Daily Technical Highlights - (BKOON, GDEX)

kiasutrader

Publish date: Wed, 19 Jul 2017, 11:30 AM

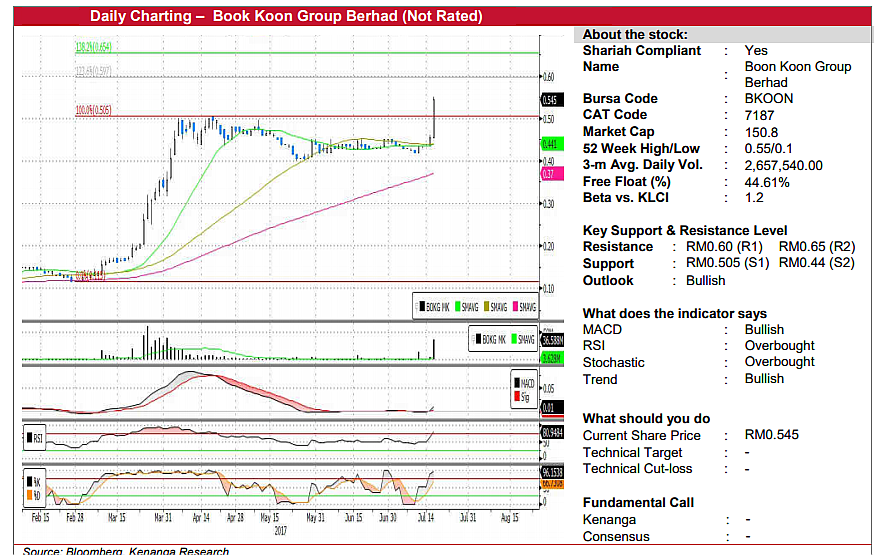

BKOON (Not Rated). Yesterday, BKOON rallied 9.0 sen (19.8%) to a 9-year high of RM0.545. Trading volume surged to 36.6m shares, or more than 10-fold the daily average. Earlier in March, BKOON’s share price broke out of a prolonged range-bound trend at RM0.17, and subsequently rallied to as high as RM0.505 before consolidating sideways. Nevertheless, yesterday’s strong move signals a resumption of its prior uptrend after a three-month pause. Key indicators have also hooked upwards as a result. From here, we expect follow-through buying towards RM0.60 (R1) and RM0.655 (R2) next. Meanwhile, support levels are RM0.505 (S1) and RM0.44 (S2) where investors will likely buy on dips.

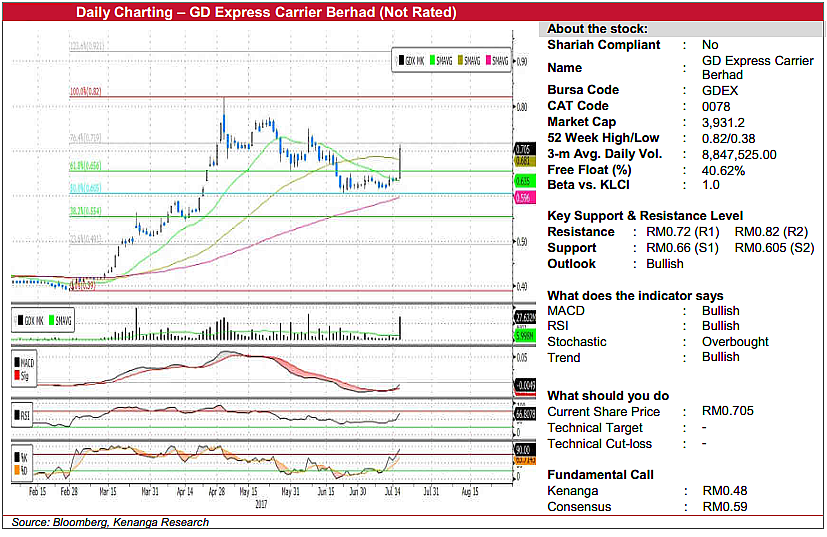

GDEX (Not Rated). GDEX surged 6.5 sen (10.2%) yesterday to close at RM0.705. This was accompanied by high trading volume, with 27.6m shares exchanging hands, as compared to a 20-day average of 6m shares. Additionally, yesterday’s move marks as a breakout from a month-long period of sideways consolidation. All key indicators displayed upticks following yesterday’s breakout, with the MACD emerging with a bullish crossover above its Signal line. From here, expect some immediate overhead resistance at RM0.72 (R1). If taken out decisively, it is expected that the share to trend towards its all-time high at RM0.82 (R2). Downside support can be identified at RM0.66 (S1), with a stronger support further lower at RM0.605 (S2).

Source: Kenanga Research - 19 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024