Hidden Undervalue Counter - Aturmaju Resources Berhad (ARB Berhad)

Jordan Khoo

Publish date: Mon, 04 Mar 2019, 10:00 AM

ARB's foray into the Information Technology business on the foundations of healthy balance sheet promises a huge bullish upside potential due to earnings visibility.

Company profile:

Aturmaju Resources is a group of companies based in mainly two business sectors: Timber and IT-solutions.

The group forayed into IT solutions business in the last fiscal, this was a strategic move to contain the losses of its timber business which were mainly attributed the type of business- requiring working capital and due to Aturmaju's mostly export based clientele, it involves foreign exchange risks.

"Aturmaju said the proposed diversification is part of the group’s plans to diversify its business activities and to provide another stream of revenue to reduce its dependence on its core existing business"

The ERP solutions acquisition and further development was financed by a rights issue of RM10 million. The best part of the existing management was that the core business was kept debt free and so even after the rights issue, the balance sheet remains healthy at around 0.44 times. Thus, the Q3 and Q4 results have received a boost from this high cash flow business reporting good profits.

Fundamental analysis:

key indicators:

- P/E: 5.7x ; undervalued(based on unaudited TTM figures)

- P/B: 1.02x ; undervalued

(* @price=0.36 RM)

- D/E: 0.44x ; healthy level medium debt

- Dividend yield: 0%, the company has not paid any dividends yet

- current ratio: 4.69; great figure, company can easily fulfil payments in next fiscal

- quick ratio: 4.68; very good, company has no cash crunch in very short term

>Grahams rule of thumb for valuation: P/E x P/B <= 22.5

Currently for Aturmaju Resources, this multiple comes at 5.7 x 1.02= 5.81, which suggest the valuations being very low. Considering the upside from ERP segment, the valuations seem dirt cheap, a signal to BUY!

>an estimate of intrinsic value using grahams formula based on quantitative data:

The following economic data is sourced to suggest the growth rate of a developed, upper-middle income country of Malaysia. Thus, the return of the stock must viable to these discount rates and Ben Grahams formula gives the intrinsic value of the stock based on the following values:

Malaysia 10 yr yield: 3.905%

Malaysia CPI: 0.6% Q4 FY18; January,2019: -0.7%

Malaysia average AAA bond yield: 4.54%

considered current EPS: 6.28 sen (though most is from Q3-Q4)

Intrinsic value, V= the value expected from the growth formulas over the next 7 to 10 years

EPS= the company’s last 12-month earnings per share

8.5= P/E base for a no-growth company(this can tweaked here)

g= reasonably expected 7 to 10 year growth rate

4.4= the average yield of AAA corporate bonds in 1962 (Graham did not specify the duration of the bonds, though it has been asserted that he used 20 year AAA bonds as his benchmark for this variable

Y= the current yield on AAA corporate bonds.

by this, intrinsic value is calculated to RM 0.99 which is 275% upwards of the current price of RM 0.36. This suggests very high upward potential with highly undervalued current price.

Key stock catalysts:

These are the key triggers to start impulsive buying in the stock which will unlock and reflect the fundamental value of the stock in the near term.

1. Good annual results:

After the stellar performance by the company in recent released of Q4 result,

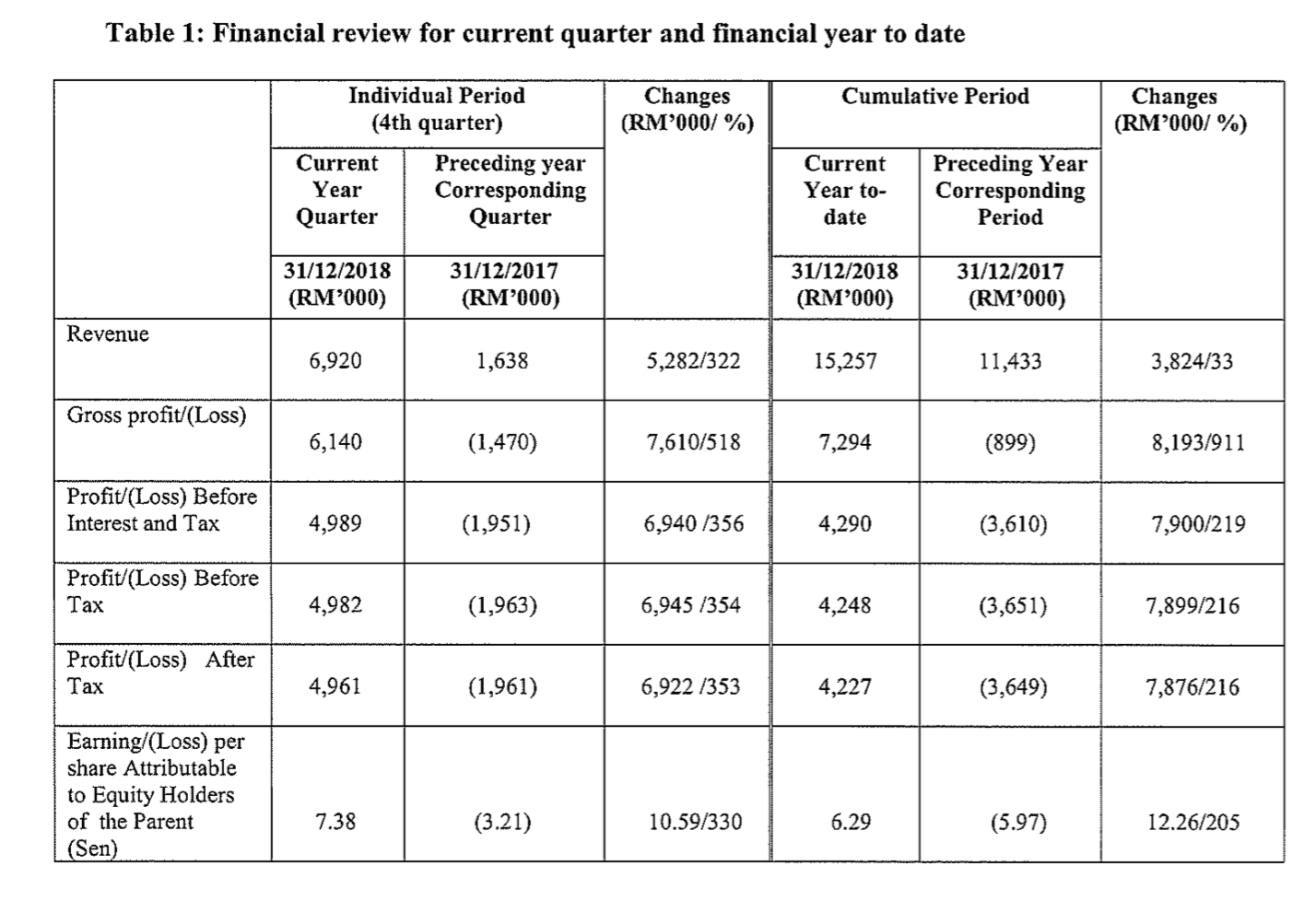

The group’s revenue increased by 322% compare to preceding year corresponding quarter.

Source: http://www.bursamalaysia.com/market/listed-companies/company-announcements/6074925

2. High profit from ERP business:

The company's foray into this segment had captured investor interest which had shoot the price up, The same business has delivered great Q3, Q4 results with huge profits. The segment now contributes about half of the total revenue and is expected to produce better results in the coming quarters.

3. Earnings visibility:

The company has signed an MOU with Yes’s Comm. Enterprise Sdn Bhd (YESS) to collaborate in a new retail business model and to supply the latter’s five retail outlets with an inventory tracking system. The company has stated that the one project alone is to provide an annual RM 20 million in revenues. The contract is renewable annually and provides good earnings visibility in the medium term.

Conclusion:

The fundamentals of Aturmaju Resources has improved drastically, given profit jump and increase in book value from RM 0.27 to RM 0.35 quarter on quarter in Q4, still undervalued. The undervalued nature combined with the future cashflows the stock can be valued at RM 0.8 - 1.0 in near-terms when the above triggers execute. Hence, now would be a great time to buy the stock after the stellar Q4 performance and before the release annual report is announced.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Sharing to all Malaysians! Let's Win Together

Created by Jordan Khoo | Jul 11, 2019

Created by Jordan Khoo | Mar 28, 2019

Created by Jordan Khoo | Feb 14, 2019

Discussions

q4 is really good result, this is really hidden gem in bursa just like what patrick said earlier.

2019-03-04 12:17

ZhuJiaHao

very good fundamental analysis, mother today morning edi 0.40, literally possible it will hit like what u analyse 0.80 to 1.00

2019-03-04 10:49