Daily Technical Highlights - (PLABS, ASB)

kiasutrader

Publish date: Tue, 18 Jul 2017, 09:39 AM

PLABS (Not Rated). PLABS saw its share price surging 5.0 sen (15.4%) yesterday to a new high of RM0.375 on high trading volume of 39.5m shares. As a result of the bullish move, the share price has formed a bullish “Marubozu” candlestick, which indicates that the bulls were in firm control throughout the day. Furthermore, PLABS has now broken out of its two-month long consolidation phase to signal a continuation of its prior uptrend. From here, we expect the share price to be positively biased towards RM0.39 (R1) and RM0.41 (R2). Conversely, any weakness towards the RM0.35/0.355 (S1) is likely to see investors buying on dips. Further support is located at RM0.33 (S2) where the breakout point is.

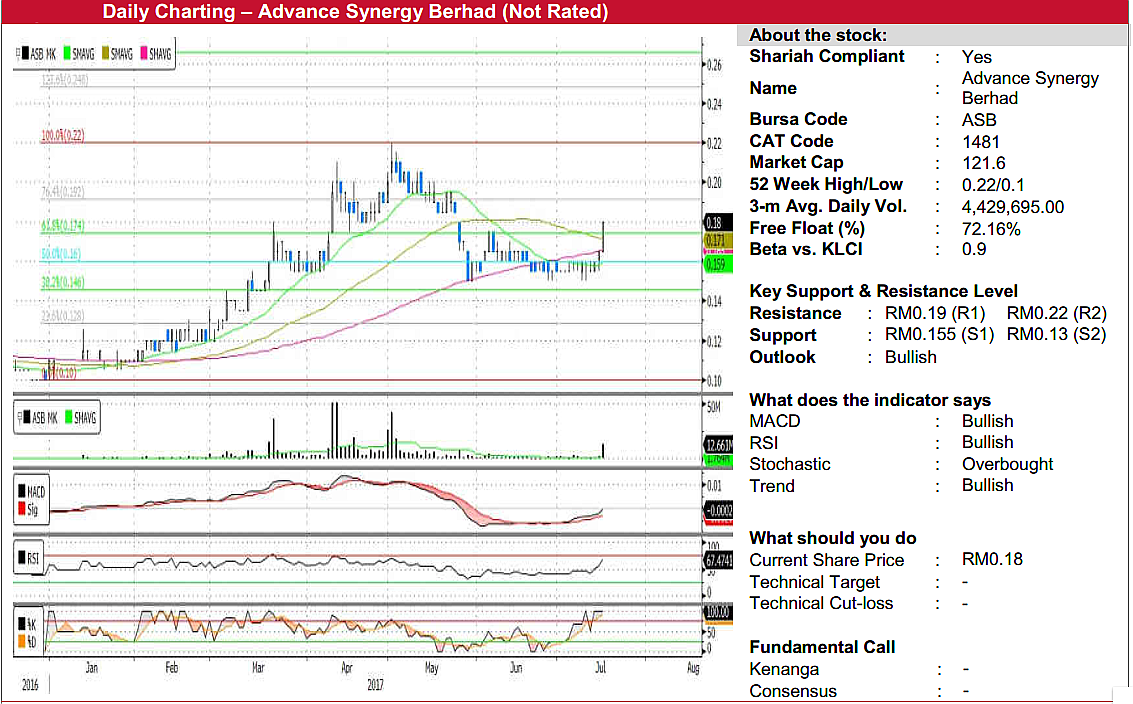

ASB (Not Rated). Yesterday, ASB caught our attention after it surging 1.5 sen (9.1%) to close at its intra-day high of RM0.18, forming a white “Marubozu” candlestick. This was accompanied by exceptionally high trading volume, with 12.6m shares exchanging hands, about 7x its daily average of 1.8m shares. Yesterday’s move marks as a breakout from a monthlong sideways consolidation, with the MACD and RSI also showing signs of a bullish convergence. From here, we expect the share to trend upwards towards RM0.19 (R1), with a stronger resistance found at its 20-month high at RM0.22 (R2). On the other hand, expect some considerable support at the RM0.15-0.16 (S1) range, with another lower support at RM0.13 (S2).

Source: Kenanga Research - 18 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024