Daily Technical Highlights - (SIGGAS, BKOON)

kiasutrader

Publish date: Thu, 27 Jul 2017, 09:46 AM

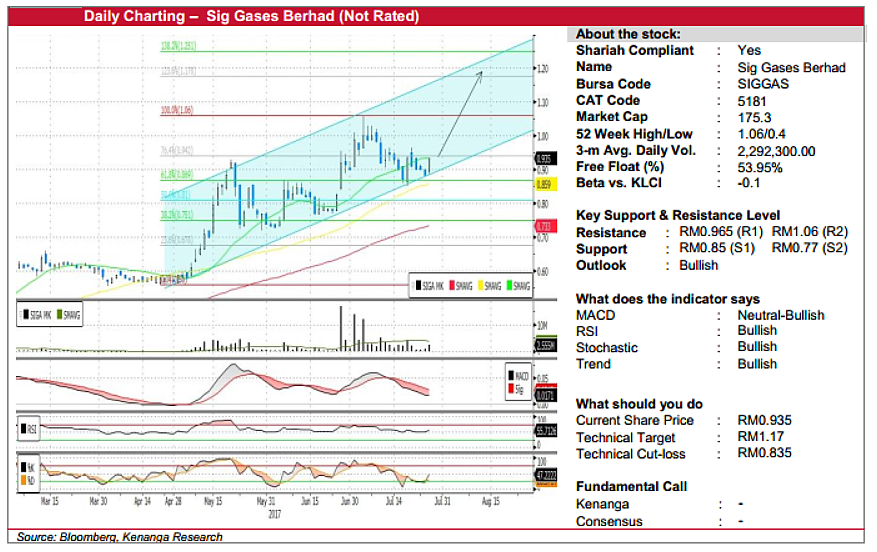

SIGGAS (Trading Buy, TP: RM1.17, SL: RM0.835). SIGGAS’ share price gained 5.0 sen (5.7%) yesterday to finish at RM0.935 on increased volume of 2.5m shares. From a charting perspective, the share price has been trading within an uptrend channel since May, and yesterday’s move signals the possible start to a rebound from the channel support. Key indicators are also supportive of a move higher, with the RSI now above the 50-point mark while the Stochastic has hooked upwards from oversold levels. As such, we expect further gains ahead, towards immediate resistance levels RM0.965 (R1), the recent high of RM1.06 (R2), and possibly RM1.20 (R3) where the channel resistance is located. Downside support levels are RM0.85/0.89 (S1) and RM0.77 (S2) below.

BKOON (Trading Buy, TP: RM0.64, SL: RM0.485). BKOON’s share price closed at a fresh nine-year high yesterday, after its gained 4.0 sen (7.8%) at RM0.555. Earlier in March, the share price kicked off a strong rally which saw BKOON climbing from a low of RM0.115 to as high as RM0.505 within a short span of a month. The share price subsequently entered into a period of range-bound trade over the following three months, before staging yet another breakout last week. With this bullish move, BKOON’s shares are poised for further gains in the near term towards RM0.60 (R1) and RM0.65 (R2). The former RM0.505 resistance has now turned support, while additional support is located at RM0.415 (S2) below.

Source: Kenanga Research - 27 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024