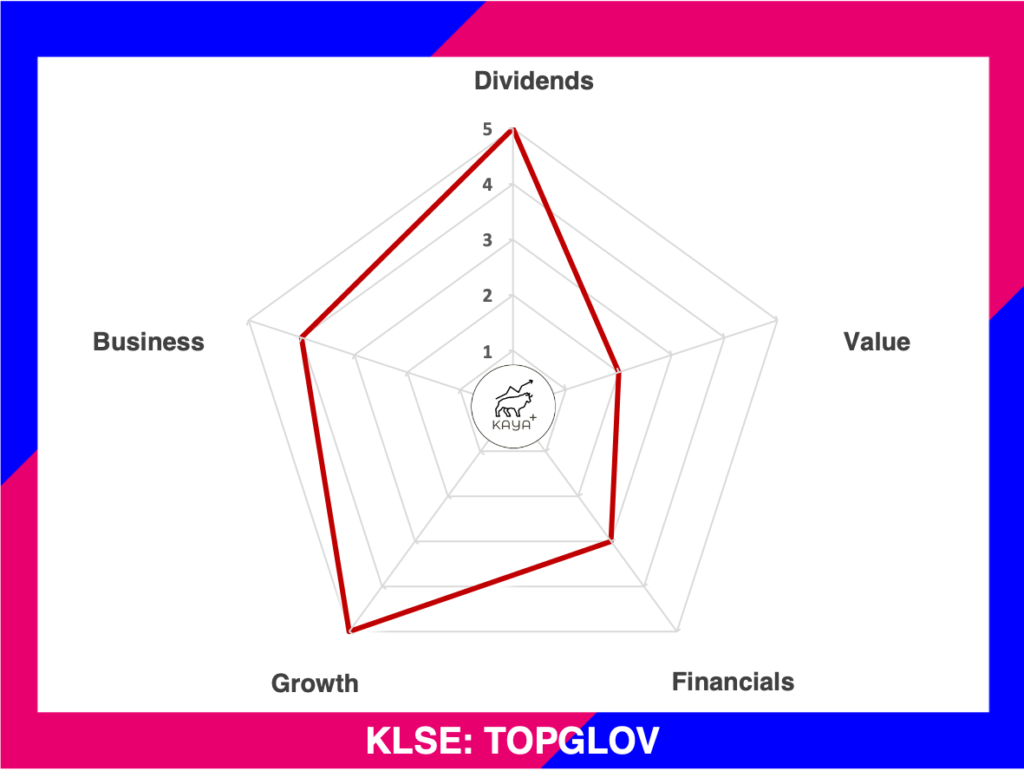

Dividends (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (2/5): ⭐ ⭐

Financials (3/5): ⭐ ⭐ ⭐

Growth (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Business (4/5): ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management

Top Glove Bhd was founded by Tan Sri Dr Lim Wee Chai, who currently now serves as the Executive Chairman. Dato’ Lee Kim Meow is the current Managing Director, with a length of service with the company of 16 years. The spouse of Dr Lim Wee Chai, Puan Sri Tong Siew Bee also currently serves as a Non-Executive Director.

Tan Sri Dr Lim & family collectively hold around 79% of the ownership of Top Glove Bhd, via direct and indirect interests. As of 2019, the total remuneration package of the total Top Glove board of directors stands at around RM 5.8 million per annum, which is roughly 0.1% of their annual revenue.

Financial Performance

Top Glove Bhd has seen fantastic growth over the last 10 years. Net profit also saw growth from RM 250 million to RM 368 million as of the year 2019. Although they started off as a strong rubber glove producer, Top Glove Bhd manage to switch to the more favourable nitrile gloves, which in the year 2016 surpasses their rubber gloves production. Nitrile gloves are stronger than traditional latex gloves, while also offering higher chemical resistance.

As of 2019, Top Glove Bhd has a Return On Equity (ROE) of roughly 15% and a Return Of Assets (ROA) of around 6%. Even though profit has increased quite a lot in the last 10 years, ROE and ROA are on a downtrend as the number of equity increases more than the profits generated. Top Glove’s growth plans hinged strongly on the effective merger and acquisition, Hence compared to its competitor Hartalega Holdings Berhad, Top Glove Bhd has a higher gearing ratio, where the majority of its funds required for expansion is obtained via a mixture of debt and equity financing. Nonetheless, it still clocks a respectable ROE and ROA when compared with other glove companies.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2019 | 5,688,205 | 3,134,064 | 2,554,141 | 0.97 |

| 2018 | 5,270,560 | 2,876,792 | 2,393,768 | 1.12 |

| 2017 | 2,990,177 | 925,745 | 2,064,432 | 1.57 |

| 2016 | 2,649,142 | 823,303 | 1,825,839 | 1.93 |

| 2015 | 2,687,930 | 1,073,537 | 1,614,393 | 1.60 |

In the year 2019, Top Glove Bhd has Assets of around RM 5.7 billion, liabilities of RM 3.1 billion and Equities of RM 2.6 billion. The current ratio is close at 0.97, which gives us assurance it has enough current assets to meet its current liabilities.

Free Cash Flow & Dividends Paid Out

Source: TOP GLOVE CORPORATION BHD ANNUAL REPORT

Glove manufacturing is a cash cow business. Top Glove Bhd has proven that with the rapid expansion of its merger and acquisition, and an increase in revenues and profits, operating cash flow also trends up accordingly. Dividends paid has a 10-year compounded average growth rate of around 7.1%

Top Glove Bhd actually is considered a fantastic growth and dividend stock. Given its successful track record in increasing sales, profits, cash flow and historical dividends paid out, there are plenty of shareholders who are reaping great dividend yields for holding on to Top Glove Bhd shares for a long period of time. Plus, Top Glove Bhd also has a dividend policy of distributing a minimum of 50% of its annual profits to shareholders as dividends

But as Top Glove Bhd is trading at a Price to Earnings ratio of roughly 32 times, many investors would automatically disregard it as a good dividend stock, as its current trailing dividend yield is just at 1.63% per annum.

Price

MyKayaPlus Verdict

Top Glove Bhd is one of the rare companies that is a combination of growth and dividend company. And share prices automatically go up when a company keeps getting more sales and profit, with also increasing dividends paid out.

Hence, it is not surprising that Top Glove Bhd is currently trading at a Price to Earnings ratio at about 32 times. Of course, it is a high price to pay even for such a fantastic company.

But it all boils down on how aggressive Top Glove will continue to grow as it maps out its expansion plans beyond 2020. We have seen Top Glove buying up factories in countries outside of Malaysia. Being a global player, Top Glove will definitely be ready for any opportunities around the world.

Do you see Top Glove Bhd continuing its momentum? Let us know in the comments below!

Like our Top Glove Corporation Bhd analysis? Please check out our Hartalega Holdings Bhd analysis which may be out soon!

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from direct and indirect use & application of any contents of the article/report/written material

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://www.mykayaplus.com/

Created by mykayaplus | Apr 05, 2020

Created by mykayaplus | Feb 07, 2020

Created by mykayaplus | Jan 19, 2020

Created by mykayaplus | Jan 14, 2020

Created by mykayaplus | Dec 23, 2019

Created by mykayaplus | Dec 23, 2019