Daily Technical Highlights - (FRONTKN, DNONCE)

kiasutrader

Publish date: Thu, 08 Jun 2017, 09:22 AM

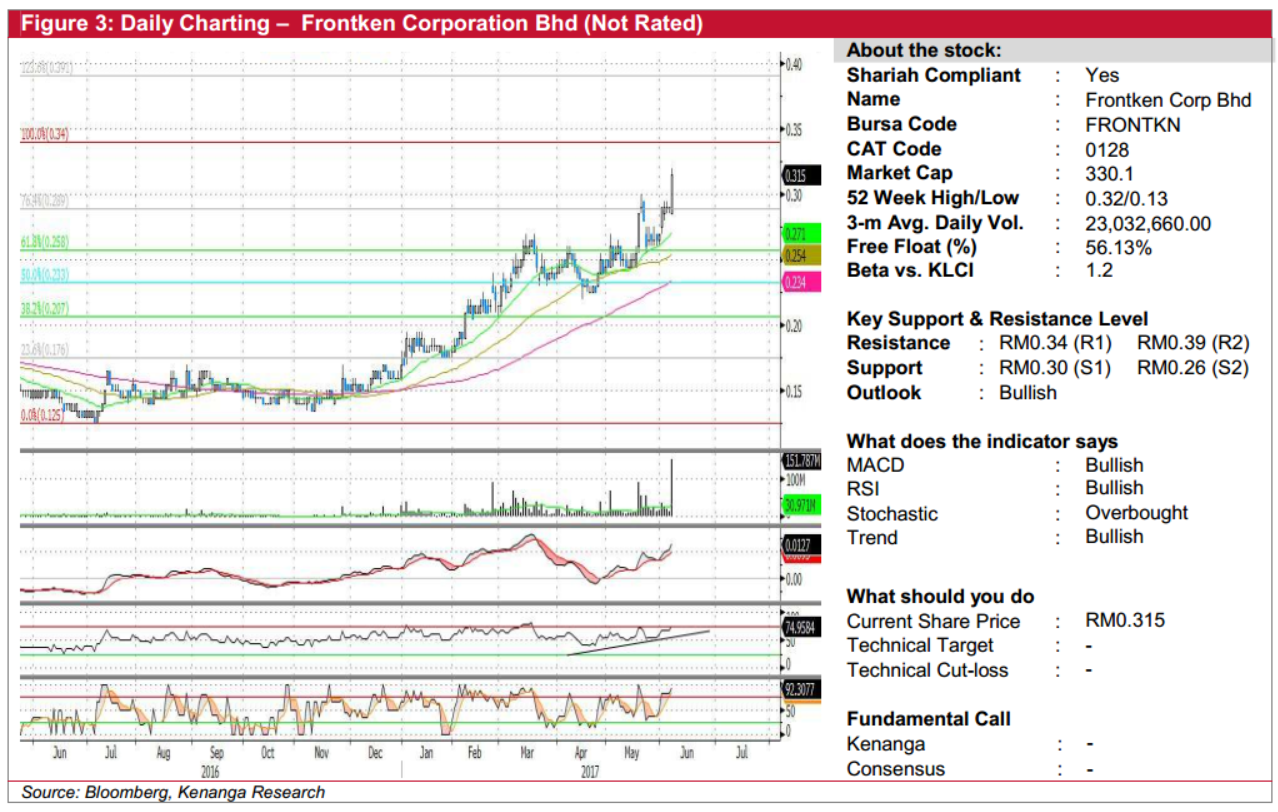

FRONTKN (Not Rated). FRONTKN rallied 2.5 sen (8.6%) to RM0.315 following an announcement that the company is proposing to boost its holdings in Ares Green Technology Corp from 73.2% to 84.6%. Trading volume spiked to 151.8m shares, making FRONTKN the most actively traded counter for the day. Chart-wise, FRONTKN has been on a steady uptrend since July last year. Currently, its technical picture remains bullish with the share price now at a fresh two-year high and momentum indicators are on an incline. From here, expect the share price to retest its May 2015 high of RM0.34 (R1) before a possible move towards RM0.39 (R2) next. Any weakness towards RM0.30 (S1) can be viewed as a buying opportunity, failing which RM0.26 (S2) should offer additional support.

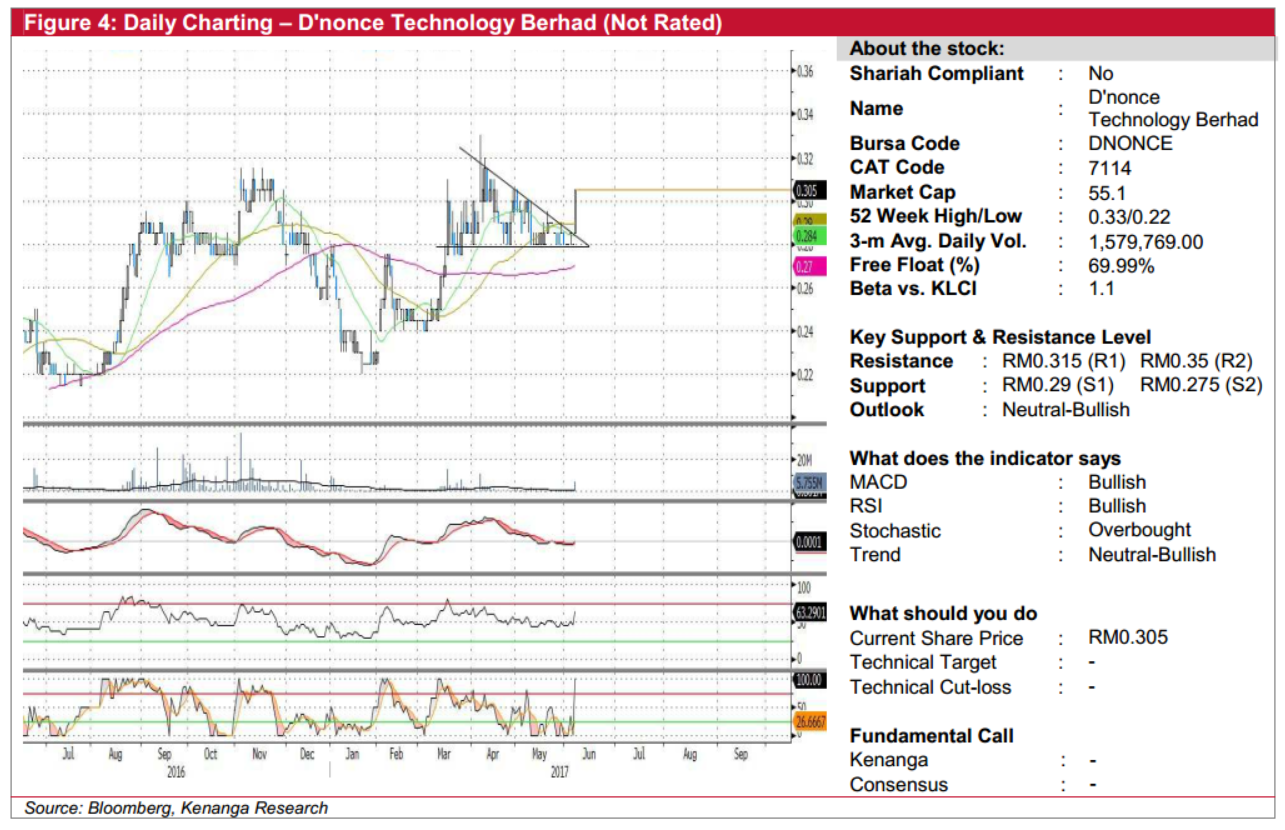

DNONCE (Not Rated). DNONCE has been consolidating to form a ‘Wedge’ chart pattern over the past three months. Yesterday, the share price garnered strong investors interest to surge 2.5 sen (8.93%), closing at RM0.305 to break out from its ‘Descending Triangle’ chart pattern. MACD has also staged a bullish crossover above its signal line to hint a upsidebias outlook ahead. Besides, the upticks depicted by RSI and Stochastic are reflecting the re-emergence of the bulls to resume their uptrend trajectory. From here, DNONCE could look to retest its key resistance level of RM0.315 (R1), whereby a decisive breakout above R1 is vital for the stock to gear higher up towards RM0.35 (R2). On the flip side, failure to breach above the R1 level would see DNONCE consolidating within a channel between RM0.275 and RM0.315. Support levels are found at RM0.29 (S1) and RM0.275 (S2).

Source: Kenanga Research - 8 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024