JAKS - Vietnam Story Has Only Just Started

kltrader

Publish date: Wed, 07 Feb 2018, 11:44 AM

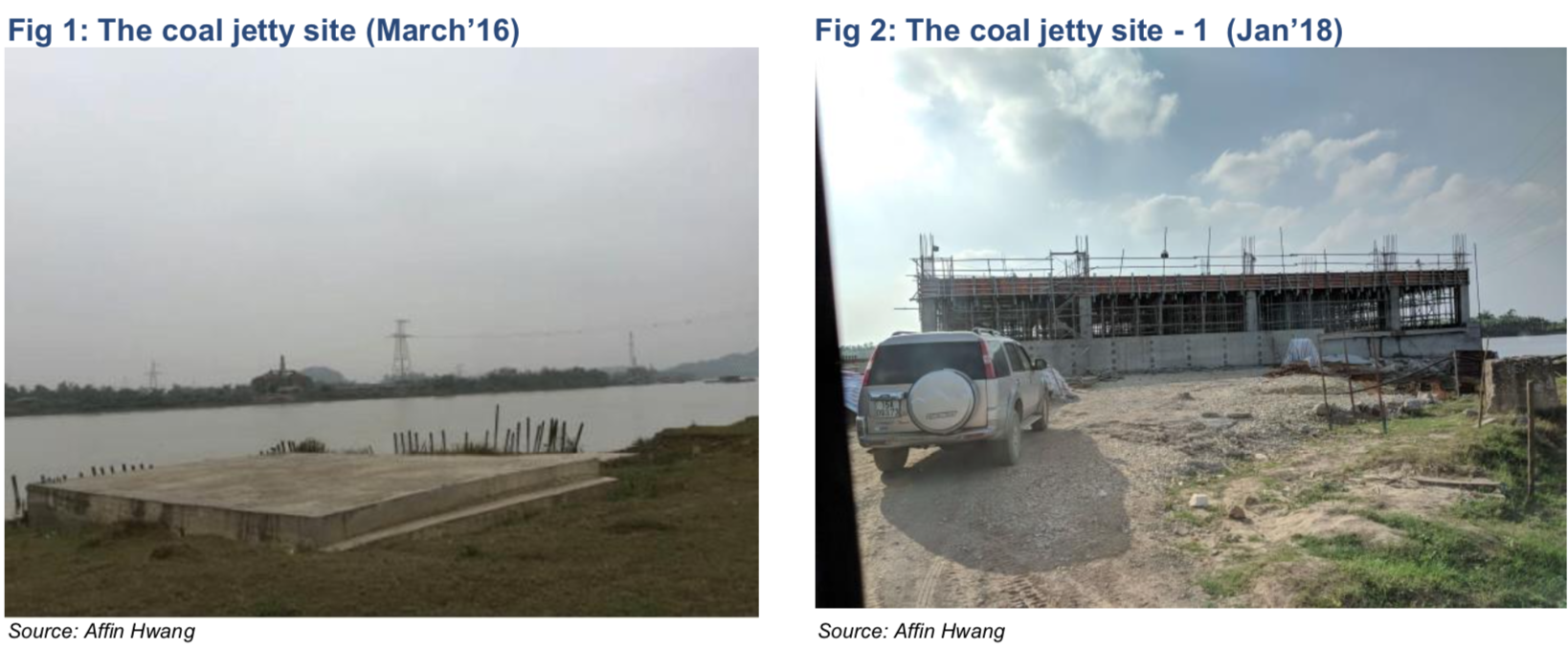

We are reiterating our BUY call on Jaks Resources (Jaks) with a higher TP of RM2.25 (previously RM1.75), on the back of a higher valuation on Jaks’ 2x600MW Vietnam power plant project, post our recent visit to the site. We believe that management will complete the project on time, as it will play a significant role in bolstering Jaks’ chances of securing new power-related projects in Vietnam. Hence, we believe the risk of delay is minimal, providing better visibility and lower risk in the earnings delivery from the Vietnam EPC contract.

Power Plant Is Just the Beginning

Although management’s current focus in Vietnam is to get the power plant operational by 2020, it is also interested in getting involved in other powerrelated projects (including renewable energy) in Vietnam. However, we believe that any new projects will only materialise in 2019/20, when the current power plant is near completion, as it will provide Jaks with better bargaining strength when bidding for new power projects. We believe that for management to take up any new projects, the return of them would have to be similar to the current one. Although management did not provide details on the potential partners for new projects, we believe that they will need to have the ability to secure financing for those projects, and Jaks will likely maintain an associate stake in any new ventures so as to minimise the need to raise new equity.

Property Development Will Have Some Closure in 2018

While the potential of new power projects in Vietnam remains attractive, we believe that the near-term re-rating catalyst for Jaks lies with the completion of the Pacific Star project, which has been a drag on earnings since early 2017. The project is now expected to be completed by end-2018. We estimate that Jaks’ earnings for FY17-18E would be 5-12% higher if the losses from Pacific Star were excluded.

Reaffirm BUY With a Higher TP at RM2.25

We are maintaining our BUY call on the stock, with a higher RNAV-based 12-month TP of RM2.25, as we raise our valuation of Jaks’ Vietnam power plant project, as we believe the risk for late delivery is now lower as we progress into 2018-19. Downside risks could arise from: 1) lower revenue recognition of its Vietnam EPC contract; and 2) higher-than-expected losses from its Evolve Concept City Mall.

Source: Affin Hwang Research - 7 Feb 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Affin Hwang Capital Research Highlights

Created by kltrader | Jan 03, 2023

Created by kltrader | Sep 30, 2022

GG_Liang

Yes. The beginning of the end

2018-02-08 19:43