Daily Technical Highlights - (CYPARK, CAREPLS)

kiasutrader

Publish date: Tue, 30 May 2017, 09:32 AM

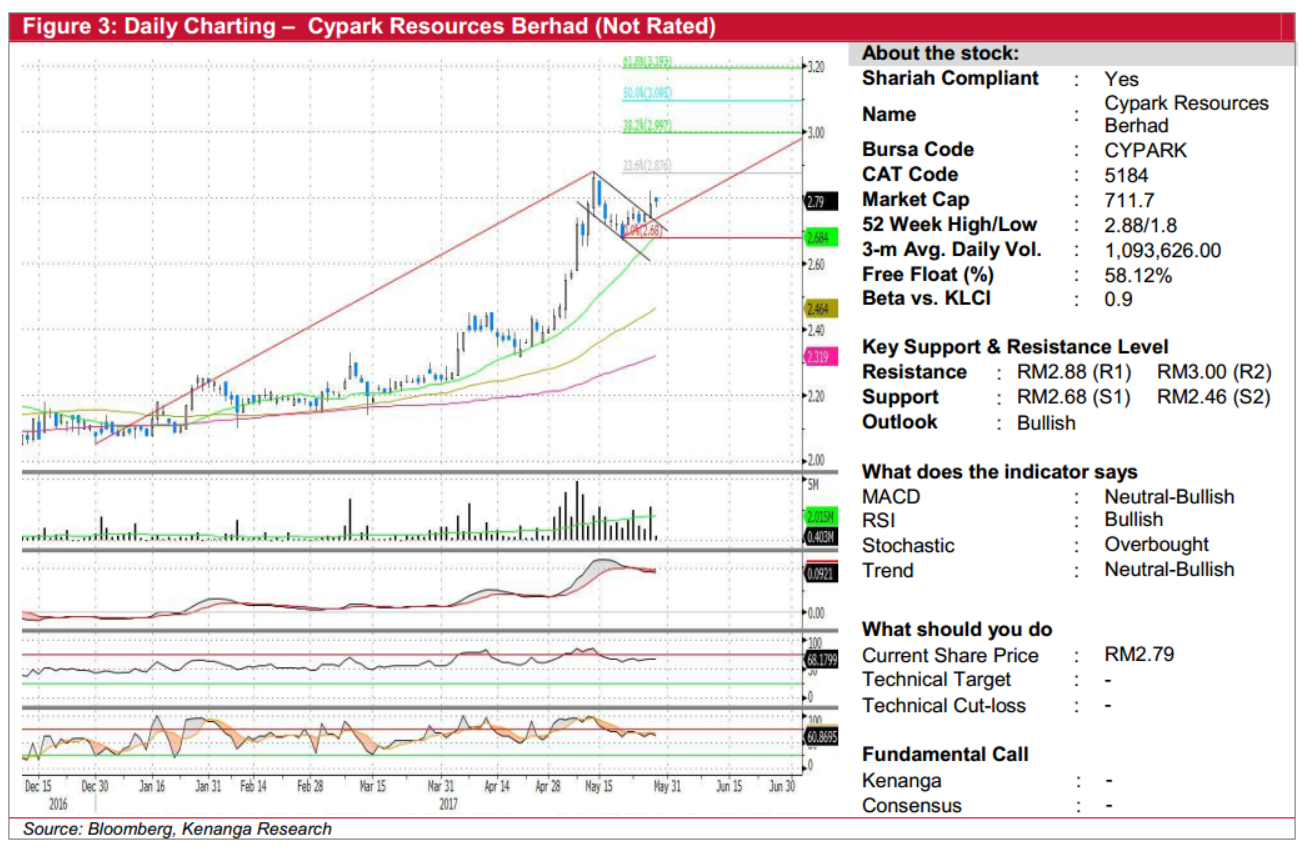

CYPARK (Not Rated). Despite the broader market weakness, CYPARK’s share price managed to eke out a marginal 1 sen gain (0.4%) to RM2.79. Chart-wise, CYPARK has been on a rising trend since the start of the year, having risen from a low of RM2.04 in January to as high as RM2.88 earlier this month. Although the past few weeks have seen a modest pullback to RM2.68, the share price staged a consolidation breakout on Friday to signal a resumption of its prior uptrend. From here, expect a retest of the RM2.88 (R1) high. Should this level be taken out next, further gains would then be expected towards RM3.00 (R2). Downside support levels are RM2.68 (S1), although a break below would be highly negative for the stock.

CAREPLS (Not Rated). CAREPLS gapped up 5.0 sen (16.95%) to stage a breakout from its consolidation zone to close at RM0.345 yesterday. The MACD has displayed its strong bullish convergence away from its zero-line, while upticks in daily RSI and Stochastic are suggesting pilling buying interest on the stock. While the primary trend is looking positive from here, we observe the long upper-shadow candlestick formed during yesterday’s price action that hints emergence of selling pressure. Taking into consideration of the formation of a long upper-shadow candlestick, we do not discount the chances of the stock taking a healthy retracement before resuming its uptrend trajectory. In this case, any pullback towards RM0.325 (S1) would offer a good accumulation point while the RM0.30 (S2) mark will act as a stop-loss. Meanwhile, overhead resistance levels are seen at RM0.38 (R1) and RM0.40 (R2).

Source: Kenanga Research - 30 May 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024