Daily technical highlights - (WASEONG, SENDAI)

kiasutrader

Publish date: Wed, 14 Jun 2017, 11:14 AM

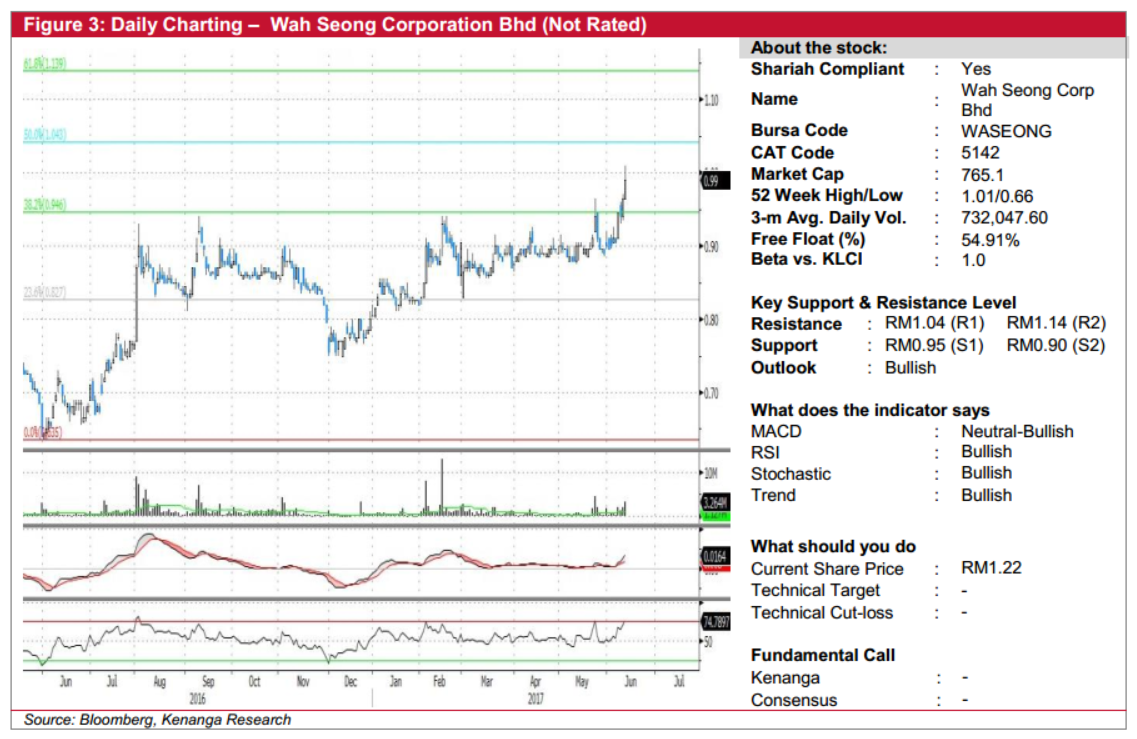

WASEONG (Not Rated). Yesterday, WASEONG rose to a fresh 18-month high after it climbed 2.5 sen (2.6%) to RM0.99. Earlier in the trading session, the share price notched an intra-day high of RM1.01 although gains were pared by subsequent profit taking. From a charting perspective, the bullish move marks a significant breakout above the RM0.95 key congestion zone. Similarly, the MACD and RSI have both hooked upwards to reflect an increase in buying momentum. Hence, investors can now expect WASEONG to be biased to the upside from here. Immediate resistance levels to look out for are RM1.04 (R1) and RM1.14 (R2) while downside support levels include the aforementioned RM0.95 (S1) level, and RM0.90 (S2) below.

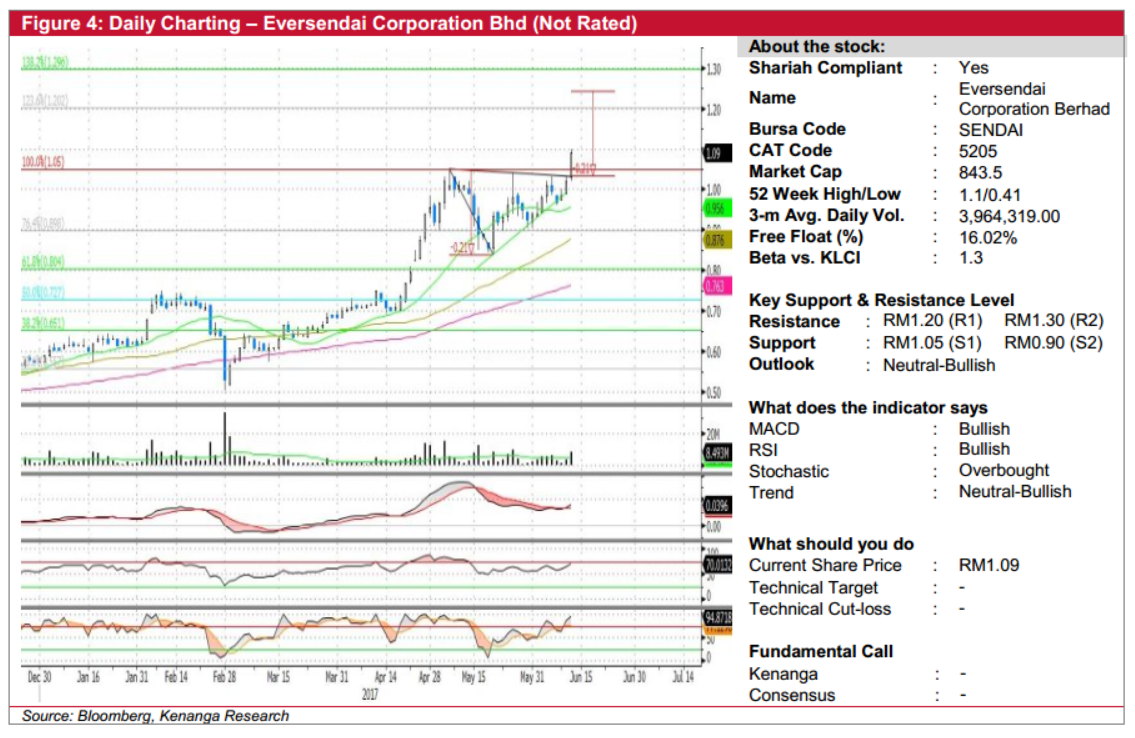

SENDAI (Not Rated). Yesterday, SENDAI’s share price surged 7.0 sen (6.9%) to close at RM1.09. We believe this breakout confirms an “Ascending Triangle” pattern, characterised by a horizontal resistance with rising troughs since May. The MACD indicator also saw a signal-line crossover following yesterday’s surge, coupled with an increased trading volume to mark the spike in trading interests. From here, our upward projection from the ascending triangle arrives at a measurement objective of RM1.24. Resistances can be identified at RM1.20 (R1) and RM1.30 (R2), while immediate support levels include the resistance-turned-support at RM1.05 (S1), followed by RM0.90 (S2) lower down.

Source: Kenanga Research - 14 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024