Things to know before investing in QL Resources

Jordan Khoo

Publish date: Tue, 15 Jan 2019, 09:26 AM

QL Resources Berhad is a multinational agro-food corporation which is primarily involved in three core businesses: integrated livestock farming, marine products manufacturing, and palm oil activities. As I write, the company is worth RM11.2 billion in market capitalization, making it one of the most notable homegrown success stories in Malaysia.

In this article, I’ll bring an update on QL’s financial results, its plans for growth, and introduce a few valuation metrics to assess its current stock price. Here are 13 things you need to know about QL Resources before you invest.

Segment results

1. QL’s marine products manufacturing division includes deep-sea fishing, aquaculture activities, and the production of surimi, fishmeal, and consumer foods under brands such as Mushroom and Figo. Presently, QL is the largest surimi and fishmeal producer in Malaysia and its products are distributed over Asia, Europe, and North America. In 2018, this division made RM905.4 million in revenue – the 10th consecutive year of sales growth.

Source: QL Resources annual reports

2. QL’s integrated livestock farming division is a leading operator of animal feed raw materials and poultry farms in Malaysia. It is able to produce 5.5 million eggs a day, 40 million day-old chicks (DOC) and 20 million broilers a year, and trades over one million metric tonnes (MT) of animal feed raw materials annually. Egg production increased 20% from 2017, while DOC and broiler production remained the same. The increase in egg production contributed higher revenues of RM1.97 billion in 2018 — the highest over the last 10 years.

Source: QL Resources annual reports

3. QL owns 1,200 hectares of mature palm oil estate in Sabah and 15,000 hectares (9,000 hectares mature) of palm oil estate in East Kalimantan, Indonesia. It also owns three palm oil mills and a 44% stake in Boilermech Holdings, the largest manufacturer of biomass boiler in Southeast Asia. In 2018, the palm oil activities division made RM387.3 million in revenue, up from RM351.9 million the year before. This was mainly contributed by improved fresh fruit bunchesproduction in 2018.

Source: QL Resources annual reports

Group results

4. QL has a compound annual growth rate (CAGR) of 9.9% and 9.7% in revenue and shareholders’ earnings respectively over the past 10 years. Revenue increased from RM1.40 billion in 2009 to RM3.26 billion in 2018, which contributed to growth in shareholders’ earnings from RM89.3 million to RM206.2 million over the same period. QL has maintained a stable net profit margin of 6-7% over the past 10 years.

Source: QL Resources annual reports

5. As at 30 June 2018, QL reported non-current liabilities of RM569.8 million and has a gearing ratio of 30.5%. Over the past 10 years, QL has generated RM1.77 billion in cash flows from operations, and raised RM1.07 billion in net equities and net long-term borrowings. Out of which, QL has:

- Invested RM2.20 billion in capital expenditure

- Paid RM424.2 million in dividend payments to shareholders

QL’s cash balance increased from RM61.1 million in 2009 to RM282.3 million in 2018. Not only is QL a cash-generating business, but its management has reinvested its cash proceeds well which have resulted in higher sales, profits, and dividends over the last 10 years.

Source: QL Resources annual reports

Growth drivers

6. In March 2018, QL completed a new chilled surimi-based product plant and frozen products factory in Hutan Melintang, Perak at a cost of RM100 million. The factory will double QL’s surimi production capacity to 25,000 MT a year and increase its production for frozen products to 35,000 MT a year.

7. QL is expanding its new integrated layer farm in Raub, Pahang which would increase total egg production capacity by 30% to 650,000 eggs a day. The farm’s budgeted investment cost has increased from the original allocation of RM50 million to RM70 million, and the extension phase of this expansion project is scheduled to complete in FY2019.

8. QL’s oil palm plantations are relatively young as their ages range between four to eight years old. QL expects FFB production to increase in the future, especially from Indonesia, as the oil palms continue to mature. QL also has 6,000 hectares of plantation land which have yet to be utilised and would be an area of growth for its plantation division.

9. In April 2016, QL signed a 20-year master franchise agreement with Japan-based FamilyMart Co. Ltd where it was granted exclusive rights to operate FamilyMart convenience stores in Malaysia. As of July 2018, QL has opened 50 FamilyMart stores across Malaysia. QL intends to open a total of 89 stores by 31 March 2019 and 300 stores by FY2022.

Valuation

10. P/E ratio: As at 3 December 2018, QL is trading at RM6.97 a share. For FY2018, QL reported earnings per share of RM0.13. Therefore, its current P/E ratio is 53.6 — the highest in the last 10 years.

11. PEG ratio: Based on QL’s P/E ratio of 53.6 and annualised shareholders’ earnings growth of 9.7% over the last 10 years, its PEG ratio is 5.5. Based on its PEG ratio, QL is currently overvalued as its stock price is growing at a faster pace compared to its earnings.

12. P/B ratio: As at 30 June 2018, QL has a book value per share of RM1.15. Therefore, QL’s current P/B ratio is 6.1, the highest over the last 10 years.

13. Dividend yield: In 2018, QL declared RM0.045 in dividend per share. If QL maintains its dividend, its yield is 0.66% based on its last closing share price of RM6.97. It is substantially lower than the 3% in interest rates offered by Malaysian banks presently.

The fifth perspective

QL has carried on its legacy of growth by delivering steady growth in sales, profits, and dividends to shareholders over the last 10 years. Its profit in 2018 is 131% higher than in 2009. Likewise, its stock price has grown tremendously, causing its market capitalization to rise by a whopping 575%, from RM1.66 billion in 2009 to RM11.2 billion in 2018. However, much of this growth happened over the last 12 months.

Chart: Google Finance

Value investors look to invest in fundamentally sound stocks at low prices. Obviously, this is not the case for QL as its stock price is at an all-time high, and its valuation metrics also indicate that it is overvalued at this time.

You could say: “Won’t QL go even higher?” The answer is no one really knows. However, the more important question is: “What if QL falls in price? What do you intend to do if that happens?”

It can be easy to get carried looking at a high-performing stock thinking that share prices will continue to always rise. But as an investor, it’s critical to weigh your risks and protect your downside before you invest.

Insider News & My Portfolio

Last but not least, throughout the years, I’ve been implementing strategies that allow me to extract the maximum amount of return with the least amount of risk. I do this by either rebalancing my position or tweaking my strategies from time to time to meet the needs of my portfolio.

This year, thanks to some channels, i able to get some insider info.These are very high convictions position and this strategy entails that I take into account the risks and downside as much as possible because all it takes is one or two to blow up my portfolio so I put a lot of effort into watching that risk tails over there.

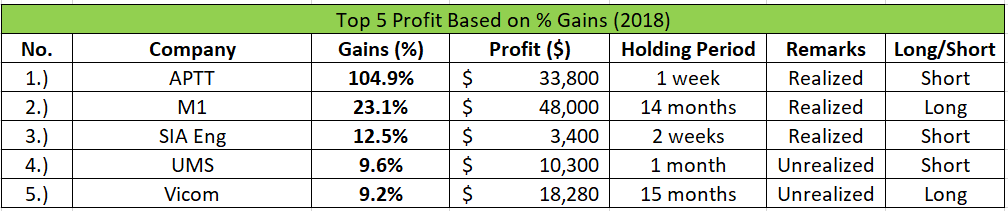

Below is a chart of my profit gained using my own fundamental and technical analysis and insider news that i got from channels:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Sharing to all Malaysians! Let's Win Together

Created by Jordan Khoo | Jul 11, 2019

Created by Jordan Khoo | Mar 28, 2019

Created by Jordan Khoo | Mar 04, 2019

Created by Jordan Khoo | Feb 14, 2019

Discussions

but we r more interested to know why u r not taking part in stock pick 2019.

r u afraid of having a ranking lower than me????

i give u a handicap of 10, ok????

lol...........

Posted by calvintaneng > Jan 15, 2019 10:09 AM | Report Abuse

Very fair post.

Thumbs up.

As to Vicom watch out for Sg Govt future moves

If COEs are reduced then Vicom will be mediocre

2019-01-15 10:12

Joetay.. Hahaha

Ur trademark "but we are more interested bla bla bla"

Laugh die me

2019-01-15 10:27

lol........

i m just a very inquisitive tikoman than the average joe.

Posted by 鹅麟依旧≈ 扫地僧 > Jan 15, 2019 10:27 AM | Report Abuse

Joetay.. Hahaha

Ur trademark "but we are more interested bla bla bla"

Laugh die me

2019-01-15 10:29

calvintaneng

Very fair post.

Thumbs up.

As to Vicom watch out for Sg Govt future moves

If COEs are reduced then Vicom will be mediocre

2019-01-15 10:09