Kenanga Research & Investment

Kenanga Daily Technical Highlights - MYEG | HOVID

kiasutrader

Publish date: Thu, 16 Jul 2015, 10:25 AM

Holiday mood

The FBMKLCI managed to inch up marginally by 6.16 points (0.3%) to close at 1,727.26 yesterday ahead of the shortened trading

week. Trading volume and value surged during the 11th hour as investors eyes the on-going Greece debt issue resolution. Chartwise,

the key index had broken above the ‘Double-Bottom’ chart pattern neck-line to confirm a near-term reversal play. A swift

recapture of the 1,750 level next is vital for the index to reassure its uptrend trajectory. However, despite the final rush-hour gains,

we reckon that the local bourse will most likely continue to trade tepidly within the range of 1,690-1,730 on the back of the continued

weakening of the Ringgit as well as the overnight slip in Wall Street. To note, trading on Bursa Malaysia will only be in the morning

session today as the exchange will be closed for the Hari Raya Aidilifitri Holiday.

Winning streak broken

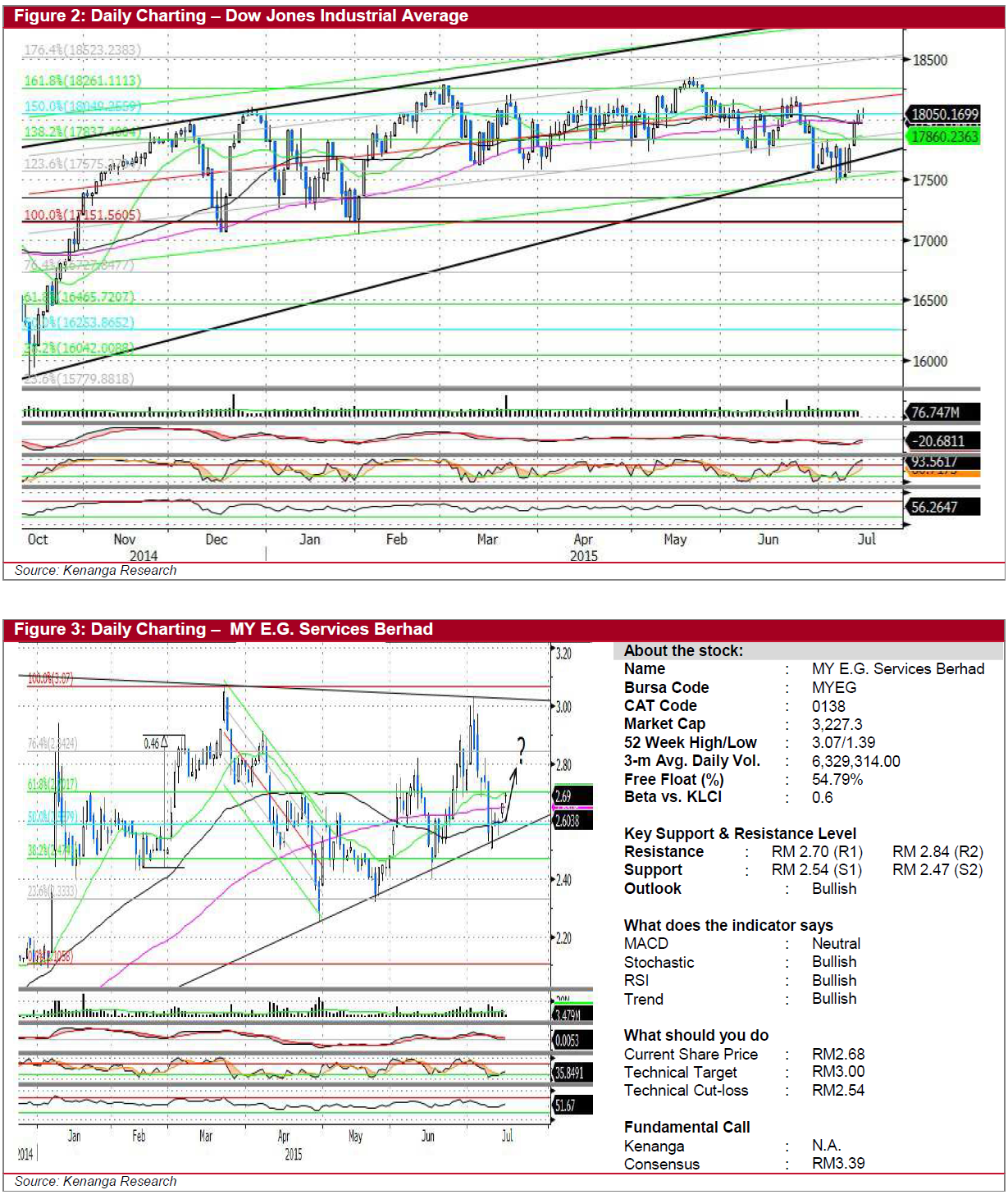

Last night, Wall Street ended its 4-day winning streak as the Dow slipped marginally by 3.41 points or 0.02% to settle lower at

18,050.17. The key index edged lower during the last leg of its trading session amid a decline in crude oil prices as concerns over

increased export from Iran will weigh on the global supply glut. Chart-wise, the underlying index remained above all its key SMA

levels as well as maintaining its rebound-play trajectory (refer to figure 2). Near-term consolidation is expected, in view of the

overbought situation shown in the Stochastic indicator, while RSI has started to flat out. Hence, we reckon that the Dow could

potentially consolidate towards the 18,000 level in the near-term. On a side note, Fed Chair Janet Yellen mentioned that the current

stable economy is "accommodative" for the Fed to increase interest rates but did not disclose any hints on the timing or pace of the

hike. Market expects the interest rate hike by the Fed to occur in September or December.

Daily Technical Highlights

- MYEG (TB, TP: RM3.00) yesterday inched 2.0 sen or 0.75% to close at RM2.68. The share price is gaining momentum after asteep sell-down end of April. Chart-wise, MYEG has formed a strong uptrend support level while we observe that the shareprice would stage a reversal each time it touches the aforesaid level. Besides, key indicators such as RSI and Stochasticindicator are reinforcing the rebound play hypothesis as the former has emerged from its oversold territory. With the anticipationthat the share price will continue to rally on a rebound play, we are calling a “Trading Buy” on stock with a Target Price ofRM3.00 (which is its long-term resistance level) with a strict stop-loss placed at RM2.54 (S1).

- HOVID (Close Position) has been consolidating since April after peaking at a high of RM0.565. Recall that we issued a “Trading Buy” on the stock on 3 June based on strong rebound from a descending triangle pattern. However, the share pricedid not perform according to our expectations but has continued to hover at its downward mean regression line. Hence, wedecided to close position given that our previous technical outlook is deemed invalid and will revisit the stock once it becomestechnically attractive again.

Source: Kenanga Research - 16 Jul 2015

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - TH PLANTATIONS BHD (THPLANT)

Created by kiasutrader | Nov 04, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 04, 2024

Telecommunication - U Mobile is the Chosen One for Second 5G Network (OVERWEIGHT)

Created by kiasutrader | Nov 04, 2024

Banking - Sep 2024 Statistics: Modest But Well-Supported (OVERWEIGHT)

Created by kiasutrader | Nov 01, 2024

US Presidential Election 2024 - A pivotal clash between progressivism and protectionism

Created by kiasutrader | Nov 01, 2024

Discussions

Be the first to like this. Showing 1 of 1 comments

skyz

so conveniently open a buy call and later on suddenly CLOSE it. so your fund managers escaped already?

2015-07-21 19:36