istone The next jade in the making!

orked

Publish date: Tue, 25 Aug 2020, 11:24 AM

Recently, there were a lot of penny stock topping the most active list. This is actually normal as penny stock are cheaper hence investor can actually buy and sell in larger quantity (e.g. RM1,000 can buy 10,000 shares if the company is price at RM0.10, as compare to 1,000 shares if the company is price at RM1). Hence, we usually don't see blue chip stocks topping the most active list (Then again, this does not mean that it is impossible).

Joining the most active list today (21/8/2020) is one of the stock known as Istone. For those of you that have been following Istone, you would have realised that there is a new owner in town. What does this mean and what will the future be for this stock?

Background of the company - I-stone Group Berhad

Istone's main operating activity is as follow:

1) Providing solutions to customers in automation machines (including fabrication, assembly, test and inspection, transporting, packaging and storage) & Maintenance and technical support services

2) Distribution of manufacturing automation software & hardware

With the industrial revolution coming, we can all agree that Istone's operationg activity will definitely play an important role in the years to come.

As Istone is a fairly new company (the company was listed on 17 July 2019), the financials of the company might not be reflective due to the varying market condition over the past year. Then again, attached below is just a summary of the earnings for your reference.

| Year | Quarter-over-Quarter Profit |

| March 2019 | RM 4.194 mil |

| June 2019 | RM 2.148 mil |

| Sept 2019 | RM 1.715 mil |

| Dec 2019 | RM 348 mil |

| Mar 2020 | RM 2.824 mil |

| Jun 2020 | RM 1.541 mil |

Profit has been dropping for the company since 2019, but overall, the company seems to be performing quite well for the 2 quarter of 2020.

A new owner in town - Istone

For those of you who do not know, there is a new owner buying a majority stake in Istone.

On the 12th August, the company has announce that Awang Daud (Executive Chairman of Minetec and Co-founder of Serba Dinamik) has taken up a 27% in Istone. Subsequently, he has been appointed as Non-Independent and Non Executive Chairman on the 19th August.

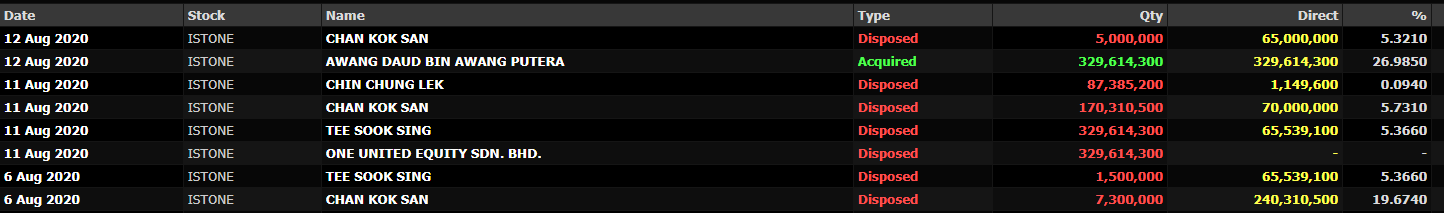

What is really surprising here is Awang has only taken ~27% of the company's shares. However, as per the Direct Business Transaction screen below, there is approximately 49% of the shares crossed. So the question is who is holding the remaining 22% of the shares? What is their next move is still anybody's guess at this juncture. But why would the owner buy over a company if he does not see any future prospect?

FYI, should a shareholder holds more than 33%, he/she would have trigger a mandatory General Offer.

Technical Chart

Based on the technical chart, the company's price is still below its 7 & 14 days moving average. However, it is above its 100 days moving average.

While the chart of Istone is still currently not giving any buying signal, it is interesting to sell that volume has been spiking at 0.18-0.20 range. This means that somebody has been collecting the shares at this price range. Combining this with the direct business transaction of Awang Daud at 0.175, i would say that the owner's average buying price (ABP) is approximately 0.20.

It'll be interesting to see what will happen to this counter in the coming months. Given that Awang Daud has been acquiring shares of several companies, we'll be expecting some project coming to Istone anytime soon. How would this translate to Istone's coming quarter? Will this push the share price of the company higher? It'll be exciting to monitor if there is any further development of this company.

*I'm just a newbie in this field and this is just my thoughts. My views do not constitute as a buy/sell call. I'm merely sharing my opinion and observation on the above counter.

credit to : lifeisajourney

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

greedy44444

Awang must be spending millions to ask so many bloggers cum big shark to write nice story about Istone. Seems Awang already earned enough at Serba and Minetech, now trying very hard to earn billions from his new venture.

2020-08-25 13:20