Daily Technical Highlights - (HEVEA, PETRONM)

kiasutrader

Publish date: Fri, 04 Aug 2017, 04:04 PM

HEVEA (Not Rated). HEVEA gained 7.0 sen (4.2%) yesterday to close at 18-month high of RM1.74. This was accompanied by high trading volume, with 14.8m shares exchanging hands, almost 3-fold its average of 4.9m shares. Yesterday’s move can be considered as a decisive break above its previous high of RM1.69, possibly signalling a resumption of a prior uptrend after taking a brief pause for the past week. With the share remaining in a “Golden Cross”, coupled with a bullish convergence from the MACD, the share may be poised for a move higher. However, an immediate overhead resistance at RM1.78 (R1) must first be taken out, in which the share came close to testing during yesterday’s intra-day trade. Decisively taking it out will see a next resistance at RM1.84 (R2), while failing to do so could see the share price retreating to support levels at RM1.60 (S1) and RM1.94 (S2) further lower.

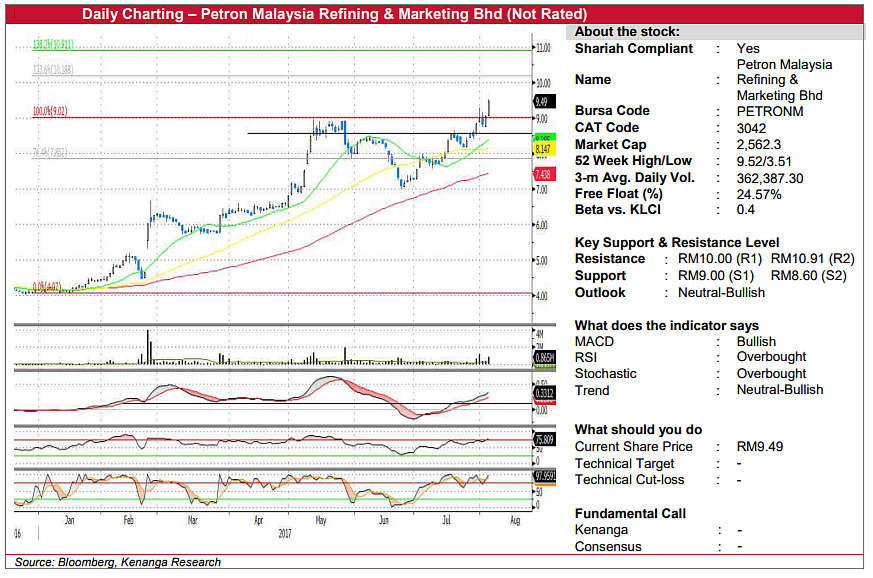

PETRONM (Not Rated). PETRONM’s share price surged 44.0 sen (4.9%) before finishing at an all-time high of RM9.49. Chart-wise, yesterday’s breakout signaled the continuation of its prior uptrend after an earlier correction in June. Additionally, the “Golden Crossover” between the 20-day and 50-day SMAs, confirms the resumption of this bullish trend. From here, we expect PETRONM’s share price to move towards the RM10.00 (R1) psychological level, before a possible climb further up to RM10.91-RM11.00 (R2). With overall bias to the upside, we view any weakness towards the RM9.00 (S1) resistance-turned-support as a buying opportunity. Further below, the next support level is located at RM8.60 (S2), although a breach below this level would be highly negative for the stock.

Source: Kenanga Research - 4 Aug 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024