Daily Technical Highlights - (CAB, GHLSYS)

kiasutrader

Publish date: Fri, 18 Aug 2017, 09:30 AM

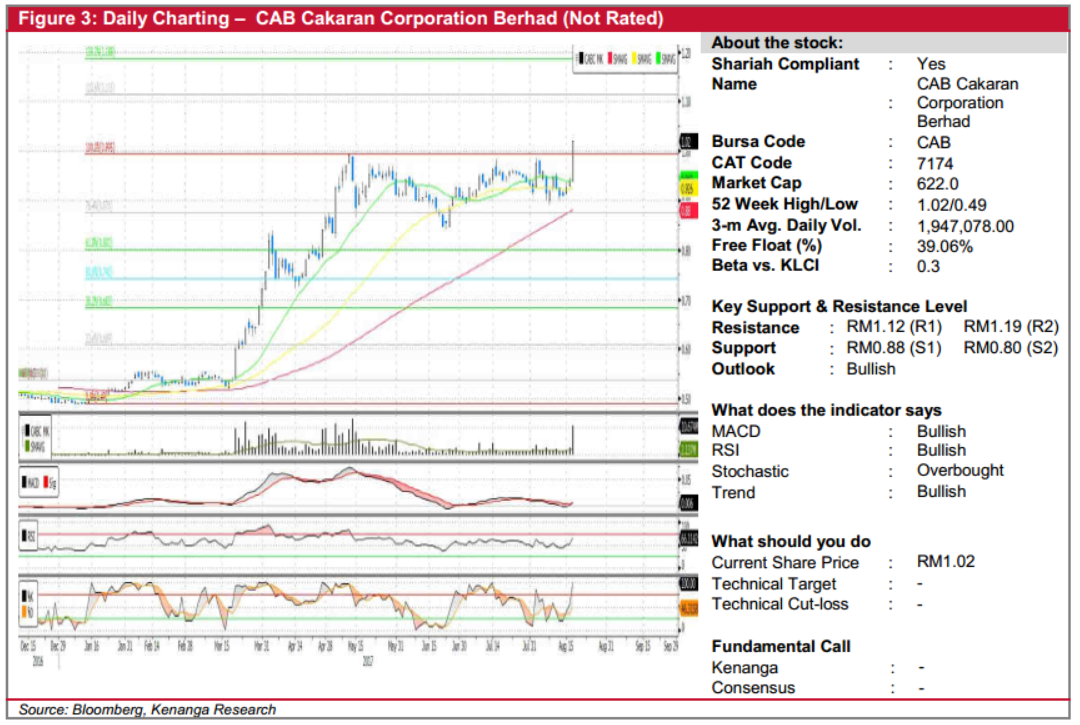

CAB (Not Rated). CAB jumped an impressive 8.0 sen (8.5%) yesterday to close at an all-time high of RM1.02. Trading volume was exceptionally high, with 10.7m shares exchanging hands – nearly 5x its 20-day average of 2.1m shares. Likewise, the trading session was mostly dominated by the bulls as the share staged a white “Marubozu” candlestick. More importantly, yesterday’s move can also be seen as a breakout from its previous high at RM0.995 after an extended period of sideways consolidation. Key indicators have also staged bullish upticks following yesterday’s gain, with the MACD crossing over its Signal and zero lines. From here, expect positively-biased momentum with resistances level placed at RM1.12 (R1) and RM1.19 (R2). Support levels can be found at RM0.88 (S1), with another further lower at RM0.80 (S2).

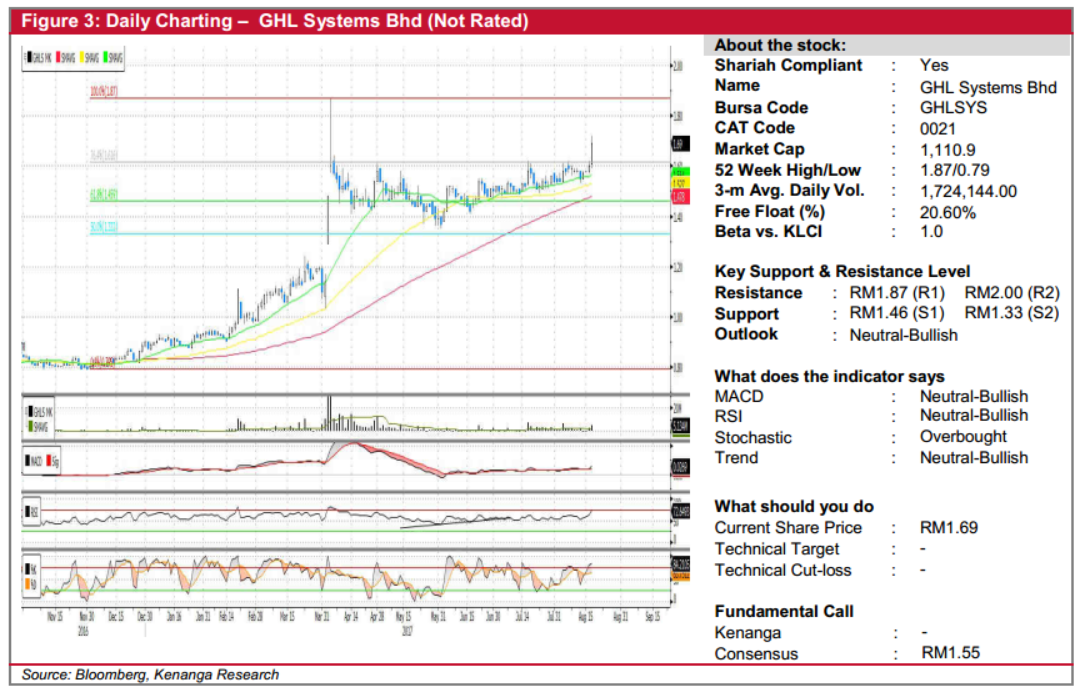

GHLSYS (Not Rated). GHLSYS saw its price surging 9.0 sen (5.6%) yesterday to close at all-time high of RM1.69. The movement marks a crucial breakout above the resistance of previous all-time high of RM1.57, which was retested 7 times during its previous 4-month consolidation. The bullish price action was supported by high trading volume with 5.1m shares traded, more than double its 20-day average of 2.3m shares. By the same token, upticks on key-indicators reflect sudden pick-up on momentum. From here, we expect follow-through momentum to carry the share price towards resistance levels RM1.87 (R1) and RM2.00 (R2). As for the downside, support levels are RM1.46 (S1) and RM1.33 (S2).

Source: Kenanga Research - 18 Aug 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024