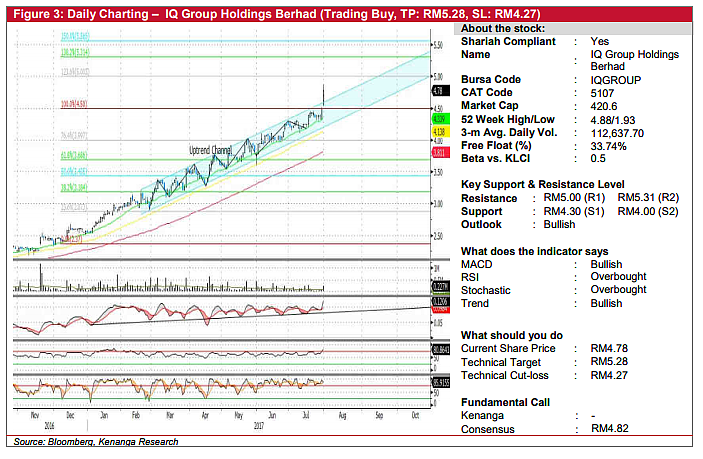

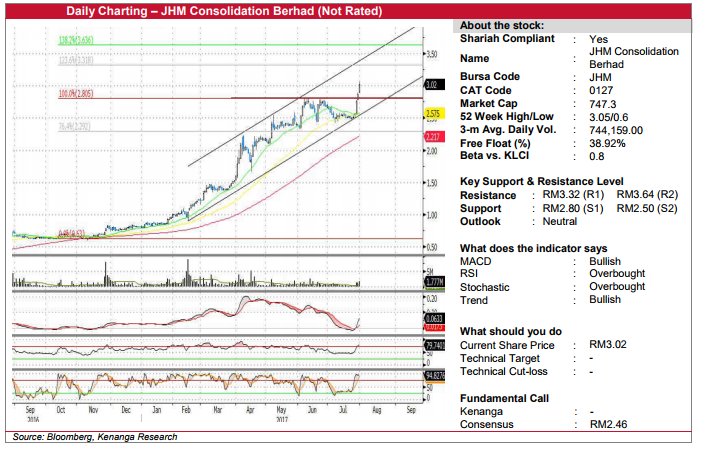

Daily Technical Highlights - (IQGROUP, JHM)

kiasutrader

Publish date: Tue, 01 Aug 2017, 12:22 PM

IQGROUP (Trading Buy, TP: RM5.28, SL: RM4.27). IQGROUP caught our attention yesterday after it surged 28.0 sen (6.2%) to close at its all-time high of RM4.78. This was accompanied by increased trading volumes, with 227k shares exchanging hands, roughly 2.7x its average volume of 86k shares. Chart-wise, the share has been trading within an uptrend channel since end of last year, with yesterday’s move marking a breakout from above its channel resistance. Key-indicators are also supportive of a move higher, with upticks seen in both the MACD and RSI following yesterday’s rise. From here, we expect the share to trend higher towards resistances at RM5.00 (R1) and RM5.31 (R2). Downside support can be found at RM4.30 (S1) and RM4.00 (S2).

JHM (Not Rated). Yesterday, JHM rallied 15.0 sen (5.2%) to the all-time high of RM3.02. 1.8m shares changed hands, almost triple the SMAVG (20-day) of 0.61m shares. Additionally, yesterday’s move signaled a decisive breakout from its previous resistance which it retested twice within the past 2-month of consolidation. The move is supported by a Signal-line crossover by the MACD which reflects a shift in momentum from bearish to bullish. Next resistance levels would be at RM3.32 (R1) and RM3.64 (R2) based on 123.6% and 138.2% Fibonacci projections, respectively. Meanwhile, immediate support could be found at previously resistance-turned support, RM2.80 (S1). Further support level is located at RM2.50 (S2).

Source: Kenanga Research - 1 Aug 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)