IPO overview

New Ipo Eversafe Rubber Berhad

Opening of Application : 31 Mar 2017

Closing of Application : 10 April 2017 before 5 pm.

Balloting of Application : 12 April 2017

Allotment of Ipo : 19 April 2017

Tentative listing date: 21 April 2017

Listing on Ace Market.

IPO Price: RM0.36

Market Cap : RM86.61M

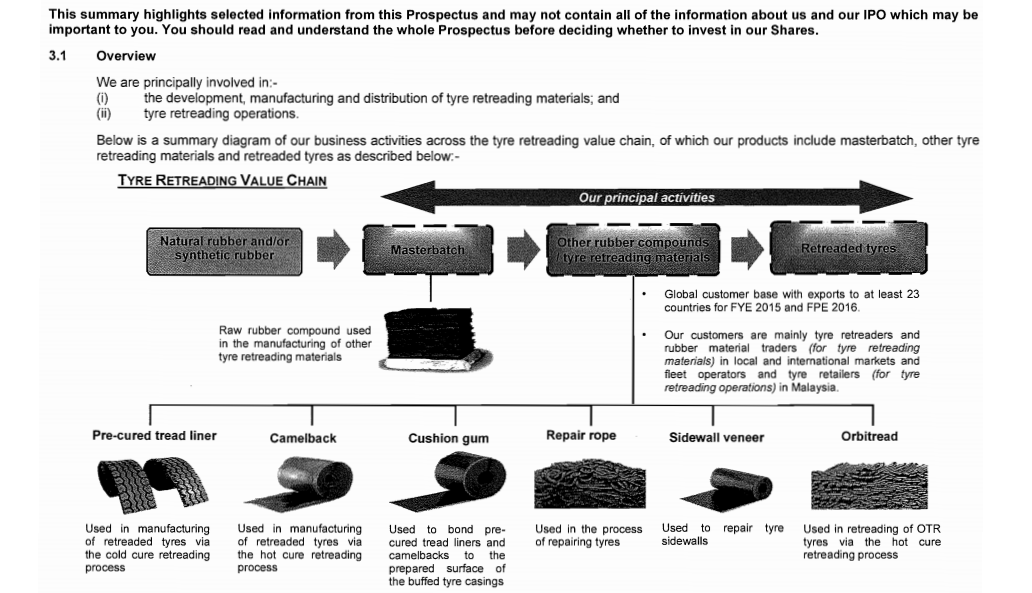

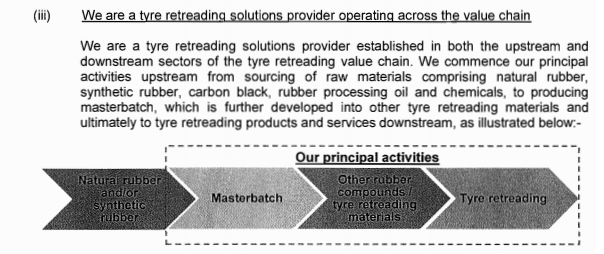

Business overview

Analysis on business segment

Tyre retreading materials segment

- contributed to around 90% of revenue in FPE2016

- manufacturing of tyre retreading materials in Malaysia and China, of which 94% in Malaysia.

-Major customer in this business segment are tyre retreader and rubber materials trader.

- Tyre retreading materials can be customized due to specific usage according to customers.

Tyre retreading operations segment

-contributed around 10% of revenue in FPE2016

-Main reason to use retreaded tyre especially for fleet operator- value for money, safe to use (MS 224:2005 certified), Durable (lifespan of 3 months to 1 year), product flexibility

-Manufacturing facility at Penang, and hence customer focused on northen region, mainly tyre retailer and fleet operator (logistic company), with brand name OLP.

-tyre casing sourced from tyre trader, retailers and customer (fleet operator).

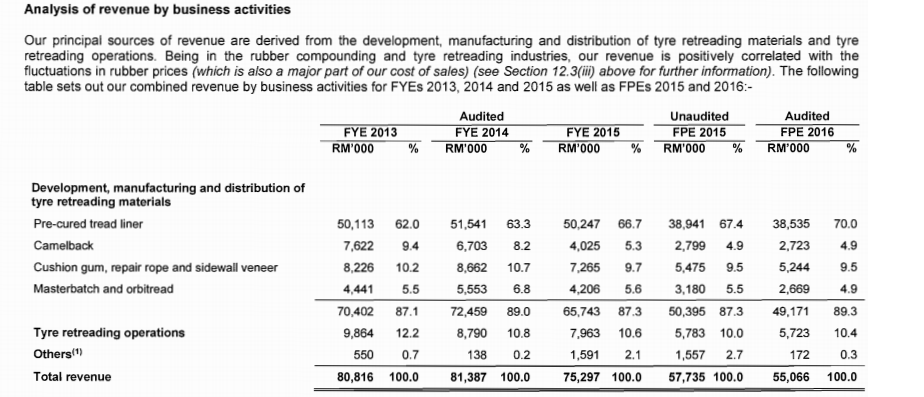

Analysis of revenue by business activities

Apparently pre-cured tread liner, one of the tyre retreading materials, contributed the most to the company revenue. (please google or refer to the prospectus to know more about this product)

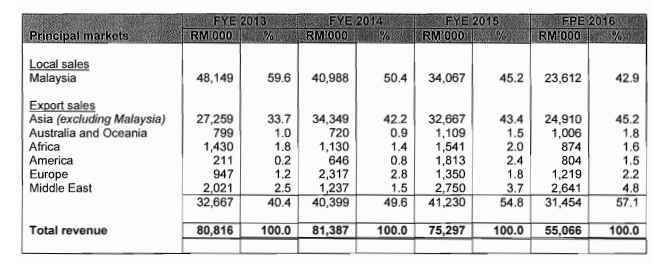

Revenue contribution on local and oversea market

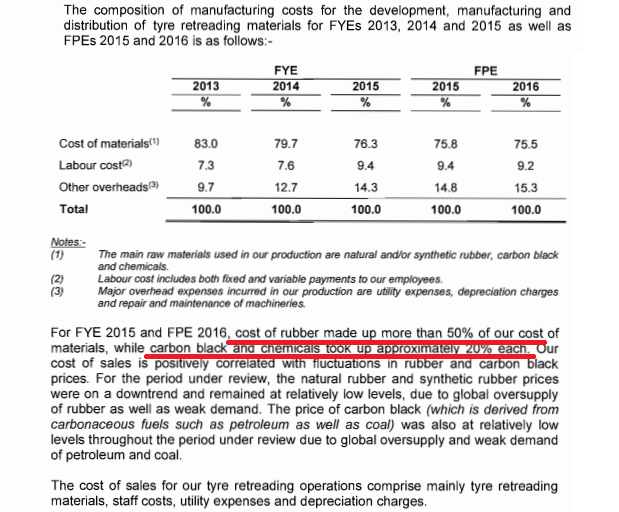

Cost structure for the company

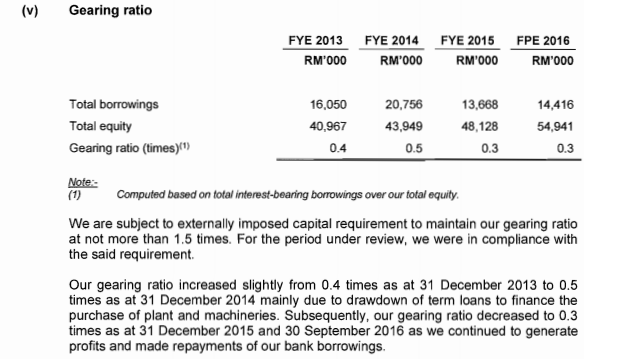

Debt Analysis

The company always operating in manageable gearing ratio as shown above. Out of 14,416 of total borrowing, 81% is from banker acceptance. Banker acceptance is a short term debts

which is used for working capital purpose and normally in low interest rate than other borrowing.

Competitive advantage and key strengths

-command market share of 22% n 2015 for the development, manufacturing and distribution of tyre retreading materials in Malaysia.

-over 360 customers for FPE2016 with top 10 customers contributed 47.5% to FPE2016 revenue. Those are loyal customer with collaboration more than 25 years in average.

-Export to at least 23 countries, in which oversea market make up 57%(from 55% in FPE2015) of total revenue.

- Their control against the whole value chain as tyre retreading solutions provider enables them to become competitive in the market.

-development and customization capabilities to meet unique requirements for applications in different weather and workload (suitable for their export market)

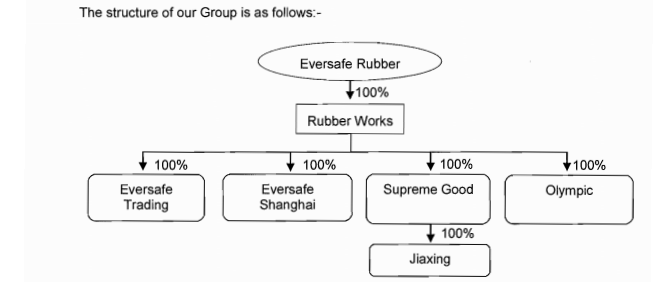

Corporate structure

Company future plans and strategies

With current 57% of revenue made up by foreign market, the company has made it clear that their future expansion plan will be more focused on export, with South America region being their new target market.

- secured a collaboration partner in south america in 2016 in two areas, 1)appoint new business partner as distributor to promote and market tyre retreading materials in South America region, 2) finalising a joint venture arrangement to establish a tyre retreading plant(raw materials supplied from Eversafe Rubber Berhad). Such operation of tyre retreading is expected to commence in mid of 2018, subjected to the agreement of JV.

- Set up an office and storage facility in Eastern Europe in mid 2017 to better service the current customers in the region.

-enhance manufacturing capabilities to widen range of products, with focus on high value-added and premium products(better margin).

-branding and trademark its products in other international counties (current trademark at malaysia and PRC)

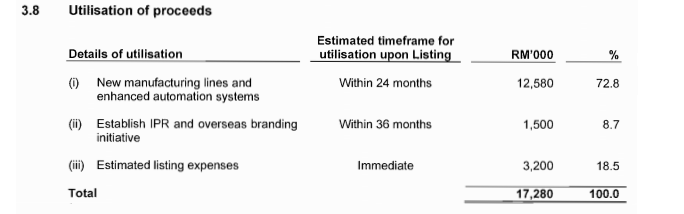

-invest in new manufacturing line and automation systems to improve efficiency, reduce wastage and ensure consistent product quality.

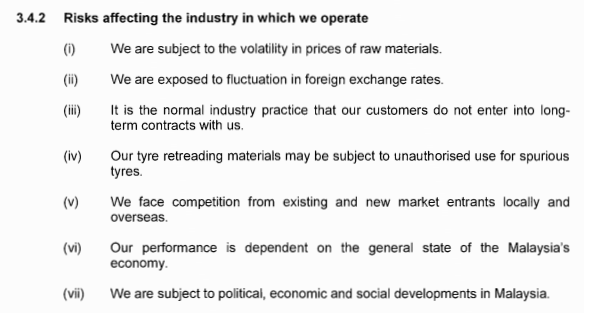

RISKS for business and industry

Some important elaboration of business/industry risk

1) Subject to volatility in prices of raw materials.

The two main raw materials, natural and synthetic rubber accounted for 50% of total purchase in FPE 2016. In the report, the management claimed that in the case of raising raw materials cost, they are able to

pass on the price volatility to their customers. Nevertheless a prolonged material increase in the price of raw materials will still affect the business and the industry as a whole

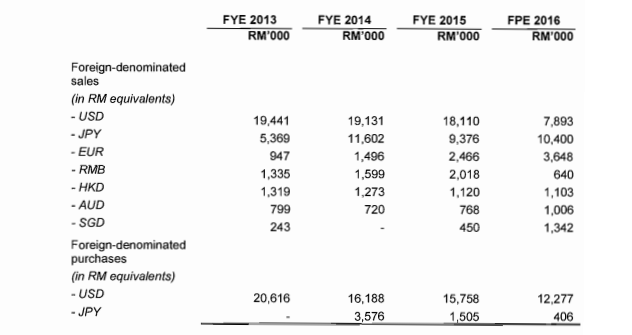

2)Forex risk

In line with company expansion to foreign market, (33%, 44%, 46% of total revenue throughout past 3 years), the main currency transacted are USD and JPY, others are AUD, EUR, HKD, RMB, SGD. Besides revenue, some of the raw materials imported are mainly denominated in USD.

3)Intense competition from existing and new market entrants locally and oversea.

Own about 22% for tyre retreading materials in Malaysia and mere 4% market share for tyre retreading operation. Management view this industry as high barrier to entry due to high capex but the competition is intense given the fall of rubber price in recent years, which causing the average selling price (tyre retreading materials) to drop. However, company strategy to expand to foreign market causing sales volume to increase.

Utilisation of IPO proceeds

Dividend Policy

Boards intends to recommend and distribute dividend between 40% to 60% of Profit after tax, which translate to approximately 5% dividend yield based on IPO price.

Per Share Calculation post IPO

Net Asset Per Share: RM 0.28

Earning Per Share: 2.42 cents (2015), of which PE at 14.9

Annualized EPS: 4.13 (2016), of which PE at 8.7

Conclusion (Opinion)

Revenue for the company dropped slightly over the years mainly due to the weaker performance on the sales of tyre retreading materials in local market while profit went up mostly boosted by other income(forex gain), or lower cost of goods sold. Export contribution is increasing which is in line with company plan to expand oversea. Company able to generate positive operating cash flow and free cash flow since FYE2013. The company's proactive approach to expand the business (73% of IPO proceeds into new manufacturing line) could potentially boost up their profit, profit margin (9.4 in FPE2015, 13.5% in FPE2016) in coming years. Besides that, the development of highway infrastructure in Malaysia, together in the boost of e-commerce activities (Jack Ma's distribution hub in Aeropolis) will make Eversafe Rubber berhad as the indirect beneficiary and potentially bring back/increase their local sales.

All the information provided here are retrieved from company's prospectus, as the link in reference. The conclusion written is merely author's opinion.

Reference

P/s: Please note that the author are attached with one of the

Participating Organization in Bursa Malaysia

and providing stock broking services. If you wish to open an

trading account/consult in IPO subscription please do not hesitate to contact

gnihckes@gmail.com

john

u said Net Asset Per Share: RM 0.28, then the offer IPO price is RM0.36. will it go down then?

2017-04-02 23:57