Daily Technical Highlights - (MUDAJYA, PRG)

kiasutrader

Publish date: Wed, 07 Jun 2017, 09:46 AM

MUDAJYA (Not Rated). Yesterday, MUDAJYA surged 14.0 sen (9.7%) to finish at the day’s high of RM1.58. Its share price has been on an uptrend since March, and currently remains positive with the key SMAs (20-, 50- and 100-day) fanning outwards. Furthermore, the share price now appears poised to resume its bullish run following yesterday’s consolidation breakout. Although trading volume has been lower than what we prefer, the momentum indicators are supportive of a move higher. Investors may look towards a retest of last month's high of RM1.67 (R1), beyond which RM1.74 (R2) is located further up. Downside support is RM1.40 (S1), failing which the next major support is located at RM1.26 (S2).

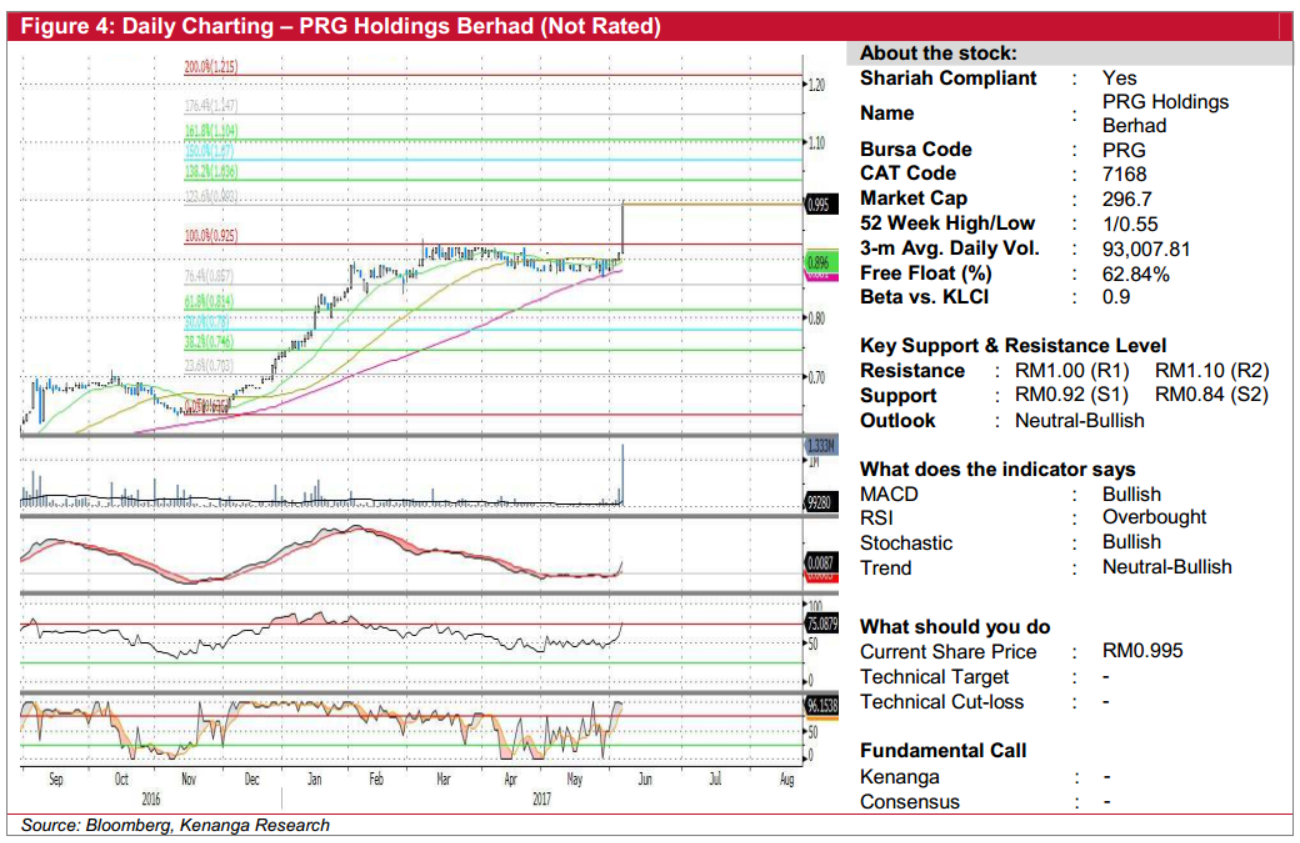

PRG (Not Rated). PRG has been consolidating within the range of RM0.84-RM0.935 over the past six months. Yesterday, the share price finally made a technical breakthrough, surging 8.5 sen (15.6%) to stage a breakout from the consolidation zone to close at RM0.995. The underlying trend is looking positive from here, as the share price is currently trading above all its key moving averages. Besides, the bullish convergence of MACD is also laying a hand on the bullish-bias outlook ahead. Nonetheless, the sharp price action yesterday led the stock turning deeply overbought as depicted by the RSI and Stochastic. Hence, we do not discount the possibility of a slight pullback, where any retracement towards RM0.92 (S1) would be deemed as a good accumulation point, with RM0.84 (S2) seen as an exit. Near-term upside resistance now seen at RM1.00 (R1)/RM1.10 (R2).

Source: Kenanga Research - 7 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024