Daily Technical Highlights - (GCB, ASTINO)

kiasutrader

Publish date: Fri, 21 Jul 2017, 09:29 AM

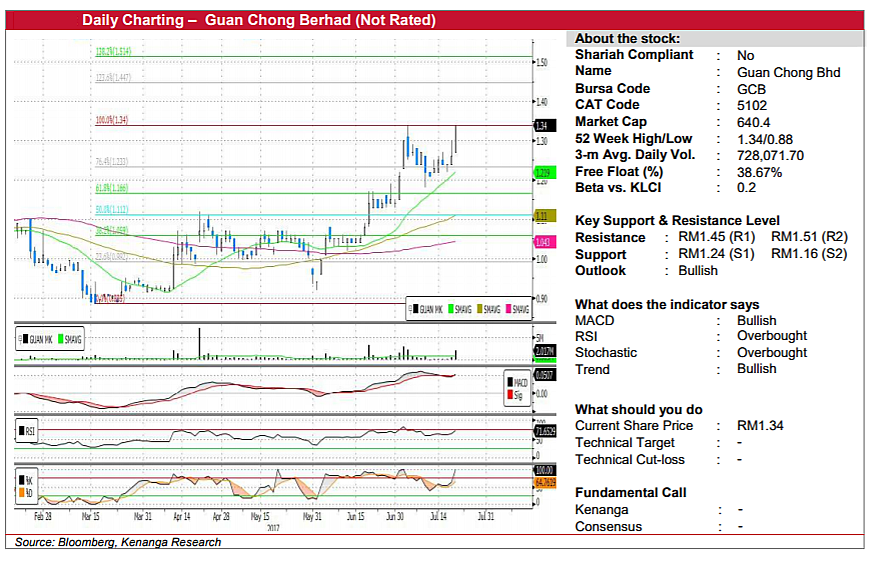

GCB (Not Rated). Yesterday, GCB’s share price rose 8.0 sen (6.3%) to a closing high of RM1.34 on increased volume of 2.0 shares. The share price has been experiencing a strong run since breaking out of its year-long down-trend earlier last month. Since then, the share price had climbed to as high as RM1.34 before staging a healthy pullback. Nevertheless, yesterday’s bullish move signals a continuation of its prior uptrend. At the same time, the MACD has crossed over its Signal line to reflect a pickup in momentum. From here, we expect follow-through buying to continue, with RM1.45 (R1) and RM1.51 (R2) as next resistance levels to watch. Downside support levels are likely at RM1.24 (S1) and RM1.16 (S2) further below.

ASTINO (Not Rated). ASTINO surged 8.0 sen (6.6%) yesterday to close at its intra-day high of RM1.29, forming a white “Marubozu” candlestick. This was also accompanied with high volume as 7.1m shares exchanged hands, nearly 3-fold its 20-day average of 2.4m shares. Yesterday’s breakout marks as a continuation of a prior uptrend, after a month-long period of sideways consolidation. Additionally, yesterday’s move also confirms an “ascending triangle” continuation chart pattern, after it broke out from its previous all-time high of RM1.23. From here, the triangle’s price projection arrives to a technical target of RM1.43 (R2), with a mild resistance at between at RM1.36 (R1). Downside support can be found at the base of its recent consolidation, at the range of RM1.10-1.11 (S1), with a lower support placed at RM1.00-1.03 (S2).

Source: Kenanga Research - 21 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024