Daily Technical Highlights - (COMFORT, HIBISCS)

kiasutrader

Publish date: Wed, 31 May 2017, 09:52 AM

COMFORT (Not Rated). COMFORT gained 1.5 sen (2.1%) yesterday to finish at RM0.745 after the company announced its 4Q17 earnings, which jumped 21.8% to RM8.2m. With the bullish move yesterday, the share price has now broken out of a narrowing-sideways range. This signals the end of a 10-month indecisive phase and the start of a potential uptrend. From here, we expect a swift retest of the February high of RM0.77 (R1). Should this level be taken out next, further gains would then be expected towards RM0.815 (R2) next. Downside support levels are RM0.72 (S1), failing which further support is located at RM0.70 (S2) below.

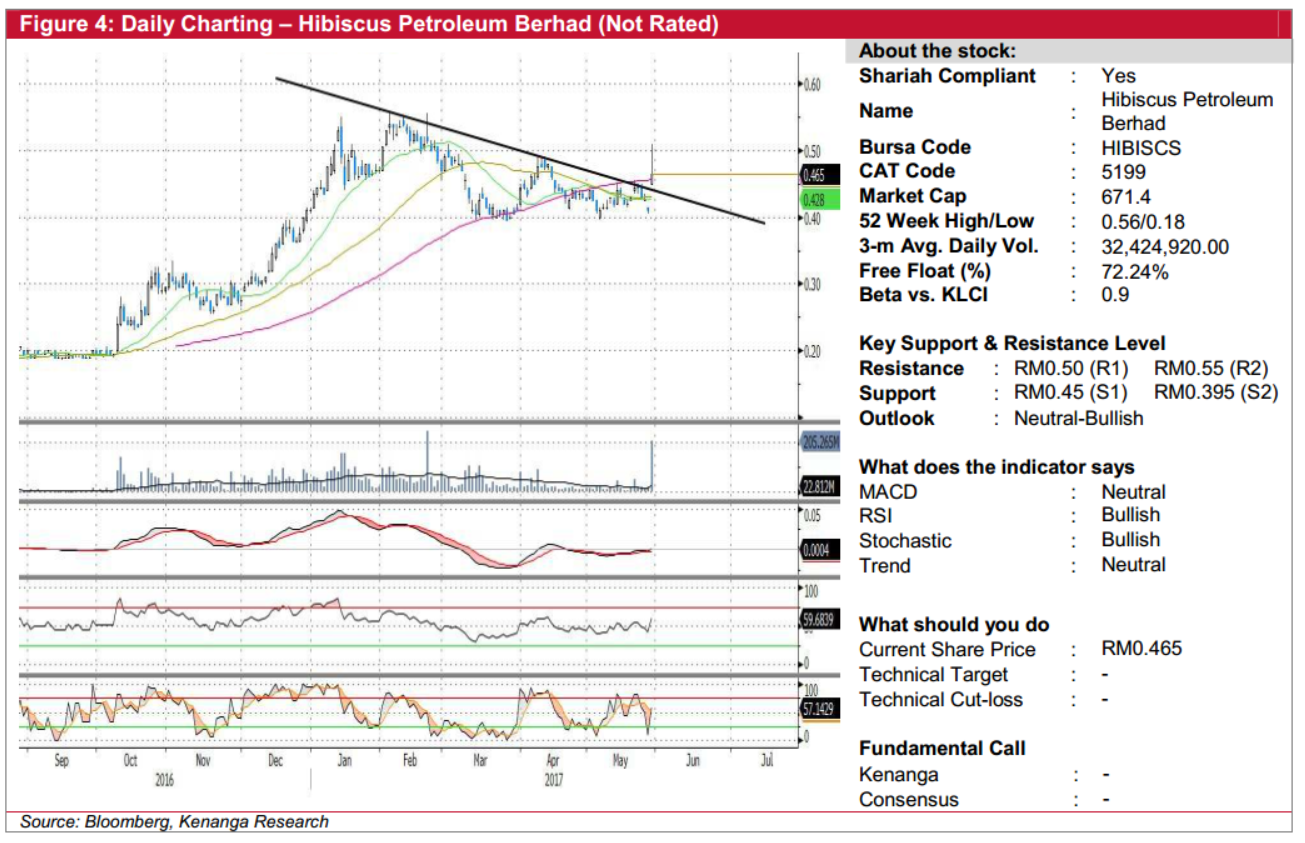

HIBISCS (Not Rated). HIBISCS surged on strong trading volume yesterday after it was given the go-ahead by Petronas to purchase a 50% stake in the North Sabah enhanced oil recovery project from Shell, closing 5.5 sen (13.41%) higher at RM0.465. Riding on the long-awaited bullish news, the stock surged to an intra-day high of RM0.51 before facing profittaking to form a long-upper shadow candlestick on the daily chart. This led us to take precaution on the stock given the strong emergence of profit taking during the intraday, whereby investors are advised to look out for an appearance of another white candlestick to affirm the uptrend trajectory, while upside resistance is capped at RM0.50 (R1)/RM0.55 (R2). Any decline below the RM0.45 (S1) support will result in the stock continuing on its downside-bias consolidation, where the next support is seen at RM0.395 (S2).

Source: Kenanga Research - 31 May 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024